[ad_1]

cemagraphics

Introduction

FactSet (NYSE:NYSE:FDS) is a stock that should be of interest to investors. We believe that the stock is undervalued based on our DCF model, and the company’s business prospects are solid given the large market size and the stability of its subscriber-based model.

Company Overview

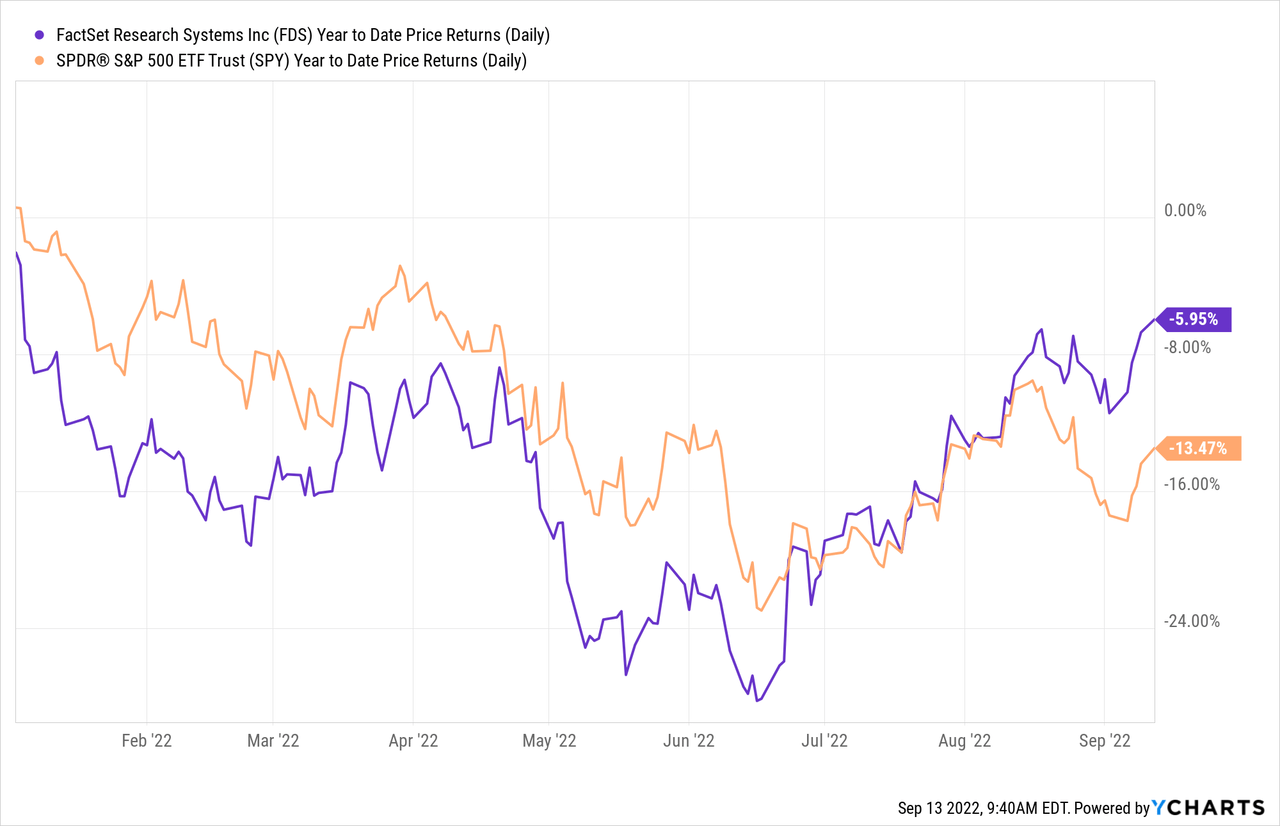

FactSet Research Systems Inc. is an American financial data and software company that provides integrated data and software to other businesses. FactSet serves various clients in the financial services industry, including but not limited to Asset Management, Banks, Insurance, Private Equity & Venture Capital, and more. FactSet provides financial data solutions as well as tools for firms to create platforms and models using their proprietary datasets. The company’s stock performance has been decent with a return of -5.95% compared to S&P 500’s return of -13.47% in the same time frame. FactSet’s market capitalization currently stands at $17.1 billion.

Firing on All Cylinders

Recent Financial Performance

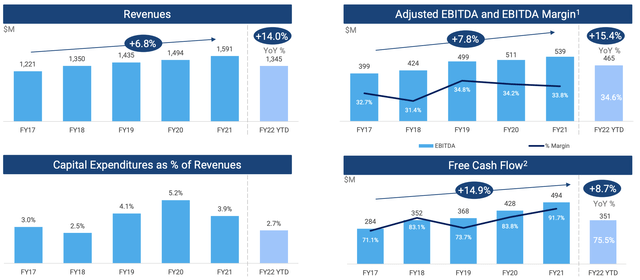

FactSet has had great financial performance in the last few years, with a revenue CAGR of 6.8% and an Adjusted EBITDA CAGR of 7.8% from FY17 to FY21. The company’s Free Cash Flow generation has been extremely strong in the same time frame, with a Free Cash Flow CAGR of 14.9%. In the most recent earnings report, management reported quarterly revenue of $488.8 million, which is an increase of 22.3% YoY, and an adjusted diluted EPS of $3.76, which is an increase of 38.2% YoY.

Strong Business Model

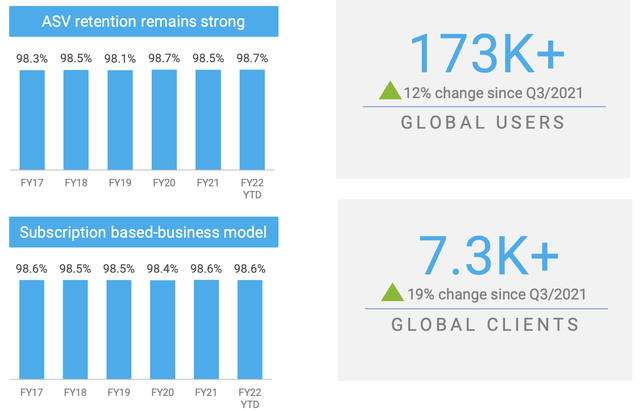

FactSet’s recent history of strong financial performance is likely the result of two factors: strong retention in its subscriber-based business model and the expansion of the company’s subscriber base. According to the recent earnings presentation, the company reported a robust 12% YoY growth in the number of global users of more than 173,000 users and an even more impressive 19% YoY growth in the number of global clients. The solid growth metrics on a subscriber basis and the high retention rates show the quality of the company’s products and the capabilities of the company’s sales team.

Growth Potential

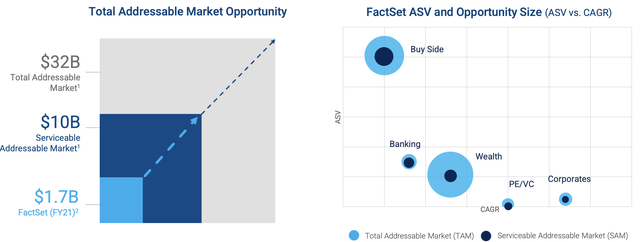

Given the solid history of financial growth and important KPIs, it is important to also assess the future growth potential of the business. We believe that the high retention rates and the increasing subscriber base should lend confidence to investors in the success of FactSet’s products and services. As a result, we believe it is important to look at the larger market dynamics that may help us size the company’s future business growth prospects. According to management, the company views the TAM to be approximately $32 billion with the “Serviceable Addressable Market” (SAM) to be $10 billion. Given that the Full-Year revenue of FactSet was $1.7 billion last year in FY21, the company has only captured 17% of the SAM, and we believe this leaves ample room for the company to continue to grow its revenue organically. With an 8%-9% FY22 organic growth, we believe that the current growth rates can easily be maintained given the high customer retention rates and the large market that the company operates in.

Capital Distribution

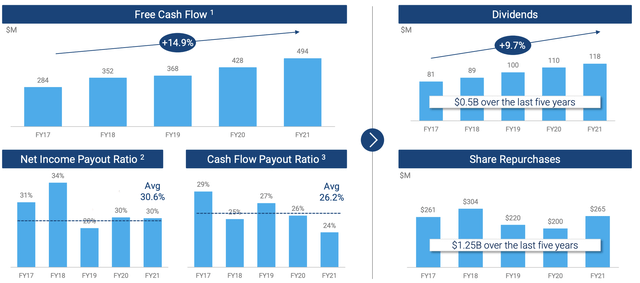

With robust FCF generation and a high 5-year CAGR of 14.9% over the past full fiscal years, it is no surprise to see strong capital returns to shareholders through the form of dividends and share repurchase programs. As seen below, the company has raised dividends at a rate of 9.7% CAGR in the same time frame, returning $500 million to shareholders. The company’s payout metrics are also extremely healthy, with the average net income payout ratio standing at 30.6% and the cash flow payout ratio at 26.2%. This leaves ample room for the company to sustain its current dividend levels and raise dividends even if financial performance were to be stunted. Furthermore, the company has initiated share repurchase programs to the tune of $1.25 billion in the past five years, helping enhance shareholder value.

Valuation

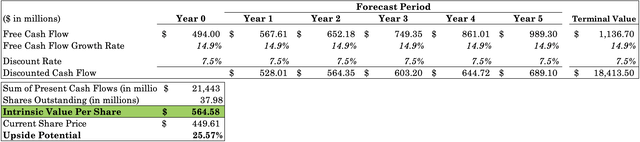

We valued FactSet using a Discounted Cash Flow model and used historical FCF growth as the assumptions for our baseline model. We used 14.9% CAGR between FY17 and FY21 as the FCF growth assumption for the next five years. We believe this is achievable given the large market size and as a result of the company’s success in increasing its user base. We also used a terminal growth rate of 3.5%, which is near the current 10-year treasury yield (our approximation for medium-term inflation). Based on this model and assuming no change in the shares outstanding, our model presents an intrinsic value per share of $564.58, which translates to a 25.57% upside from current levels. With share buyback programs, we can expect the stock price to rise even more as the number of outstanding shares declines.

Sweet Minute Capital Valuation Model

Risks

One risk to consider is the large exposure to the financial services industry that FactSet has. As interest rates rise and the economy slows, it is possible that the financial services industry will be heavily impacted in the process and affect FactSet’s bottom line. Nevertheless, the high retention rates even during the pandemic recession in 2020 provide us with a level of confidence in the strength of the company’s business model. Given that FactSet provides data and other key infrastructure, we believe the company’s services are essential for many financial services to operate efficiently and therefore the client base will prove to be sticky. Furthermore, the company is liquid with cash (~$500 million as of last quarter), and so we also do not foresee any liquidity issues.

Conclusion

Overall, FactSet is an attractive investment that can provide both income growth and capital appreciation during a time of economic volatility. The company’s business model is strong, with high customer retention rates and growing market size. Based on our valuation model, the company’s stock price is significantly discounted by the market, and we believe the current price point is a great entry point for investors to acquire some shares.

The post FactSet Stock: Don’t Miss This Consistent Grower At A Discount (NYSE:FDS) appeared first on HumanitasConnects.

The post FactSet Stock: Don’t Miss This Consistent Grower At A Discount (NYSE:FDS) appeared first on .

[ad_2]Source link