[ad_1]

naphtalina/iStock via Getty Images

Investment Thesis

The pandemic has increased the adoption of private travel, and as its addressable end-market expands, business jet manufacturers such as Textron Inc. (NYSE:TXT) should benefit from this secular tailwind. More recently, the surge in travel demand at a time when major airlines are under-staffed from pandemic-related layoffs has resulted in reduced satisfaction around commercial flying. Frustrated business-class consumers are likely to view private aviation options more favorably, accelerating the shift to private travel.

In terms of valuation, we view TXT more favorably than its peer group – Bombardier (OTCQX:BDRAF, OTCQX:BDRBF), General Dynamics (GD), and Embraer (ERJ) – due to TXT’s strong cash flow generation and low leverage profile. Currently, the stock trades at a 31% discount to its discounted cash flow (“DCF”) intrinsic value. We assign a buy rating to TXT.

|

Upside |

|||

|

Intrinsic Value |

$ 85.94 |

31.6% |

|

|

Yr 1 Target Value |

$ 87.08 |

33.3% |

|

Growth Catalyst

The primary driver of our investment thesis is Textron’s Aviation segment (41% of revenue), which will be the focus of this article. TXT operates in five business segments: Textron Aviation, Bell (commercial and military helicopters), Industrial (other vehicles and services), Systems (other vehicles and services), and Finance. Textron Aviation is one of the leading manufacturers of business jets, and we believe the busjet industry will see significant growth over our forecast horizon.

Based on a research report done by Fortune Business Insights, in 2021, the global business jet market is $25.9 BB, and the industry is on track to grow at 4-6% CAGR to $38.3 by 2029. COVID accelerated the expansion of the private aviation industry through encouraging consumer trial and creating wealth for high-net-worth individuals. The pandemic lockdowns converted many first-class commercial travelers to private aviation, many of them through charter and fractional jet ownership programs. Overall business jet flight activity has risen 20-30% since pre-COVID levels, exceeding pre-2008 levels for the first time. General flight activity has yet to exceed 2008 levels.

Notably, demand for fractional jet ownership and charter services has seen significant growth through the pandemic. Based on public filing data from charter operators such as Wheels Up (UP) and Blade Air Mobility (BLDE), we estimate that the fractional/charter demand has been growing at a ~25% per annum rate since COVID. We believe the fractional/charter market will continue to expand on the back of wealth creation for high-net-worth individuals. The post-pandemic recovery has asymmetrically created wealth for billionaires who own whole jets and millionaires who increasingly charter or own fractional jets. The number of millionaires in the US has grown 13.6% from 2021-2022, and US billionaires saw a 62% growth in wealth compared to ~8% for the median household.

Anecdotally, during the 2021 Dubai airshow, executives from busjet OEMs pointed out that the demand for new and used aircraft has surged to record levels, creating an imbalanced supply and demand dynamic that benefits busjet OEMs such as TXT. In the future, we see tight inventory and supply bottlenecks translate into pricing power for TXT, and as TXT builds a healthy backlog of aircraft orders, we expect to see margin expansion by ~200bps by 2027.

Another catalyst for private aviation stems from the chaotic 2022 summer travel season. In 2020, the U.S. airline industry was forced to cut ~90K jobs, representing around 25% of the total workforce among major airlines. The result of the layoff was a commensurate 20-40% reduction in transportation capacity. As pandemic lockdowns eased globally, travel demand returned faster than airlines could resume pre-COVID capacity. The percentage of flights cancelled or delayed reached the highest point since 2014. The frustration over commercial travel could further expand the total addressable market for private jets, as first-class fliers view private travel as a necessary way of circumventing busy airports and unpredictable flight scheduling.

We also note that we view OEMs of private jets more favorably than jet operators such as Blade, JetSuite, and Wheels Up. The main reason for our preference is supply-chain constraints. For charter operators, supply bottlenecks generally mean less opportunities for market expansion. For OEMs like TXT, a limited supply increases pricing power and improves margins.

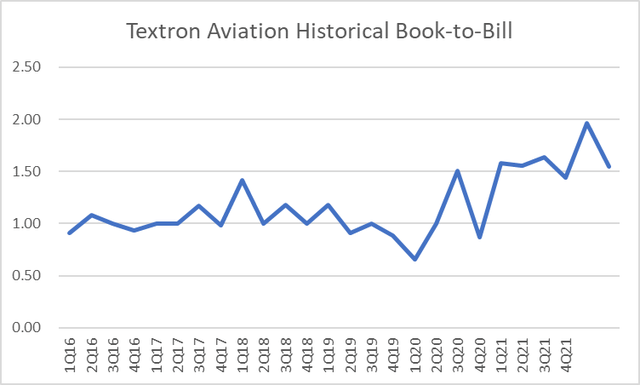

As of Q2 2022, TXT’s aviation segment has a backlog of $5.8 BB, representing about 13.5 months of revenue, up from $2.7 BB from a year ago. The segment’s book-to-bill ratio has also seen a dramatic rise post-COVID. Tight supply combined with growth in the private aviation sector creates a favorable market condition for TXT and provides support for our growth thesis. We forecast a 5-7% topline growth (giving 0 credit to TXT’s non-aviation segments) and a 200bps EBIT margin expansion by 2027.

Visualization of company data by Author

Financial Analysis

Among busjet OEMs, TXT is our top pick due to its financial profile. Compared to Bombardier (5.3X), GD (1.8X), and ERJ (2.5X), TXT’s 0.9X net leverage/EBITDA indicates that the company has a better credit profile than its peers and could have easier access to capital markets. TXT also has the highest EBIT margin (10%) among its peer group (Bombardier 7%, ERJ 5%, GD 10%). TXT also has the highest quality earnings among its peer group. Through the COVID crisis, TXT had only one-quarter of negative free cash flow, compared to 4 quarters of negative FCF by Bombardier, 2 quarters by GD, and 5 quarters by ERJ. TXT’s ability to generate cash flow even in periods of distress provides us comfort in assessing the downside risk of the company.

In 2021, TXT generated $1.2B of free cash flow, representing 80% of EBITDA. This excellent FCF conversion ratio is in large part due to the company’s effectiveness in managing capital expenditures. From 2020, the company has only spent on average 2-3% of revenue on capital expenditures; a lower capex/rev ratio results in more cash available on the balance sheet. We believe the ability to generate cash in the private aviation industry is crucial for an OEM to stay competitive. As there is an abundance of greenfield growth areas within the industry – for example, electrical flights (TXT’s own eAviation segment shows promise), supersonic jets, etc. – a healthy cash position can help TXT react to growth initiatives quicker than its competitors.

Valuation

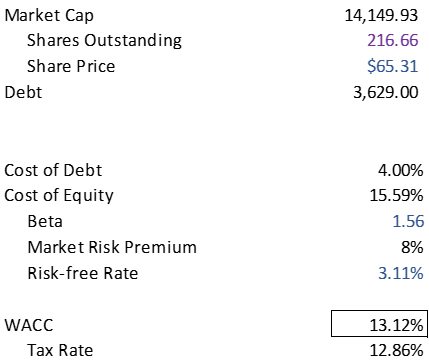

Using the inputs below, we arrive at a 13.12% discount rate.

Tabulation of company filing data by Author

Currently, TXT trades at 10.72X EV/EBITDA. This compares to ERJ’s 16.30X, Bombardier’s 18.17X, and GD’s 14.2X. While TXT is not the cheapest among its peer group, we believe TXT’s valuation multiple is the most attractive based on its low leverage profile, sizable cash pile, and high-quality FCF.

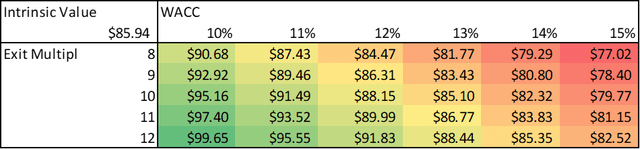

Our DCF model arrived at $85.94. We further sensitize our fundamental valuation based on discount rate and exit multiple. We observe that the current price level provides significant “margin-of-safety,” as the intrinsic value stays above the stock price, even as the year 10 EBITDA multiple reduces from 10X to 8X and the discount rate widens to 15%.

Created by Author using company filing data

Conclusion

The pandemic has been a positive catalyst for private aviation, and OEMs should enjoy the most benefit due to favorable supply and demand dynamics created by lockdowns. Among the top busjet manufacturers, we view TXT as having the healthiest balance sheet and the highest quality earnings based on its historical performance. The company is currently valued at a reasonable 10.7X EBITDA.

Given our view on TXT’s growth and profitability, we conclude that the company trades at a significant discount to its intrinsic value, and hence we assign a buy rating. We end our analysis with a cautionary note. TXT’s aviation segment accounts for 41% of the company’s revenue; Bell, Systems, and Industrials accounts for the remainder. While the non-aviation segments are profitable, we do not believe they would experience meaningful growth. If the other segments show negative growth or margin compression, there is a possibility that TXT’s combined operations will underperform.

Source link