[ad_1]

cemagraphics

In this article, I’m going to be looking at a few companies that I believe represent excellent investment opportunities in today’s market. While we’re being bombarded with potential negatives or very real negatives, it’s important to remember that the market is far from black and white. What to some can look like a terrible time to invest, is a very different perspective or time for bargain hunters and value investors.

There’s no doubt that we’re currently in a very negative spiral. No one knows how long this will continue.

What to do?

Oh, you’ll get people who say “Don’t invest this year”, or “Wait at least this many months before touching anything”, but in the end, these are all, and only assumptions – not facts, and not 100% accurate forecasts.

This is important to recall.

Despite the markets going up and down, I’ve made plenty of investments the past few months that are currently either flat or inclusive of dividends, positive. My portfolio for the year is still actually in the green, and inclusive of FX and dividends is up almost 16%. It would, therefore, have been foolish of me to stay “outside” of the market.

There is no doubt that the current market situation is likely, or has the potential to provide us with plenty of short-term pain. This is part of life, and part of investing. It goes up – and it goes down.

Sow the Wind – Reap the Whirlwind

Whether you as an investor are comfortable with riding the whirlwind of the current situation is also up to you. The quote, based on Hosea 8:7, I believe is very apt.

Sow the wind, reap the whirlwind

(Source: King James Bible, A reference to Hosea 8:7 “For they haue sowen the winde, and they shall reape the whirlewinde”)

For years, the combined upsides of free money and growth investing as well as things like crypto and other inflated assets or quasi-assets have inflated things to unheard-of levels. We’ve literally been in a market where investors argue that a company that has never made a single dollar worth of GAAP profit should be valued at 30-50X P/E.

Now that we’re sobering up – imagine that for a second. Chronically unprofitable companies have been able to get investor support – and still very much are.

To me, this has always been nonsensical – which is why I never invested in any of them.

We have been, quite literally, for years, sowing the wind.

We’re now reaping the whirlwind.

Not everyone is comfortable in that situation – and that’s perfectly fine. There are things to be said for saying “You know, I’m stepping outside of this until things have calmed down”. These circumstances bring out the market timers in all of us – that part of us that goes “Should I invest today, or wait?” It’s perfectly human.

Why I remain calm

Investors often ask me why I remain collected in today’s environment, as opposed to selling my investments. A combination of reasons, really – but all of them are really centered around the fact that I invest in companies with businesses that are necessary and like as not to continue generating cash flows (and increasing ones, as many recent results suggest) to fund the dividends they are paying to me.

While a downturn year is starting to look likely on a portfolio-wide basis, this does not concern me, because alternatives seem far worse to me. What are investors supposed to do?

- Invest in gold that doesn’t pay dividends or any sort of interest?

- Invest more in treasuries that are a far cry from matching inflation?

- Invest in interest-rate secured savings accounts that, again, do not match inflation or anything close to it?

- Keep our money in the mattress, where it’ll certainly suffer from inflation?

There are no “great” options, as I see it – not safe ones. Investors need to either accept the risks of what I mentioned – or accept the risk of investing in the market, accompanied by the potential downsides.

What I view as the “best”, is therefore to invest my capital into businesses that are likely to be able to push pricing despite inflation, increase earnings (despite cost increases), and increase those dividends.

The combination of those dividends, those earnings, and investing cash into essential services or products maintained by investment-grade (or higher) companies is what appeals to me.

When doing this, I view myself as being double-secured/safe. First, is fundamental safety from a company’s cash flows and essential services or products. Secondly, the dividend, allows me to partake of that safety, with the company paying me a substantial, attractive interest payment for my investment, even if the share price is down due to market or company-specific perceived risks.

It’s all about making sure that you invest in:

- Safe companies with great fundamentals

- Dividend-paying businesses take advantage of the growth in the expansion of profits. From 1980 to 2019, 75% of the returns of the S&P 500 came from dividends. 75%. Remember that next time someone says that dividends don’t matter.

- Valuation, making sure that we buy the sort of undervalued businesses that are likely to generate upside, even at the valuations and forecasts we’re seeing today.

As long as I follow these three rules, it is my stance that in the long term, my portfolio will continue to see the sort of outperformance I’ve seen over the past few years.

The following 3 companies are some of my highest conviction buys at this time. All of these companies are:

- BBB+ or above.

- 4% yield or above.

- I own at least 3.5% of my portfolio in the company.

1. Simon Property Group (SPG)

I won’t quit buying this company while it’s being traded not far from the COVID-19 sort of valuations. When an A-quality and A-rated REIT trades at around 8X P/FFO, it’s time to pay attention. Cash flow by far covers the company’s 7.12% yield – my own YoC is now above the 7% mark, having cost-averaged down nicely and buying during COVID-19. The company has seen some amazing declines.

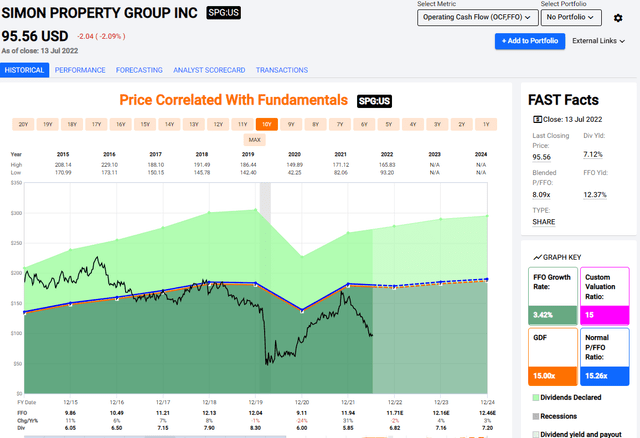

SPG performance (F.A.S.T graphs)

Are there reasons for these declines? Well, some people question the company’s earnings ability and vacancies going into a potential recession. However, we can easily see how the company weathered the last recession – a 15% FFO decline followed by another 6% in 2010. The company already recorded a 24% drop in FFO in COVID – it seems unlikely both in context of the forecasts as well as the way things seem to be going based on industry data, that SPG is going to see a significant earnings decline.

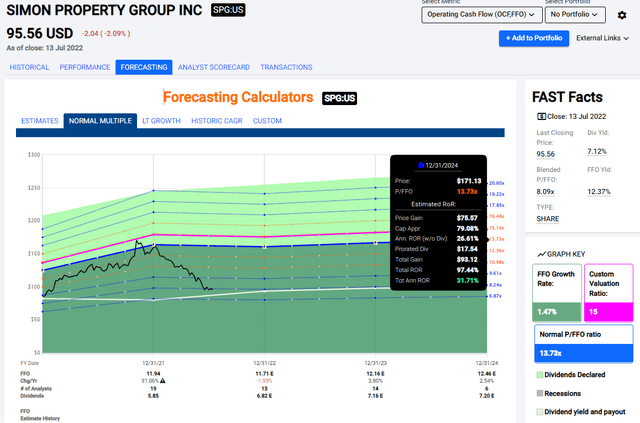

There are very, and I do mean very few scenarios where this company does not see an excellent upside from today’s valuation. Even trading at only 8.2X P/FFO, the SPG upside here us close to 26% in 3 years. That’s not moving the valuation needle an inch.

Even if we move down to COVID-19 levels of 6X, we get 8% RoR in 3 years. Any sort of positive trajectory here, any sort of reversal gives us 2024E RoR between 43.7% (9X P/FFO) to 98% RoR (13.7X P/FFO).

All that while making in yield, which is very close to the level of inflation.

SPG Upside (SPG IR)

The company isn’t forecasting declines either – SPG is forecasting growth.

Let me put it simply. At this price, I don’t foresee a realistic downside scenario to this business. That is why SPG is a “BUY”.

2. Verizon Communications (VZ)

Safety is the name of the game here. And what spells safety (aside from Water, Food, heat, and electricity?) more than the sort of essential service that every citizen in our modern society depends on?

I’m talking about telecommunications. Verizon is a great example of this. The company has taken a severe beating on the market, trading at below 10X P/E.

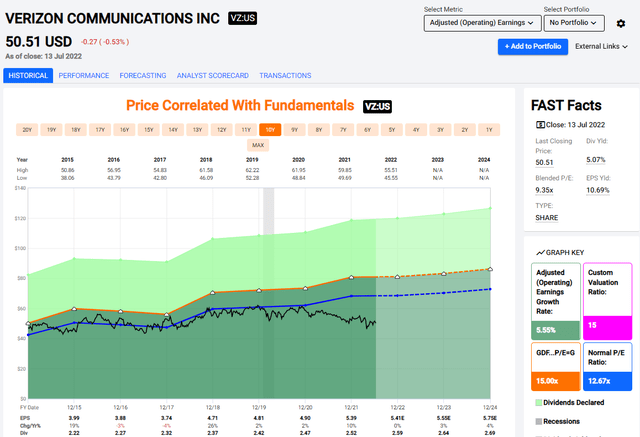

Verizon History (F.A.S.T graphs)

Is it justified? I would say no. Verizon and similar telcos have already shown us they intend to do exactly what they need to do in order to stay competitive and profitable in today’s market. Inflation will result in service price bumps to offset the cost increases and make sure the company can continue to pay its dividend.

Right now, that VZ dividend is over 5% – and that is for a BBB+ rated telecommunications company with a market cap of over $212B. Is Verizon going anywhere?

I doubt you will find anyone seriously making that argument. And below 10X P/E, this company’s typical ratio of 12.5X is quite a bit off. The company is set to grow its earnings slowly, around 3-4% per year or so.

That means Verizon’s annual upside is now close to 20% at an average forward P/E of 12.6X. That’s a 56% RoR in 4 years, and while the dividend doesn’t match inflation, it has even better protection than SPG here. Even if the company were to go into the negative, trading at 8X or so, this would still keep you in the green provided that profits are as forecasted – which they usually are.

I, therefore, say that VZ has an upside of around 19.9% annually, or 56% in 3 years – and I view this as likely. I own a full 5% of my portfolio in VZ, and I’ll keep adding as my stake and time, as well as the valuation, allows for me to do so.

There aren’t many European companies that can be said to be near-immune to the current cavalcade of catastrophes that are hounding the EU market – everything from geopolitical, to energy worries to similar issues. But Siemens is probably one of the companies that, due to its current exposures and structure, has one of the better chances of doing so. The company is also currently trading at a significant discount, giving the business a 4%+ yield.

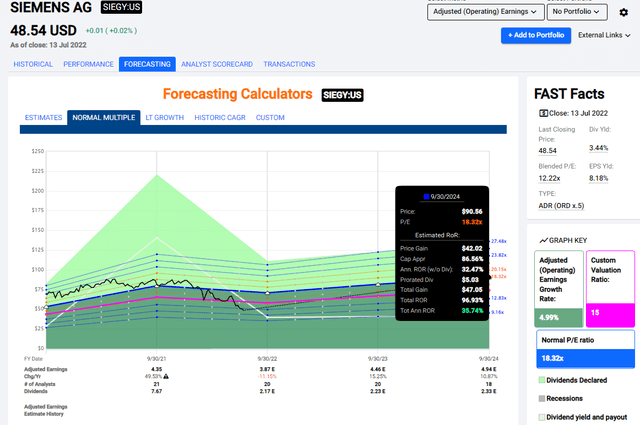

What’s more, this company is even higher rated than SPG – it’s A+ rated. Trading at around 12X P/E, the upside to the ADR 5-year average of 18.3X is no less than 97% in 3 years, and 35.7% annually until then. Can it go that high? I believe so.

Are there further downsides?

Yeah – if this decline continues, Siemens will likely suffer along with it. With the German market especially in trouble, I expect Siemens to correlate not insignificantly with the DAX – but the company is still trading at a significantly positive valuation, with regards to the overall upside.

Siemens Upside (F.A.S.T graphs)

Like the other companies on this list, there might be a bit of a dip year, but Siemens is extremely apt at raising prices and managing risks like this. The company has many decades worth of experience doing just that.

What you’re betting on when you “BUY” Siemens at a valuation that it hasn’t seen since COVID-19 is that the company will continue what it has been doing for all those decades.

Given the company’s structure and business – which I go through more in my Siemens-specific articles – this is an assumption with a pretty high likelihood of actually materializing. Even if the company were to go down to 9X P/E, we still have a 4% RoR for the next 3-4 years. The margin of safety at these levels is fairly amazing when you consider that Siemens has not traded anywhere near 9X P/E for the last 20 years.

So – Siemens. I consider this company a great “BUY” here, with a likely upside close to triple digits in a few years.

Wrapping Up

Despite the downturns we’re seeing, these companies are attractive “BUY”s here. They will continue to grow more attractive as things drop down more. My strategy is to pick the best and the highest, safest upsides in my portfolio. I then compare these to what holdings I have, to make sure I don’t overexpose any position above my limit, to ensure that my conservative portfolio stays exactly that – conservative.

You see, I’m not bothered by a downturn – not really. My timeframe is long enough that withdrawing my capital or taking it out would be pointless. I’m looking for continuous dividends, and long-term growth – both of those dividends, but also of those profits and of the company overall.

So, many of my companies are down for the year? Who cares?

Everything is down in this market climate. I’ve already established that I’m not doing one or any of the alternatives available to me and other investors because they don’t fulfill my goals.

I am, as the quote suggested, riding the whirlwind. It’s tumultuous, it’s wild – and if I wasn’t invested in A-grade quality companies, it might even have been a bit scary.

Now?

I just shrug my shoulders and plan my next investment.

Because no one knows when the market will turn or when gains will be made. By staying out of the market you’re ensuring that you’re missing out on gains. By continually investing, you’re making sure that those gains actually continue to accumulate as the markets react.

You’re also making sure that dividends continue to accumulate.

I run a well-diversified, conservative income-oriented DGI portfolio. On average, I earn about 4.31% portfolio-wide YoC on my invested capital. The market will do what the market will do, no matter what you and I think.

But what can be counted on is those dividends continuing to flow – and it’s my goal to make sure that this continues.

What is your strategy here?

Source link