[ad_1]

Editor’s note: Seeking Alpha is proud to welcome Anselm Hanstein as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Teka77

Thesis

Vonovia (OTCPK:VNNVF) (OTCPK:VONOY) is a Strong Buy right now, trading at just 0.4 times net tangible assets and with deleveraging in process. Additionally, there are no signs of a downturn in the housing market at the moment, especially with immigration fueling the demand for homes in the future. Read below for a detailed investment analysis.

Business Overview

About 89% of properties owned by Vonovia are located in Germany, another 7% are in Sweden, and the remaining 4% are in Austria. The operating business consist of five main parts which are: Rental, Value-add, Recurring Sales, Development, and Deutsche Wohnen. The main contributor to adjusted EBITDA is Rental, making up an almost 59% share in H1 2022. In addition to the classic rental business, Vonovia also provides value-added services – for example, insurance services, maintenance and modernization etc. The segment “Recurring Sales” includes the sales of properties by Vonovia and the segment “Development” summarizes all development activities of new properties. All three of those just mentioned segments contributed around 5% each to the total adjusted EBITDA in H1 2022.

The last segment that accounted for around 25% of the total adjusted EBITDA in H1 2022 is “Deutsche Wohnen”. On August 5, 2021, Vonovia made a voluntary public takeover offer to Deutsche Wohnen shareholders, which later was successful. Deutsche Wohnen itself is focused on the rental business of real estate in metropolitan areas of Germany.

With a market capitalization around $20.4 billion as of September 9, 2022, Vonovia is the biggest real estate company in Europe. In its 2022 Half-Year Report the company stated that in total 621,846 units were managed in the first half of 2022, of which 549,484 of them were owned by it. The fair value of the real estate portfolio was €98,811.2 and EPRA NTA per share amounted to €62.54. Even though Vonovia is by far the biggest player in Germany’s real estate market, its market share still is only around 2%. The next biggest competitors are TAG Immobilien (OTC:TAGOF), Vivawest Wohnen and LEG Immobilien (OTCPK:LEGIF) which only have about 350,000 properties combined. Noticeably, the German real estate market is very fragmented. Therefore, Vonovia is in a comfortable position of being the dominant market leader but still relatively small compared to the entire market size.

Although Vonovia grew its total segment revenue by 34.5% in H1 2022 and its total adjusted EBITDA by 37.2%, compared to H1 2021, the stock price of Vonovia shares keeps plummeting, now being down around 55% from its all-time high when looking at the stock price in Euros. In US Dollar terms, the stock price is down even more dramatically, caused by the increase in the US Dollar compared to the Euro.

Valuation

Fundamentally, Vonovia shares are trading at around 0.4 times net tangible assets which means a substantial discount is priced in. Realistically, a company should only trade below net tangible assets or book value if a decline of those values is to be expected or certain risks must be priced in. On the other hand, companies trading far above their NTA, which will further also be referred to as intrinsic value, are expected to do well in the coming years by the market. Because no one can tell the future, buying stocks that are undervalued in the present is easier than speculating on the above-expected future earnings. It must be said that this valuation approach does not work well with tech companies in general because of the intangible nature of their business model. For a real estate company however, using this valuation method makes perfect sense.

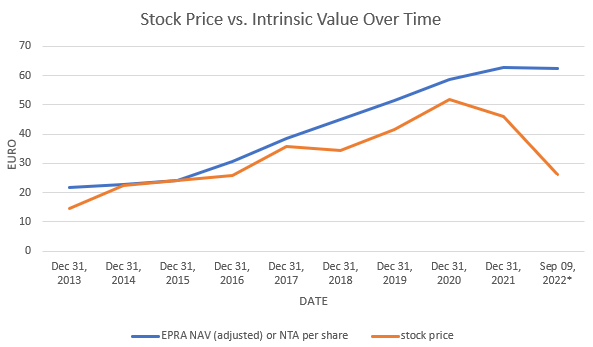

Looking at the stock price versus the intrinsic value over time a clear correlation can be noticed. This correlation is only logical because if a share of Vonovia is holding a higher value than the year before, the demand for Vonovia stock should rise and so should the price of the stock. If the stock price declines although the intrinsic value of the stock does not, either the stock was too expensive earlier and the valuation is now getting adjusted or potential future risks, which would lead to less intrinsic value per share getting priced in by the market. Furthermore, the market could just be behaving fearfully and not rationally.

created by Author using data from Company

Please notice, that until December 31, 2019, EPRA NAV (adjusted) per share was used and from thereon EPRA NTA per share. This is because Vonovia started to publish only EPRA NTA instead of EPRA NAV in their annual report. The EPRA NTA method generally is a little stricter but does not differ much from EPRA NAV. With the introduction of this new methodology, companies were asked to provide a bridge between the previous and current metrics for their shareholders, which Vonovia did. Therefore, both the EPRA NTA and the EPRA NAV numbers were published for the years 2019 and 2020 in the 2020 annual report. The EPRA NTA per share number was €54.88 in 2019 while EPRA NAV per share amounted to €54.57. In 2020, EPRA NTA per share was €62.71 while EPRA NAV per share totaled €62.11. The difference is marginal and will be ignored in this long-term view, which means both methods will be used as equals in this chart in order to assess the overall trend.

Also, the data used on September 09, 2022 for EPRA NTA per share stems from the half-year report for 2022.

Currently, the correlation discussed above does not seem to work as usual. For this natural principle to be functioning again, the annual report of 2022 must show a crash in NTA per share around 50%. This statement is only true if Vonovia was not overvalued before this decline in the stock price happened.

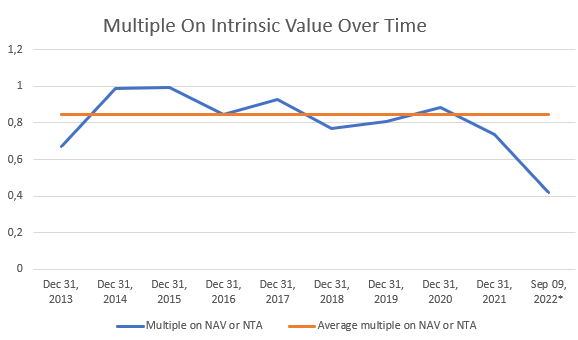

created by Author using data from Company

When considering the multiple that got paid on NAV or NTA over time the average discount since IPO, using the stock closing price as of December 31 for each year, was around 0.848. This means that Vonovia generally gets traded below net tangible assets probably mainly because of the real estate sector Vonovia is doing business in and the high amount of debt, which will be discussed later on.

The conclusion that can be drawn from this second chart is that Vonovia is currently not only trading at a multiple that is low in absolute terms but also relatively to the average. The decline in stock price could therefore not have happened because of historically high valuation, or high valuation in general. Now the investor must look for significant risks which would lead to lower NTA per share. Consequently, lower NTA per share raises the multiple that gets paid right now and therefore raising the valuation of the company. To reach the average multiple of 0.848, assuming NTA per share stays at the H1 2022 level of €62.54, the share price would have to reach a level of about €53 posing an upside potential in share price of 100%. If looked at it from the other side, NTA per share would need to drop to around €31 or down 50% in order to reach the average valuation. The question an investor should think about is as follows: If Vonovia is objectively undervalued, are there any possible headwinds that could lower NTA per share by 50%? If the quantity of risk is less than 50% of NTA per share, an investment should be profitable.

Additionally, Ukrainian immigrants as well as immigrants of other economically troubled countries in the EU like Italy or Greece, having high debt and rising interest rates, will most likely fuel the demand for living space in the near future. From February 2022 until April 2022 alone, the number of people with Ukrainian citizenship living in Germany increased by around 600,000.

Still Germany remains in a strong economic position with a comparably low debt ratio around 69% of the GDP and has a high standard of living compared to other European countries. Rolf Buch, the CEO of Vonovia sees no risk of a crash in the real estate market at the moment because the demand is very high.

Risks

Source: https://www.destatis.de

- Falling real estate prices in Germany, where a large portion of the portfolio of Vonovia is concentrated could lead to a decline in asset value. Since 2016 the price indices for single and two-family houses have almost doubled in the major cities, as shown above, in which Vonovia is heavily invested. This increase was caused by both the high demand of living space and the low interest rates put in place by the ECB.

With the ECB now rising interest rates aggressively in order to fight inflation, financing the purchase of a home becomes less attractive. Meanwhile, the supply of properties is still low in comparison to the demand, especially because Germany is now expected to witness a lot of immigration from Ukraine in addition to the low home ownership rate, with still only around 50% of citizens owning their own home. Even if property prices decline or stop rising for a while, the nature of real estate as an asset does not historically allow crashes of 50% but rather up to 20% in very extreme cases like the 2008 financial crisis, which would hypothetically already be priced in.

-

The high debt of Vonovia in combination with increasing interest rates by the European Central Bank leads to higher costs of refinancing. Vonovia is sitting on around €43.5 billion of adjusted net debt. In order to lower the debt, Vonovia is now selling about 66,000 apartments with a total value around €13 billion. This step shows, that Vonovia is very aware of the financial circumstances in Europe and acts quickly. In addition, it must be said that most of the debt is of long-term nature, with only about €4.6 billion of the total debt being short term. Still, investing in heavily leveraged companies poses a risk.

-

Rising energy prices in the EU mainly caused by the sanctions that were declared in order to punish Russia for the war in the Ukraine lead to a rise in living expenses, which allow little room for additional rent increases by Vonovia that may be necessary to keep up with inflation. Additionally, the German government intercepted rent increases in the past declaring the so called “Mietpreisbremse”. With the government being involved in the housing market, this certainly poses a risk.

Investor Takeaway

In conclusion, a 50% discount and attractive dividend yield of 6.5% could very realistically outweigh the possible risks Vonovia is facing and most certainly pose a comfortable margin of safety.

Major deleveraging by selling apartments and reducing debt is currently happening. Rolf Buch, the CEO of Vonovia sees no risk of a crash in the real estate market at the moment because the demand for apartments put to sale by Vonovia is very high. Therefore, getting them sold near their book value should be realistic.

Immigration will additionally fuel the demand for real estate in major cities in the near future.

If Vonovia does not get completely regulated by the government like the Chinese company Alibaba (BABA) (OTCPK:BABAF) and others have been but instead does just fine and real estate prices don’t crash by 50%, this looks like a major opportunity for the patient investor caused by an irrationally large discount on net tangible assets.

Source link