[ad_1]

Michael Vi/iStock Editorial via Getty Images

The tech sector has become “persona non grata” this year. After the excesses of 2020 and 2021 which saw the entire market piling into the tech bandwagon trade, we have seen a mini 2000s-era dotcom crash in 2022.

Against that backdrop, it’s understandable why investors are piling into what they perceive as the highest-quality, most consistent tech/growth stocks – those that have a reputation for never delivering surprises (at least, not bad ones). Among this group is MongoDB (NASDAQ:MDB), the non-relational database company that initially positioned itself as an Oracle-killer (ORCL) (and with MongoDB’s growth rates approaching 60% y/y while Oracle is barely striving to maintain flat y/y growth among its portfolio, this proclamation is proving itself to be true).

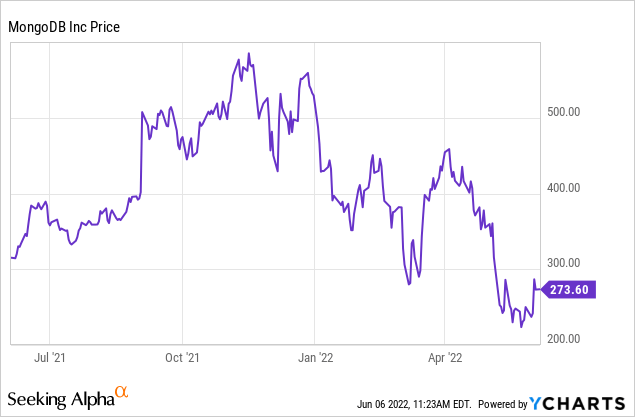

Now, MongoDB is in a better position than most tech stocks, but it’s still down ~40% year to date. That being said, this correction has not fully fixed what I viewed to be the biggest impediment to investing in this name: a huge valuation. And while MongoDB’s growth premium certainly does afford it some level of premium versus its peers, I’m still unsure that MongoDB is the best stock to buy in a choppy market. This is especially true after the stock’s generous ~15% rally post-Q1 earnings.

I’m retaining my neutral outlook on MongoDB. My base viewpoint is that the stock will continue to waver in the $240-$300 range throughout the majority of the next twelve months. For MongoDB, the bar is already set so high with its >50% y/y growth rates that it’s difficult to pinpoint to any meaningful near-term catalyst that can materially lift the stock beyond current levels. And nor do I think there will be a multiples re-rating as well, as investors have largely shed the excessive mentality of 2020/2021 which all but disregarded valuation multiples and let high-flying names soar to multiples of sometimes greater than 40x revenue.

So, I’ll start this discussion with a recap of valuation. At MongoDB’s current share prices of $274 (down 43% on the year), the stock trades at a market cap of $19.01 billion. After we net off the $1.83 billion of cash and $1.14 billion of debt on MongoDB’s most recent balance sheet, the company’s resulting enterprise value is $18.32 billion.

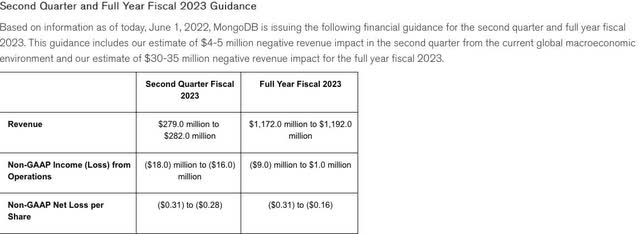

Meanwhile, for the current fiscal year FY23 (which for MongoDB is the year ending next January 2023), MongoDB has guided to revenue of $1.17-1.19 billion for the year, representing 36% y/y growth.

MongoDB outlook (MongoDB Q1 earnings release)

This puts MongoDB’s current valuation at a rich 15.5x EV/FY23 revenue. During the “boom times” of 2020-2021, this type of multiple for a >50% growth stock wouldn’t have batted an eye. Today, while the multiple still isn’t exactly expensive, it doesn’t leave much room for upside.

If we extend the view out by one year and compare instead against Wall Street’s consensus FY24 revenue estimate of $1.56 billion (+31% y/y; data from Yahoo Finance), the company’s multiple goes to 11.7x EV/FY24 revenue.

I agree that MongoDB is a fantastic, category-leading stock with the growth rates, high gross margins, and path to profitability that are the envy of most companies in the software sector. At the same time, however, I wouldn’t consider MongoDB to be a buy until the stock drops to 9x FY24 revenue. This implies a price target of $215, or ~20% downside from current levels (and a level MongoDB almost briefly flirted with in May).

Until then, I think there are more than a handful of highly attractive software stocks that have been decimated in the recent tech correction that are far more appealing investment candidates and have more room to rise in a rebound. A short list of the names I’ve tracked closely recently includes Sumo Logic (SUMO), Robinhood (HOOD), DraftKings (DKNG), Chewy (CHWY), DocuSign (DOCU), and Netflix (NFLX).

Until MongoDB corrects further, stay on the sidelines here.

Q1 download

Let’s now go through MongoDB’s latest quarterly results in greater detail. We certainly can’t argue that MongoDB continues to knock quarterly earnings out of the park every quarter – it’s just that all this strength is already baked into the current share price.

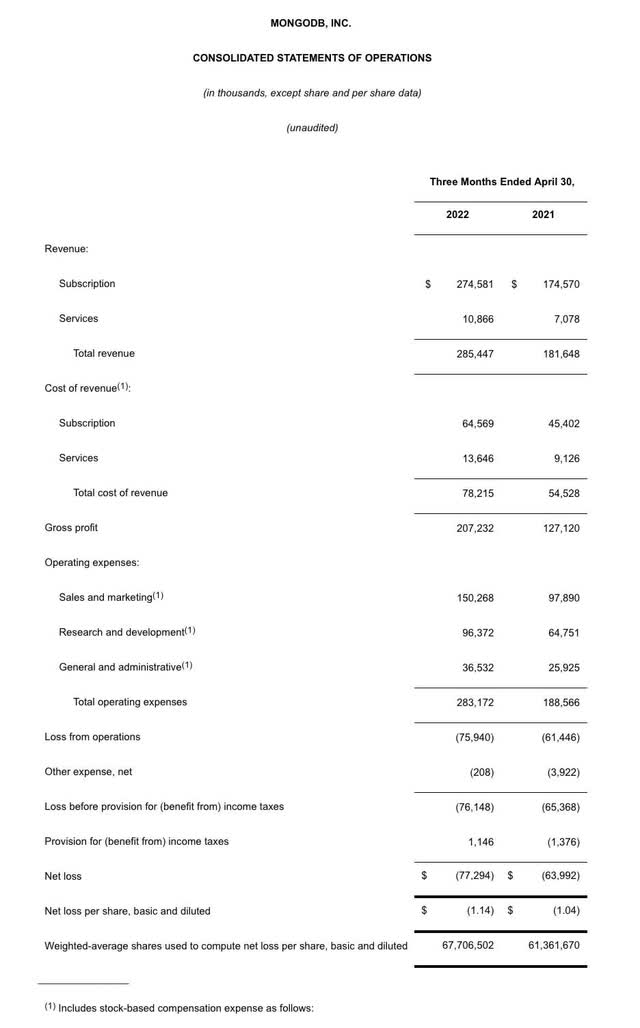

MongoDB Q1 results (MongoDB Q1 earnings release)

In Q1, MongoDB grew its revenue at a 57% y/y pace to $285.4 million, beating Wall Street’s expectations of $267.1 million (+47% y/y) by a huge ten-point margin (as usual, MongoDB does a great job of setting the bar low for expectations; in fact, the company’s 36% y/y growth outlook for the remainder of FY23 does look suspiciously conservative against this quarter’s actual results). MongoDB also managed to accelerate revenue versus 56% y/y growth in Q4.

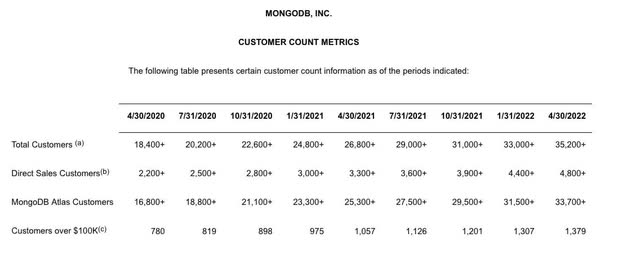

The company continued to add to its total customer base at a pace of ~2k per quarter, ending Q1 with 35.2k customers in its base. The count of customers generating more than $100k in annual revenue also grew 30% y/y to 1,379.

MongoDB customer metrics (MongoDB Q1 earnings release)

One particular business driver behind MongoDB’s recent growth is the fact that the company has leaned into its cloud partnerships to broaden its network of potential buyers. In particular, in Q1 the company deepened its go-to-market partnership with Amazon AWS (AMZN), solidifying a new multi-year contract that includes both joint sales pushes as well as additional technology integrations. The company also launched a pay-as-you-go feature for MongoDB Atlas customers who are part of the Google Cloud ecosystem.

The company believes it executed well against a challenging macroeconomic backdrop, which it estimates will have a total negative -$36 million impact to the year’s revenue (roughly a three-point headwind). Some additional helpful color from CEO Dev Ittycheria’s prepared remarks on the Q1 earnings call:

We are really pleased with our Q1 performance and see it as continued validation of the massive market we are pursuing, our strong product market fit and our ability to execute. Atlas continues to be our key growth engine as new and existing customers run more and more of their mission critical workloads on Atlas. In addition to the strong customer adoption Atlas, many customers also continue to self manage MongoDB, driving a strong quarter for our enterprise advanced product as well. We believe that our Q1 performance is additional evidence that MongoDB is leading the market through a major secular transition, which is still in the very early innings […]

Starting with what we’re seeing in the market, first quarter was a robust quarter for new business. Driving innovation remains a top priority for our customers and they’re investing in modern technologies to facilitate this. We had strong engagement with the C-suite and our deal cycles were in line with normal patterns.

The tone of our quarterly business review meetings at the start of the second quarter was that of confidence. Our sales force indicated that our messages resonated in the marketplace and they remain bullish about the opportunities to win new business. Turning from new business to expansion of existing customers, we saw a strong continued growth from existing customers in Q1. As the market went on, however, we did see a modestly lower than normal growth rate in certain parts of our business, we experienced the slow growth in our self-serve and mid-market channels primarily in Europe. The slowdown is a result of slower usage growth of underlying applications and is a reflection of the macro environment.”

We will want to be careful here: though MongoDB has certainly guided to deceleration in Q2 as it does every quarter, the reality of having it happen and citing real macro headwinds may provide the impetus for MongoDB stock to knee-jerk react downward (hopefully toward my ~$215 price handle).

On the profitability front, however, MongoDB performed admirably. Pro forma gross margins ticked up three points to 75%, up from 72% in the year-ago quarter. Pro forma operating margins, meanwhile, burst to positive 6%, sharply up from -2% in the year-ago quarter.

Key takeaways

MongoDB remains the same story as it always has been: high quality stock at a high price. Right now, that’s not my preferred investment style for a rebounding market: I think there will be much better gains to be had in snapping up more beaten-down names. Continue watching this one closely, but don’t buy in too quickly.

Source link