[ad_1]

PeopleImages

I’ve held Hims & Hers (NYSE:HIMS) stock ever since it went public (even before it de-SPACed). In each and every quarterly update, my response has always been: WOW.

In this deep dive article, you’ll understand why.

Enjoy!

Investment Thesis

The telehealth industry enjoyed massive tailwinds as a result of the pandemic. Although telehealth adoption is down from its pandemic peaks, H&H — a direct-to-patient telehealth company — is still firing on all cylinders.

Despite competitive threats and a tough macro environment, H&H managed to execute its growth plans — well beyond expectations.

And now, the company is raising guidance… by 22 percentage points!

Even with the recent rally from its May lows, H&H is still massively undervalued — considering its stellar financial performance, competitive advantages, and long growth runway ahead.

Having a portfolio dysfunction? Perhaps H&H is the prescription you need for your portfolio.

Value Proposition

A few years back, serial-entrepreneur Andrew Dudum was having a nice family dinner when all of a sudden, his older sister confronted him about his, well… his face. In her words, Dudums’ face was “ashy” and “wrinkly,” infested with “pimples.” Disturbed by her brother’s appearance, she grabbed Dudum’s credit card and declared that she’d buy a bunch of skincare products for her brother.

The bill was $300 worth of mostly women’s products — “an outrageous price point for a normal guy,” said Dudum.

Dudum learned a few things from this intervention:

- Not everyone has “an opinionated sister,” family member, or friend that could help men find or educate them about beauty products — raising the issue of inaccessibility.

- Most men are unwilling to spend that much on skincare — raising the issue of unaffordability.

- “Most guys who want to take care of themselves have to walk into Sephora,” and the internet is flooded with countless wellness products with unverified reviews — raising the issue of inconvenience.

These issues inspired Dudum to launch Hims in 2017, a wellness brand for men. A year later, its women-centric brand, Hers, was launched. At its core, H&H’s mission is to make healthcare accessible, affordable, and convenient for everyone.

HIMS FY2022 Q2 Investor Presentation

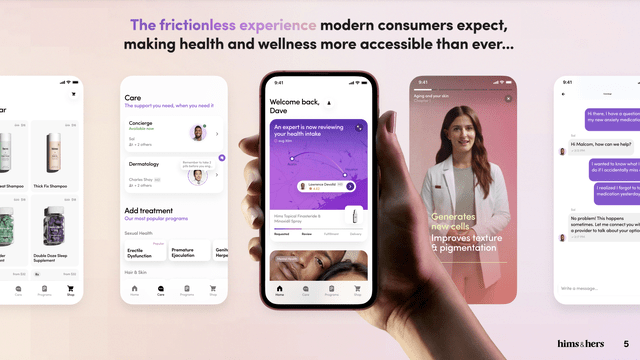

Back then, H&H was just a mail-order subscription service for generic drugs. Today, H&H is a digitally-native, fully-verticalized telehealth platform that provides consumers access to high-quality medical care.

- Digital: migrating consumers from time-consuming office visits to a seamless digital experience.

- Verticalization: its integrated platform includes access to a distributed provider network, cloud pharmacy fulfillment, and order management for an end-to-end customer experience.

- Healthcare: access to a diverse set of high-quality treatment options, supported by ongoing care from licensed providers.

On that last bullet point, H&H offers over-the-counter drugs, devices, cosmetics, and supplement products, mainly in the general wellness, sexual health, skincare, and hair care departments.

There are too many items to list here, but the picture below shows Hims’ flagship products: shampoo, minoxidil, finasteride, and biotin gummies.

Hims

How does it work? Customers only need to follow a few simple steps:

- Choose a specific condition for treatment (e.g., hair loss, erectile dysfunction, anxiety, etc.).

- Answer a few questions regarding their condition — sometimes customers need to upload pictures for visual reference.

- Receive a free online consultation from a licensed healthcare professional. Customers are also given product/prescription recommendations

- Customers choose the desired cadence to receive products (one-time purchase or subscription plans).

- Products will be shipped directly to customers.

- Receive ongoing virtual care from experts (messaging and video calls).

All these are done online through its website and mobile app.

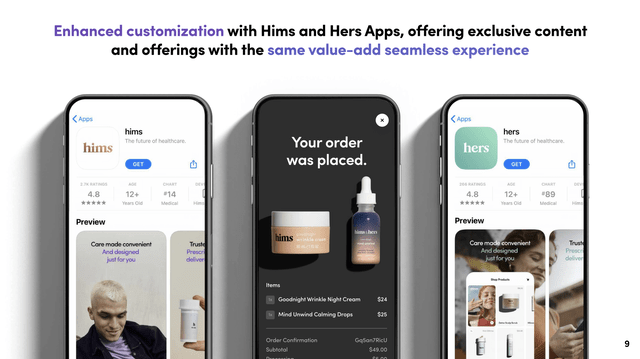

Speaking of which, H&H just recently launched its mobile app, which amplifies the company’s already high-quality product offering. The app consists of three modules:

- Care: access to 24-hour Concierge service and virtual Care team.

- Content: guided Programs and educational content led by medical professionals.

- Shop: get exclusive member pricing, manage subscriptions, and track orders.

HIMS FY2022 Q2 Investor Presentation

Wrapping up this section, H&H is elevating the patient experience by cutting out the major pain points typical of the healthcare system: office visits, expensive medication, and complex procedures, for instance. Fundamentally, H&H is paving the way for the future of healthcare — by building a direct-to-patient business model through its telehealth platform.

Market Opportunity

The opportunity lies in addressing dysfunctions within the traditional healthcare system. For one, there’s a long list of players in the industry that makes it almost impossible for them to coordinate with one another to deliver a patient-first experience.

Think about it. You go to the doctor’s office and you’re asked to sit in the waiting room, wondering when your name will be called up. Doctors are rarely transparent with pricing and it’s no surprise that the bill usually comes with a few surprises. Insurance coverage is loosely defined and it’s also uncertain whether your insurance provider will cover a particular treatment. Filing an insurance claim is also a lengthy, complicated, and uncertain process.

Put simply, the healthcare industry is notoriously inefficient — digital healthcare innovation can address these inefficiencies.

The healthcare industry is massive and growing. In the US alone, national health expenditure reached $4.1 trillion in 2020 or roughly $12,530 per person. By 2028, that figure is expected to reach $6.2 trillion. The sheer size also explains why the healthcare industry is highly fragmented.

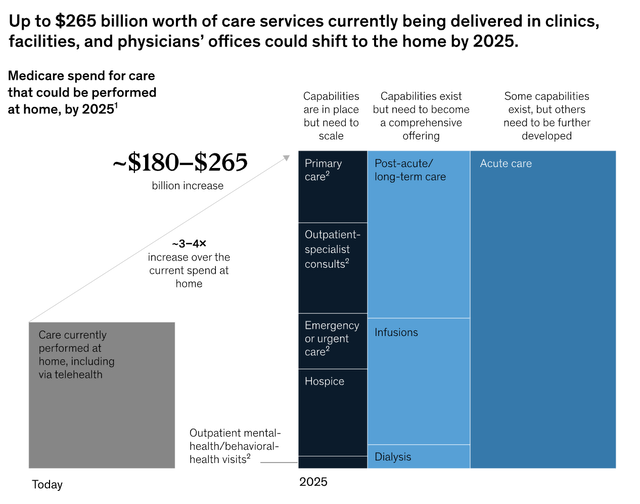

The telehealth market — or virtual healthcare — is a small subset of the healthcare industry. It is young, but growing rapidly, and spending in this subindustry could reach $265 billion.

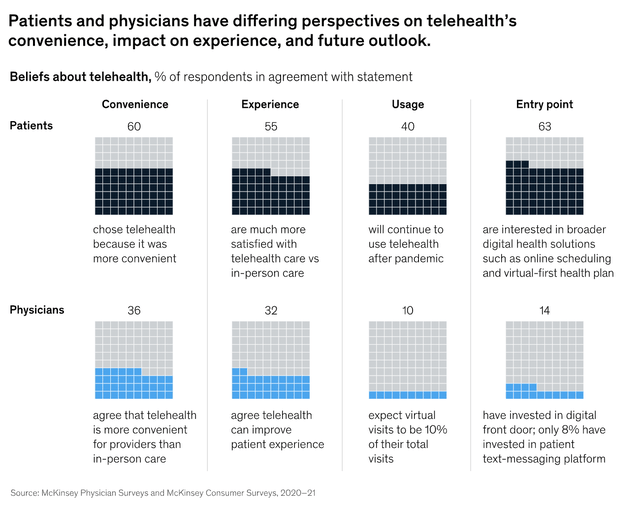

Obviously, the pandemic has pulled forward years of growth in this nascent category. Here are some statistics based on a McKinsey study:

- Virtual visits in April 2020 were 78x higher than in February 2020 — accounting for nearly 1/3 of outpatient visits.

- In May 2021, 88% of consumers had used telehealth services since the pandemic began.

- 83% of physicians offered virtual services, up from only 13% in 2019.

- Although telehealth use has dropped from its peak (due to the reopening of the economy), it is still 38x higher than pre-pandemic levels.

With or without the pandemic, telehealth adoption is inevitable and although it won’t completely replace in-person doctor visits, telehealth is likely to be a major component of the healthcare system in the future, creating a more streamlined experience for patients.

This should benefit telemedicine platforms like H&H.

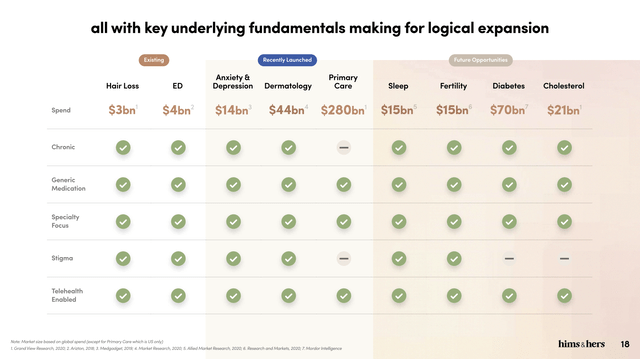

Specifically for H&H, the company focuses on ongoing stigmatized conditions that can be treated safely via telehealth means and generic drugs. According to the CDC:

- 60% of Americans suffer from a chronic condition.

- 40% of Americans suffer from two or more chronic conditions.

Eventually, H&H can branch out to other conditions — such as weight loss, sleep, or fertility — providing customers with a single platform for most of their healthcare needs. As you can see below, the market opportunity for H&H is massive.

HIMS FY2021 Q1 Investor Presentation

Business Model

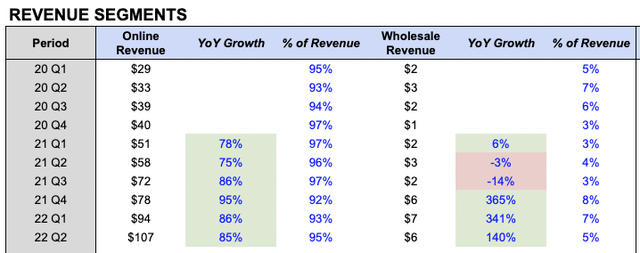

H&H generates Revenue in two ways: Online and Wholesale.

Online

H&H generates Online Revenue by selling products and services directly to consumers through its websites and apps. H&H’s business strategy is to offer treatments that require ongoing prescription and care from healthcare providers. As such, Online Revenue is primarily recurring in nature, where customers sign up for subscriptions to have products and services automatically delivered to them — monthly or every two to twelve months, based on their preferences.

Wholesale

H&H also sells non-prescription products to retailers through wholesale purchasing agreements.

Growth

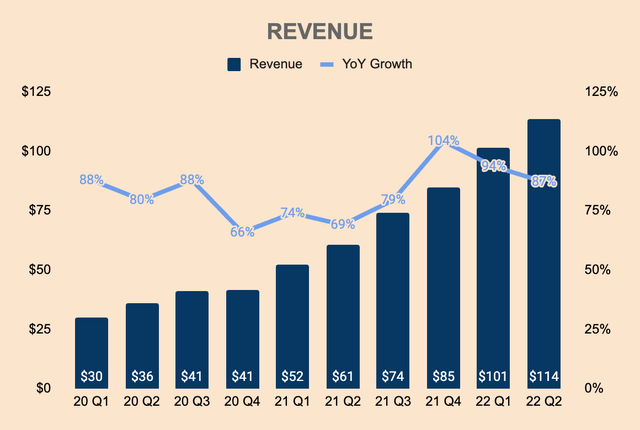

Growth has been nothing short of spectacular. H&H has sustained high double-digit growth despite tough YoY comps, especially in 2020 when pandemic lockdowns and government stimulus supercharged online sales.

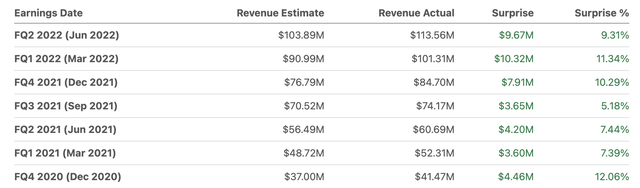

In Q2, Revenue grew 87% to $114 million, an acceleration from last year’s growth of 69%. That is an annual run rate of $456 million. To put that into perspective, that is almost double the expected 2022 Revenue ($233 million) projected by management in its SPAC merger investor presentation!

HIMS Investor Relations and Author’s Analysis

Breaking it down by segment, Online Revenue grew by 85% to $107 million driven by growth in Subscriptions, AOV, and Net Orders. The acquisitions of Apostrophe (a teledermatology startup) and Honest Health (a UK-based telehealth company) also contributed to the growth. As of Q2, Online Revenue makes up 95% of total Revenue.

HIMS Investor Relations and Author’s Analysis

On the other hand, Wholesale Revenue was $6 million in the latest quarter, up 140% YoY — primarily due to the addition of new retail partners.

In Q2, we gained traction with 2 marquee retail partners, CVS and Walgreens. We launched 6 new women’s essential supplements and probiotics, both on our own platform and exclusively in CVS locations nationwide. These new offerings are focused on daily support of general health mental wellness gut health, digestive health, skin and libido. In addition, we expanded our presence in Walgreens with the rollout of both Hims & Hers hair care lines in over 7,000 stores throughout the country.

(CEO Andrew Dudum, FY2022 Q2 Earnings Call)

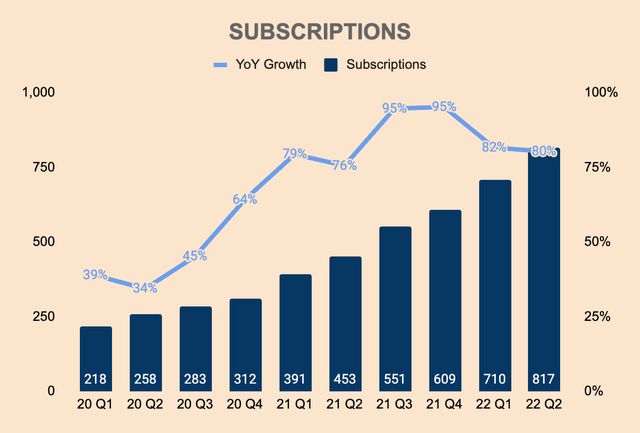

Subscriptions grew 80% YoY, to 817k, primarily due to increased marketing expenses, increased online traffic, increased conversion rates, a high appetite for multi-month subscriptions, and the aforementioned acquisitions.

HIMS Investor Relations and Author’s Analysis

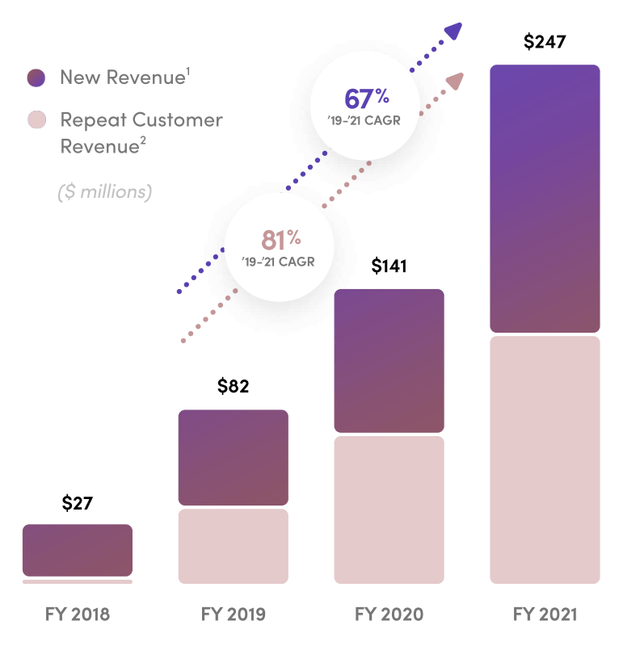

It is also worth noting that Repeat Customers — or customers acquired in prior years —are now driving about half of total Revenue, showing strong Revenue retention rates. As New Customers join the platform, Repeat Customer Revenue should grow as well, providing the company with a larger, more consistent Revenue stream.

HIMS FY2022 Q2 Investor Presentation

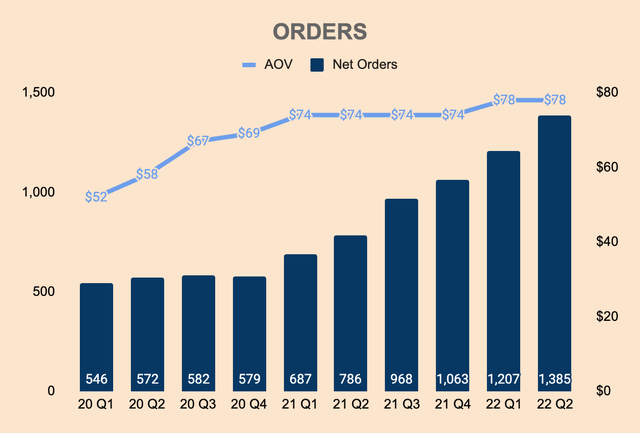

Higher Subscriptions boosted Net Orders, which was 1.4 million in Q2, up 76% YoY. Average Order Value remained steady at $78. The 5% YoY increase in AOV was driven by increased uptake from product bundles as well as higher price points from multi-month Subscriptions. Despite consumers feeling the pain of rising inflation, they are spending more on H&H’s platform — a testament to the company’s strong value proposition and brand resilience.

HIMS Investor Relations and Author’s Analysis

Again, H&H’s growth has been spectacular. The company has consistently outperformed internal and external expectations, and with the rollout of its new mobile apps, we could see higher engagement, higher conversions, and subsequently, robust growth moving forward.

Profitability

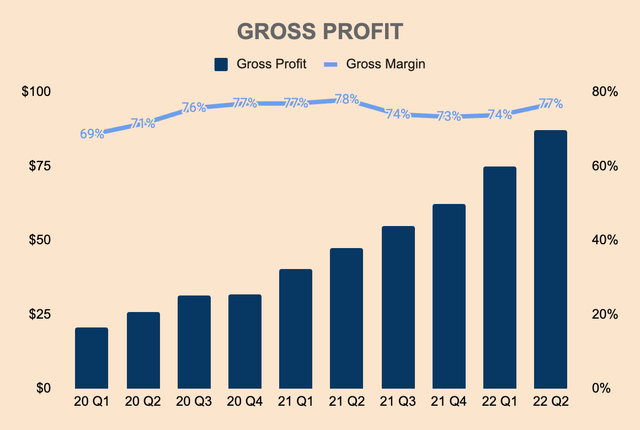

Turning to profitability, H&H sustained a high Gross Margin despite the high-inflationary environment — Cost of Revenue primarily consists of medical consultation fees paid to licensed providers, product and packaging, and shipping.

Gross Margin in Q2 was 77%, a 1pp drop YoY — primarily due to the growth of the Wholesale segment, which has a lower margin profile than the Online segment. As H&H continues to expand its retail partnerships, we can expect Wholesale Revenue to make a larger proportion of Revenue over time, thus pressuring overall Gross Margin. While the Wholesale segment is still a small part of the business, I believe it is a critical component of H&H’s overall strategy — wholesale partnerships generate brand awareness and ultimately increase website and app traffic, driving Subscriptions and Online Revenue.

The tradeoff is worth it.

Nonetheless, Gross Margin of 70%+ is exceptionally high for a “mail-to-order” business, indicating high earnings potential. Moreover, there’s an opportunity to expand margins through ancillary services in the future — such as health insurance.

HIMS Investor Relations and Author’s Analysis

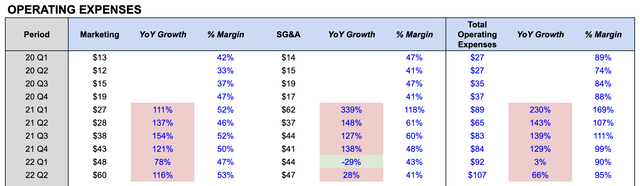

Operating Expense was $107 million, up 66% YoY. Marketing Expense was $60 million, up 116% YoY — outpacing Revenue growth. This reflects management’s priority to maximize new customer growth through increased ad spending across different media channels.

HIMS Investor Relations and Author’s Analysis

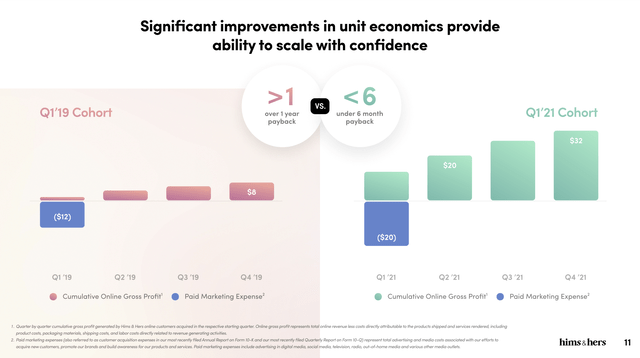

Part of the reason why management is increasing Marketing Expense aggressively is due to the company’s much-improved unit economics. As shown below, payback period — or the time it takes to recover its initial paid Marketing Expense — was more than a year for the 2019 cohort. In contrast, payback period for the 2021 cohort was less than 6 months. This attractive unit economics enables H&H to quickly reinvest the proceeds back into the business, accelerating growth initiatives.

HIMS F2021 Q4 Investor Presentation

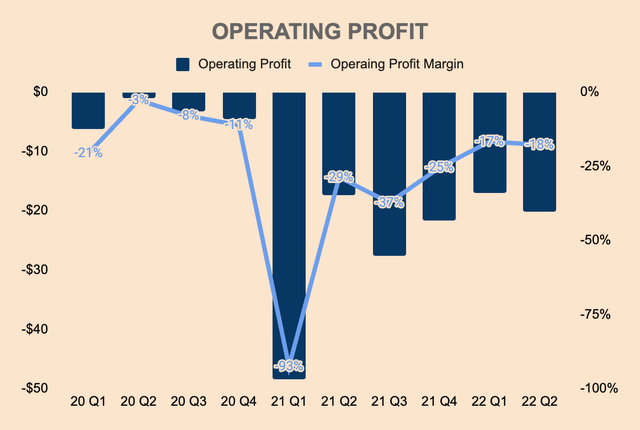

Still, the big concern here is that Marketing Expense is growing faster than Revenue, showing a lack of operating leverage and overdependence on paid Marketing Expense. Thus, Operating Margin, though improving, is still deep in the red — coming in at (18)% as of Q2.

HIMS Investor Relations and Author’s Analysis

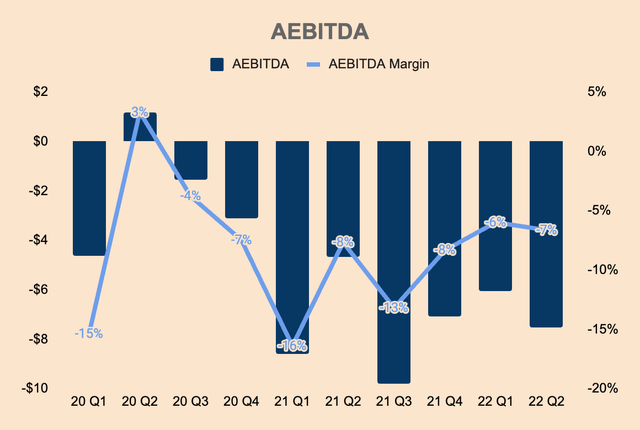

Adjusting for non-cash expenses — like Share-based Compensation and Depreciation — H&H recorded an Adjusted EBITDA of $(8) million in Q2, a (7)% margin. The cash burn is still manageable given H&H’s strong financial health.

HIMS Investor Relations and Author’s Analysis

As an investor, I am particularly interested in businesses with high Gross Margins. H&H is a great example.

H&H reported high Gross Margin, consistently, which shows high pricing power (without damaging demand) as well as high earnings potential (for capital reinvestment). On the other hand, H&H still relies on heavy marketing for growth — until we see Marketing Expense growth slow down relative to Revenue growth, we can’t know for sure whether H&H has a truly scalable business model that is sustainable.

Financial Health

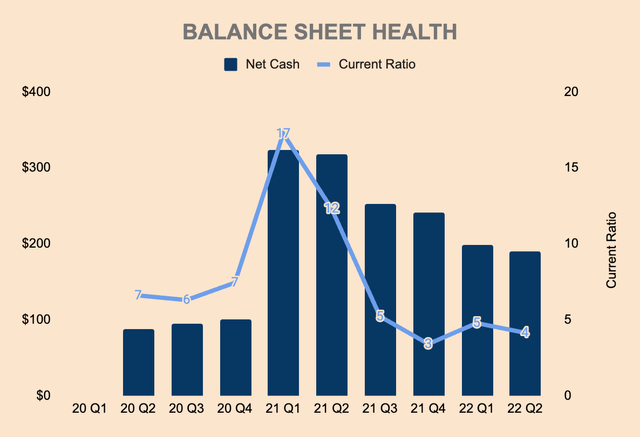

Although H&H is still unprofitable, it has a strong balance sheet to support short-term cash burn. As of Q2, H&H has $195 million of Cash and Short-term Investments, with virtually no Debt. Net Cash position is $190 million, with a healthy Current Ratio of about 4x.

HIMS Investor Relations and Author’s Analysis

Notice that Net Cash saw a massive spike in 21Q1. This comes from the SPAC combination with Oaktree Acquisition Corp. However, Net Cash has been dropping with each passing quarter. This is primarily due to three reasons:

- Overall business unprofitability, as described in the previous section.

- In 2021, H&H made net short-term investments of $105 million.

- Also in 2021, H&H spent an additional $47 million on the Apostrophe and Honest Health acquisitions, net of cash acquired from these businesses.

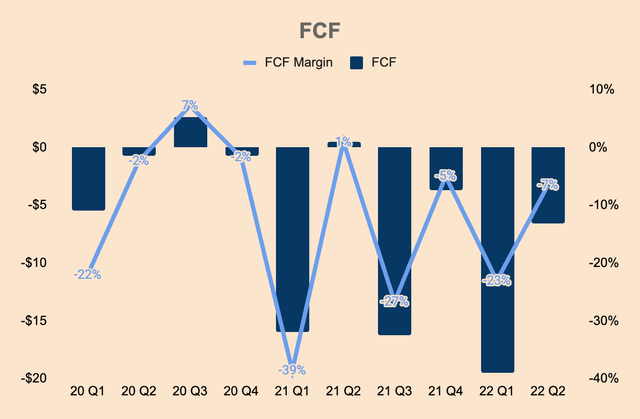

Diving deeper into point #1, H&H is still Free Cash Flow negative, burning $(46) million in the last twelve months. Given its Net Cash position of $190 million, H&H should be able to survive the next two to three years without additional capital raises. However, it won’t be a surprise if H&H issues an equity offering for M&A purposes — perhaps to expand its product line or enter a new geographic market.

HIMS Investor Relations and Author’s Analysis

Outlook

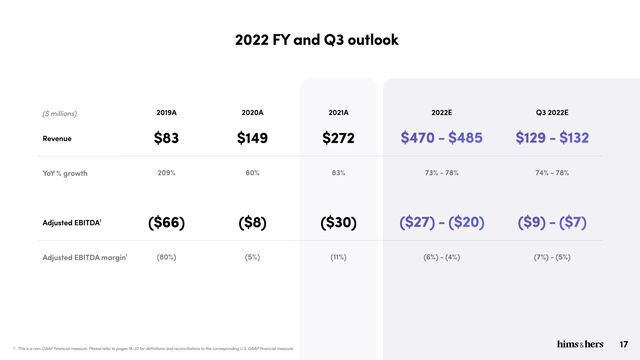

In its Q2 update, management raised its Revenue and AEBITDA guidance — for both Q3 and FY2022. Most notably, management raised (midpoint) FY2022 Revenue guidance from $418 million in Q1 to $478 million in Q2, a bump of $60 million. Instead of a 54% growth, the company now expects a 76% growth. Just wow.

HIMS FY2022 Q2 Investor Presentation

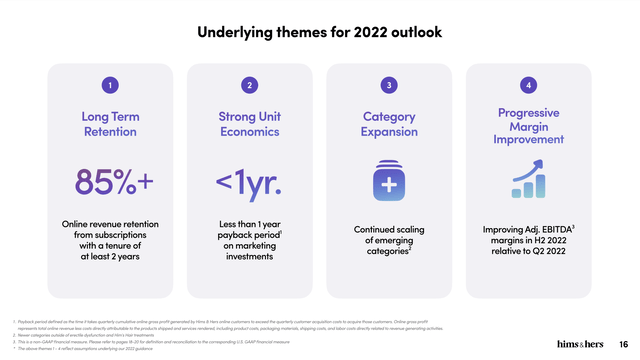

Embedded in its revised outlook, management laid out the following assumptions:

- Robust customer growth with at least 85% Online Revenue retention.

- Payback period on marketing investments of less than 1 year.

- Expansion to one to two major categories every couple of quarters.

- If these trends continue, AEBITDA profitability within the next four quarters is likely.

HIMS FY2022 Q2 Investor Presentation

On that last point, achieving positive AEBITDA would involve transitioning towards 100% in-house order fulfillment. As of Q2, the company’s two pharmacy centers fulfilled 55%+ of all orders.

One of the largest areas of focus was our verticalization efforts in Ohio and Arizona, or our affiliated pharmacy, compounding and fulfillment centers. These facilities are now filling the majority of our monthly treatment orders with pharmaceutical and over the counter. This transition away from third party pharmacy fulfillment centers has taken years of rigorous focus and is now helping to deliver improved operational efficiencies and a major beat to adjusted EBITDA. Our march towards near 100% order fulfillment verticalization is well on track.

(CEO Andrew Dudum, FY2022 Q1 Earnings Call)

On the product innovation front, the company is also working on expanding its proprietary product line, which would “unlock further customer demand, brand loyalty and ultimately, more valuable relationships.”

While the majority of products sold on our platform today are generic formulations in nature, we believe the future is one where proprietary formulations and truly personalized products not available anywhere else makes up the majority of our business.

(CEO Andrew Dudum, FY2022 Q2 Earnings Call)

These initiatives should add to business growth and operational efficiency.

It’s also worth mentioning that throughout its time as a public company, H&H has consistently beaten its own guidance as well as analyst expectations — I won’t be surprised if H&H destroys expectations once again.

Competitive Moats

Based on my research and analysis, I identified two competitive advantages for H&H: brand and network effects.

Brand

As highlighted in my first H&H article:

HIMS focuses on providing healthcare for conditions that are often stigmatized, such as erectile dysfunction, hair loss, and depression. By marketing itself as a playful and easygoing brand, HIMS makes it convenient for people to receive healthcare without feeling embarrassed.

Its approachability is the sole reason why approximately 80% of customers came to H&H to seek treatment for their particular conditions for the first time. This shows that the H&H value proposition and branding resonate well with consumers with “stigmatized conditions.”

H&H also targets millennials and younger generations — consumers who represent the future of healthcare — and as their healthcare needs grow, so does H&H.

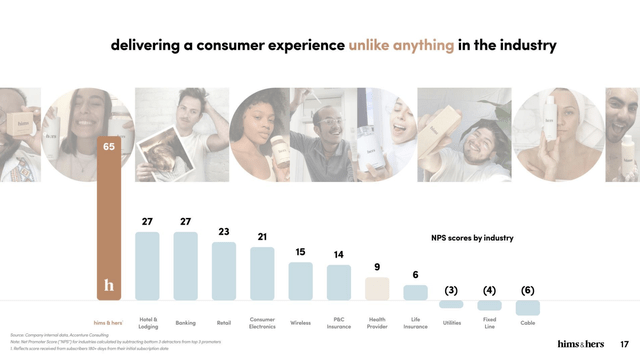

Again, its mission is to make healthcare accessible, affordable, and convenient for everyone. Its digital, seamless experience makes it all the more delightful for customers, reducing friction when seeking medical care. This is why H&H has an Online Revenue retention rate of 85%+ and a Net Promoter Score of 65, compared to healthcare providers’ average of just 9.

HIMS SPAC Investor Presentation

The launch of the H&H app has also gained meaningful traction and engagement, signifying customers’ strong appetite for H&H’s products.

Through the app, consumers are engaging with our brand 3x more than historically through our website creating the potential for immense value that can expand past the initial purchase. We’re excited to also reach our Android users with similar mobile apps that we expect to launch in the coming weeks.

(CEO Andrew Dudum, FY2022 Q2 Earnings Call)

As of this writing, both the Hims and Hers apps have great reviews:

- Hims: #27 in Medical with an average rating of 4.8/5.0 (3.1k reviews)

- Hers: #144 in Medical with an average rating of 4.8/5.0 (314 reviews)

Essentially, H&H’s brand power and marketing prowess should help the company accumulate more members and market share in the years to come.

Network Effects

Alongside its brand moat, H&H is particularly smart with its distribution strategy.

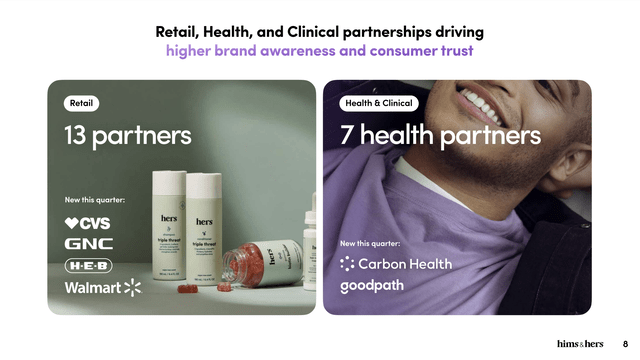

In the retail landscape, H&H has 13 partners, including:

- Walgreens (WBA) (7k+ locations)

- Uber (UBER) (on-demand delivery in 12 markets)

- Amazon

- Target (TGT) (1.8k+ locations)

- Revolve (RVLV)

- Walmart (WMT) (1.4k+ stores)

- CVS (CVS)

On the health and clinical side, H&H partners with 7 health partners, including Ochsner Health, Mount Sinai Health System, and Privia — to provide a telehealth-enabled patient experience. Most recently, H&H partnered with Carbon Health:

Licensed medical professionals on the Hims & Hers platform will provide patients with an option to connect to Carbon Health if they require additional primary care follow-up or evaluation, due to complex medical histories, symptoms, or risk factors for conditions for which Hims & Hers does not currently offer treatment.

(H&H Press Release)

H&H also works with licensed pharmacies TruePill and Curexa Pharmacy for the fulfillment and distribution of certain medications — these partners could turn obsolete as the company transitions to 100% in-house order fulfillment.

HIMS FY2022 Q1 Investor Presentation

These partnerships significantly increase H&H’s brand presence as well as provide additional convenience for customers. The presence of H&H products in well-known retail locations and healthcare partners is also further validation of H&H’s high-quality product offering.

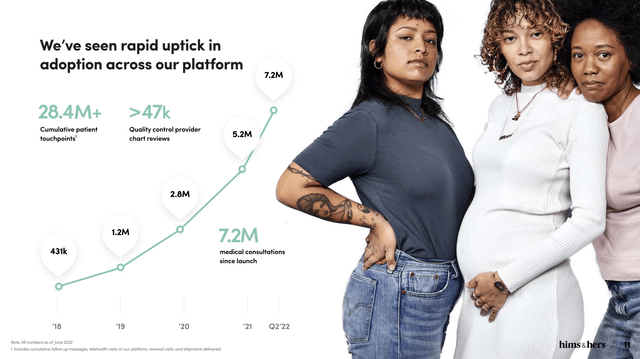

We’re already seeing network effects taking steam. In just a span of four years:

- Cumulative medical consultations grew from 431k at the end of 2018 to 7.2 million as of Q2.

- Subscriptions grew from 134k at the end of 2018, to 817k as of Q2.

The combination of an asset-light business model and smart marketing/distribution strategy explains H&H’s incredible run over the last few years. As the ecosystem continues to grow, powerful network effects should ensue.

HIMS FY2022 Q2 Investor Presentation

Valuation

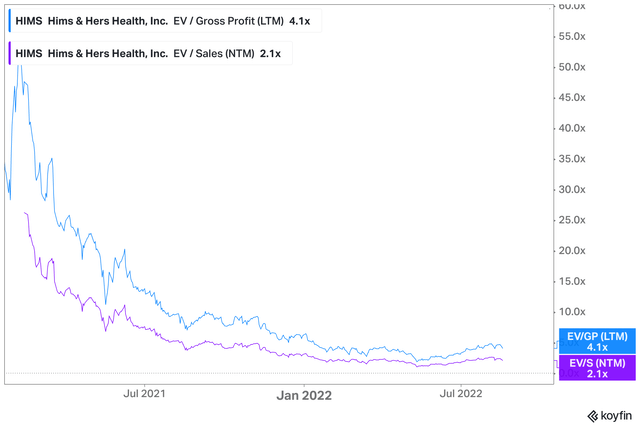

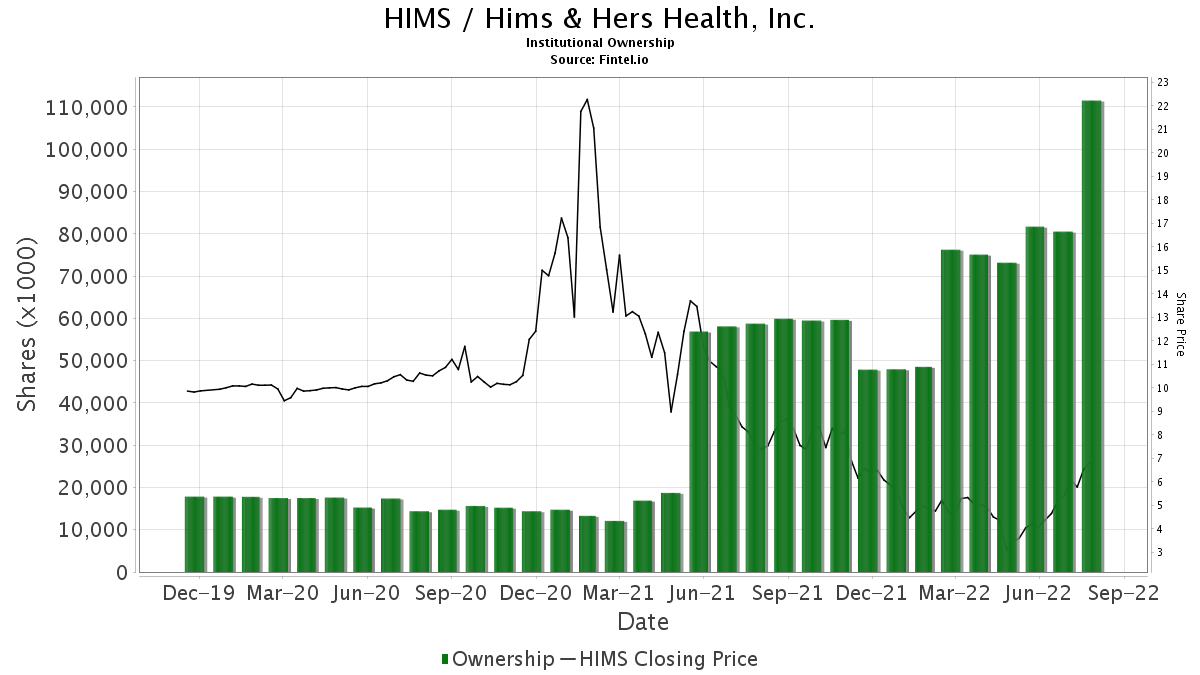

H&H stock has gone through a roller coaster ride over the past two years — the stock flew to as high as $25/share during the SPAC craze and subsequently plummeted by nearly 90% to just $3/share. Although the stock has recovered substantially from its May lows, H&H seems to be valued cheaply still.

In January 2019, H&H had a pre-money valuation of $1 billion as a private company. Today, H&H has an enterprise value of roughly $1.2 billion. H&H has almost the same valuation as it did three years ago, despite:

- Growing Revenue by ~1,700% from $27 million in FY2018 to an expected $478 million in FY2022.

- Improving Gross Margin from 29% in FY2018 to 77% in Q2.

- Growing Subscriptions by ~500% from 134k in FY2018 to 817k in Q2.

As such investors can acquire H&H, pretty much at its 2019 valuation despite being a much stronger and larger business today. On top of that, H&H is still growing at high double-digit rates.

In terms of multiples, H&H trades at an EV/Sales and EV/Gross Profit of 2.1x and 4.1x, respectively — incredibly cheap for a company growing at a blistering pace.

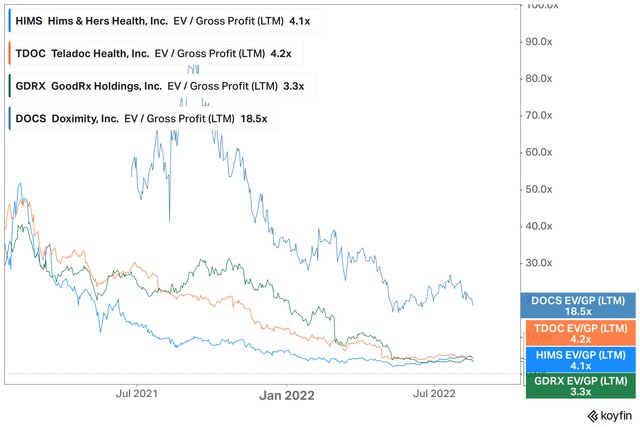

Now let’s look at how H&H is valued compared to other popular healthtech companies. As you can see, H&H seems to be valued in the same basket as Teladoc (TDOC) and GoodRx (GDRX). On the other hand, H&H is valued cheaply compared to the telehealth/networking platform, Doximity (DOCS).

Now let’s compare its valuation to Ro, another direct-to-consumer telehealth platform — in my opinion, Ro is H&H’s biggest rival. For an extensive deep dive into Ro’s business, see my article here.

Back in February this year, Ro raised $150 million at a $7 billion valuation. In a Medium post, CEO Zachariah Reitano mentioned that the company did ~$200 million of Revenue in 2020 (H&H did $149 million in 2020). Now (I’m going to be overly aggressive here), let’s assume Ro is able to 3x Revenue by the end of 2022, or $600 million.

That means Ro is valued at about ~11x EV/Revenue ($7 billion divided by $600 million). To recall, H&H is currently valued at an EV/Revenue of 2.1x. If H&H is to trade at the same multiple as Ro, H&H stock should trade ~400%+ higher than current prices. Let that sink in…

In other words, H&H could be massively undervalued.

Financial institutions are taking notice, accumulating H&H shares on the way down.

Fintel

As I see it, the risk/reward profile is very attractive in H&H stock. The fundamentals of the business are getting better with each passing quarter, and yet, the stock is getting worse.

The divergence between business fundamentals and stock price creates a wonderful buying opportunity.

Catalysts

- New Product Launches: Specifically, H&H could expand to other categories (as mentioned in the Market Opportunities section) as well as add new features on its platform, both mobile app and website. H&H consistently launches new categories every couple of quarters or so but the markets consistently ditch these positive developments as they dump anything related to growth stocks. However, given the changes in market sentiment, we could see the markets react positively in light of new product developments.

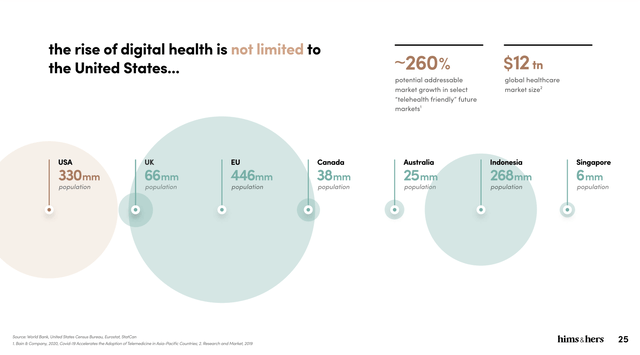

- Expand into New Geographies: While the US has the largest healthcare market, there’s substantial opportunity for H&H to expand into new geographic markets. After all, there are another 7.6 billion people living outside the US. H&H has already expanded to the UK following its Honest Health acquisition — Europe, Canada, and Australia should be next in line.

HIMS FY2021 Q4 Investor Presentation

- Expanding Partnerships: Whether it be with new retail companies or healthcare organizations, additional partnerships should bolster H&H’s network. The flywheel effect rolls on.

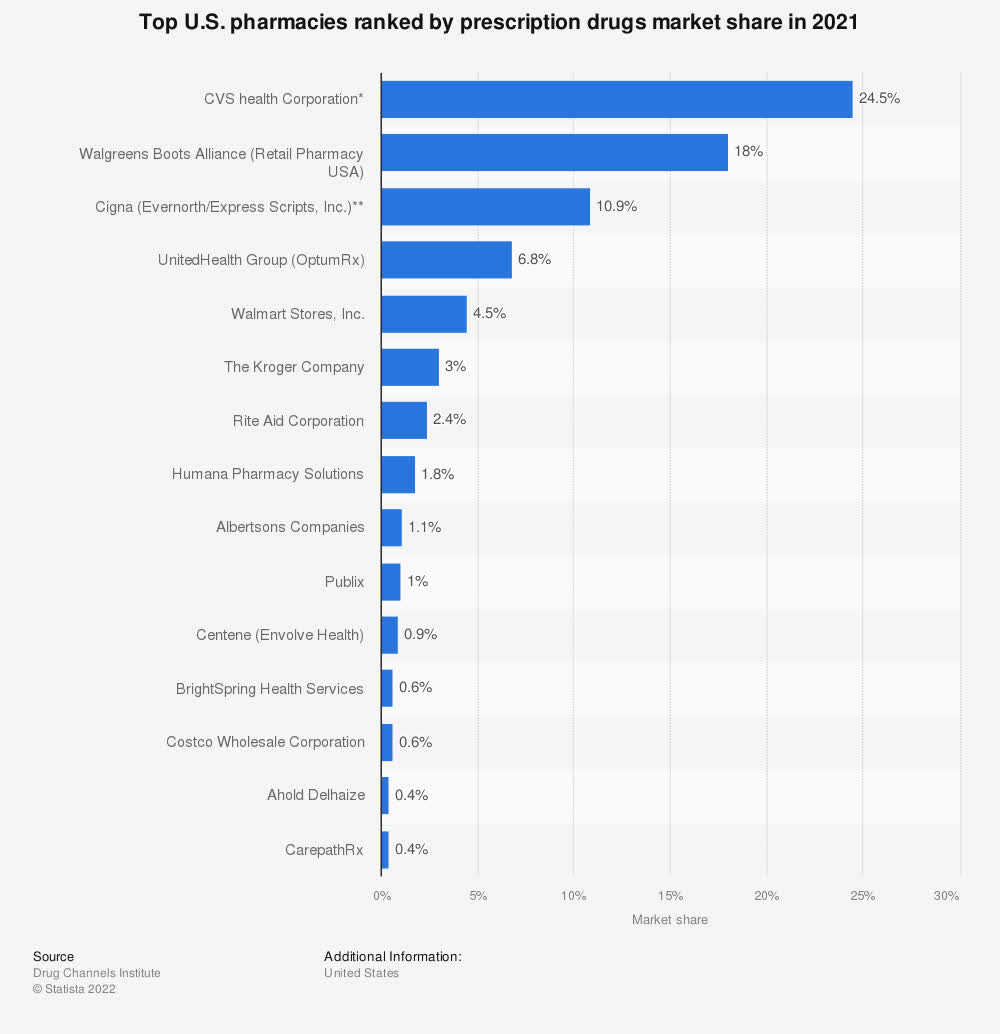

- Acquisition Target: Big tech has been trying to break into the healthtech industry lately. For instance, Amazon recently acquired One Medical for $3.9 billion. Retail-focused healthcare companies are also making initiatives to ramp up their digital offerings. For example, CVS is rumored to bid for Signify Health. Given H&H’s falling valuation and proven business model, H&H could potentially be a buyout target — at a premium, of course. Apple (AAPL), Walgreens (WBA), and Johnson & Johnson (JNJ) are all possible buyers, in my view.

- Recession: Contrary to popular belief, H&H could actually benefit from a recessionary environment. When people cut spending, they look for more affordable options — H&H can deliver that promise.

We are able to deliver given the kind of consumer-centric verticalized platform we built start to finish healthcare, cheaper than insurance. And so, during recessionary times, I think we are actually incredibly well-positioned to really disproportionately take share and build that brand equity because we’re really delivering on something people need. And the alternative which is high deductible insurance plans are really difficult for people and the majority of our customers and the majority of this country is plagued with those types of plans.

(CEO Andrew Dudum, Yahoo Finance interview)

Risks

- Competition: In my view, competition is the biggest risk for H&H.

- Firstly, H&H primarily sells generic drugs with no intellectual property protection. As such, it’s easy for copycats to find a drug manufacturer and launch their own brands — Lemonaid, which was acquired by 23andMe (ME), is a great example. Ro also offers similar products, although it is branching out to other areas of healthtech (see my article on Hims vs. Ro).

- Secondly, other telehealth companies such as Teladoc and Amwell (AMWL) may also expand to DTC healthcare. GoodRx, a platform that tracks drug prices, may also offer better pricing for consumers.

- Thirdly, big tech is already making moves into the space, which could be a big problem for H&H. For instance, Amazon acquired PillPack, an online pharmacy, back in 2018.

- Lastly, incumbents can leverage their economies of scale, fulfillment network, and brand recognition to distribute drugs to end consumers through a new telehealth offering. Although they’ll be slow to innovate, it is still a risk worth considering.

Statista

- Supply Risks: While patients enjoyed the benefits coming of telehealth services, physicians did not feel the same way. Based on a McKinsey study, 60% of patients find telehealth convenient as compared to only 36% of physicians. Furthermore, 62% of physicians recommend in-person visits — they’re also expecting telehealth to account for less than 1/3 of visits in the future. This differing perspective may lead to supply shortages in telehealth offerings, which may cause turnaround times and telehealth consultation fees to increase — conflicting factors to H&H’s value proposition.

Conclusion

H&H is reinventing the healthcare industry. Healthcare should be all about the patient. And H&H is on a mission to deliver affordable, accessible, and convenient healthcare for all — through its innovative telehealth platform, incredible value proposition, and excellent branding.

The healthcare industry is massive and growing, and H&H has the potential to be a dominant player in the direct-to-patient space.

Despite the recent runup in the stock price, H&H is still gravely undervalued, — considering its exceptional financial performance, management’s unfailing execution, and the company’s long growth runway. As I see it, I’d wait for a pullback to accumulate shares.

As we’ve seen in the last few quarters, the markets have been unforgiving. Perhaps, H&H is the prescription that your portfolio needs.

With that said, thank you for reading my H&H deep dive.

Source link