[ad_1]

Falcor/E+ via Getty Images

Earlier this year, I wrote on Osisko Gold Royalties (NYSE:OR), noting that the stock offered a rare mix of growth and value. I ended up timing this call very poorly, with the stock sinking 30% since my April update. However, outside of a slightly weak gold/silver price, I don’t see any change to the investment thesis, given that Osisko Gold Royalties has an inflation-resistant business model and isn’t seeing margin contraction like some of its producer peers. So, with OR on the fire sale rack (~0.80x P/NAV) and paying a ~2.0% dividend yield, I see the stock as a steal, and I’ve continued to accumulate on weakness.

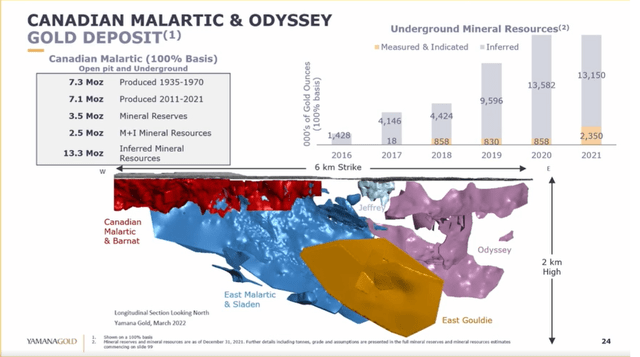

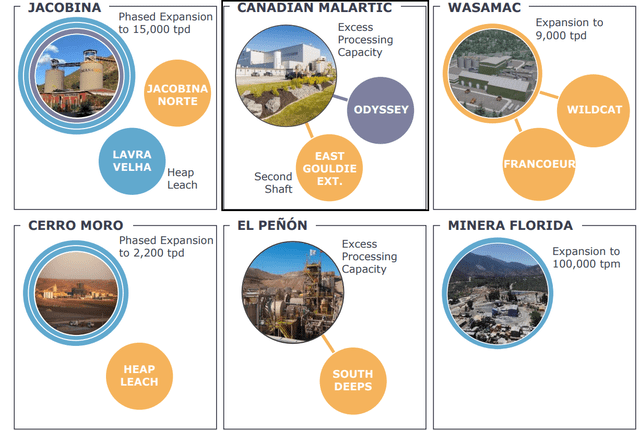

Canadian Malartic Mine (3-5% NSR held by OR) (Agnico Eagle Presentation)

While the Osisko Gold Royalties (“Osisko GR”) investment thesis already was attractive with a new stream on the world’s highest-grade gold mine in Utah, and several royalties/streams on attractive Tier-1 jurisdiction assets, the story has only become better since Q2. This is because the Canadian Malartic Partnership continues to have drilling success at Osisko GR’s flagship property, Osisko Mining (OTCPK:OBNNF) just unveiled further growth in grades and size at its Windfall deposit, and Agnico Eagle (AEM) continues to churn out free cash flow, boding well for elevated exploration spend across several properties where Osisko GR holds royalties.

In this update, though, I believe it makes sense to focus on its flagship royalty, Canadian Malartic, and look at the true value of this asset based on some of the transactions we’ve seen in the royalty space over the past year (Great Bear Project, Cortez, etc.). Given the exploration success at Canadian Malartic, this asset alone makes up a massive portion of Osisko’s net asset value and is being improperly priced within its portfolio based on where the market is valuing the company. In fact, given how attractive this asset is (having the potential to deliver 30,000-plus GEOs per annum over the next 20 years), I’m surprised that Osisko GR doesn’t have a target on its back from larger royalty companies looking to scoop up its portfolio in a takeover scenario.

Canadian Malartic

Canadian Malartic is arguably one of the most attractive royalties in the gold space. However, while Franco-Nevada (FNV) has a 1.5% net smelter return [NSR] royalty on the mine, Osisko GR has a 3.0% – 5.0% NSR royalty on Odyssey, with its highest royalty rate on East Gouldie, the breadwinner of the deposit with the highest grades. So, while exploration success at Canadian Malartic benefits companies like Franco Nevada, it has an outsized impact on Osisko GR, which has a much larger royalty and is much smaller, meaning the boost to its net asset value is that much more significant.

Odyssey Underground (3-5% NSR held by OR) (Agnico Eagle Presentation)

For those living under a rock, the Canadian Malartic Partnership [CMP] chose to build Canada’s largest underground mine, Odyssey, in Q1 2021, extending the life of the Canadian Malartic Mine to 2039. The $1.3 billion project (based on three areas: East Gouldie, East Malartic, Odyssey) was expected to churn out ~550,000 ounces of gold from 2029-2039 at sub $650/oz cash costs, making it one of the most profitable mines globally. However, it’s important to note that they decided to build this mine on just ~6.9 million ounces of expected production. Today, Odyssey is home to ~15.5 million ounces of gold, and I would not be surprised to see it surpass the 22.0 million-ounce mark (reserves and resources combined) by year-end 2026.

Canadian Malartic Historical Production & Resource Growth (Yamana Presentation)

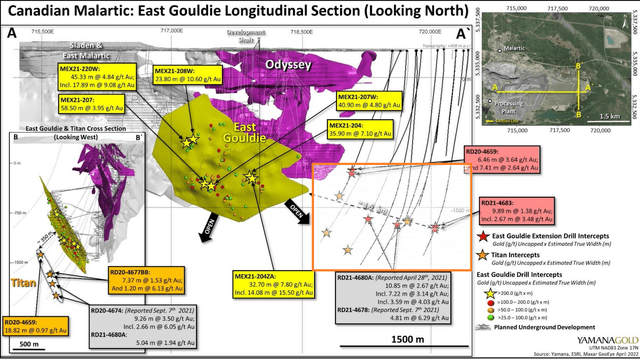

Currently, the project is tracking in line with its schedule and budget, with shaft sinking to begin in Q4 2022 and the first gold produced from Odyssey South expected in H1 2023. However, the most exciting development is the exploration success here. During Q2, we received several new highlight intercepts from Odyssey from the CMP. While not indicative of average grade drilled (these are highlight holes), they’re phenomenal and well above the average resource grades of 3.0 grams per tonne at East Gouldie and 2.1 grams per tonne at Odyssey South. In fact, these are some of the best holes I’ve seen out of Odyssey South since the CMP pursued the underground opportunity.

East Gouldie Infill Drilling Highlights

- MEX21-230WB, 6.45 g/t of gold over 22.53 meters;

- MEX22-233, 5.03 g/t of gold over 33.24 meters;

- MEX21-225WBZ, 2.23 g/t of gold over 60.26 meters; and

- MEX21-228W, 6.93 g/t of gold over 27.50 meters.

Odyssey South Infill Drilling Highlights

- UGOD-021-007, 19.11 g/t of gold over 7.40 meters;

- UGOD-021-002, 5.24 g/t of gold over 17.04 meters;

- UGOD-026-010, 17.57 g/t of gold over 8.64 meters; and

- UGOD-016-051, 28.66 g/t of gold over 6.62 meters.

The takeaways are as follows:

1. In nearly all zones, but especially East Gouldie, infill drilling is meeting and exceeding expectations, and the inferred resource is expected to be expanded, suggesting meaningful growth in indicated resources (with more to be converted to reserves down the road), and a potential slight grade lift at these underground deposits. For now, reserves should be declared in the core portion of Odyssey South at year-end. This will significantly boost Osisko GR’s attributable reserves and increase confidence in the Odyssey mine plan with reserves declared.

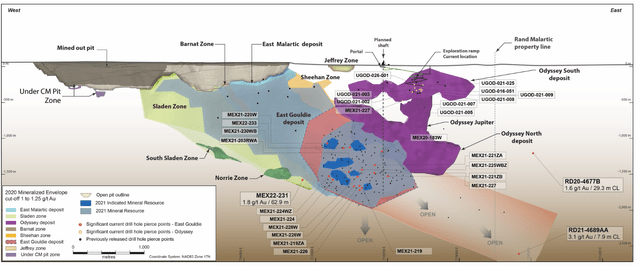

Canadian Malartic (Yamana Gold Presentation)

2. There’s clear potential to the west of East Gouldie with MEX-22-231 hitting 63 meters of 1.8 grams per tonne gold, potentially connecting East Gouldie with other zones (Norrie/Sladen) where no mineral resources are currently present. In addition, the sheer size of this deposit and long-term potential cannot be overstated, with the deepest and easternmost drill hole (RD-21-4689-AA) hitting 7.9 meters at 4.11 grams per tonne gold, in line with the average grade of East Gouldie, and being 1,700 meters east of the current mineral resource outline.

Canadian Malartic Exploration (Agnico Eagle Presentation)

This is a massive step-out, especially for a deposit that’s already home to 12 million inferred ounces (East Gouldie). If drilling success continues, the eastern extension of East Gouldie could add several million ounces to the CM resource inventory, pushing the total resource above the 20.0-plus million ounce mark. However, as discussed, there’s also potential to the west of East Gouldie to add ounces and considerable upside across the property where the CMP is looking for additional mineralization.

So, why is this important?

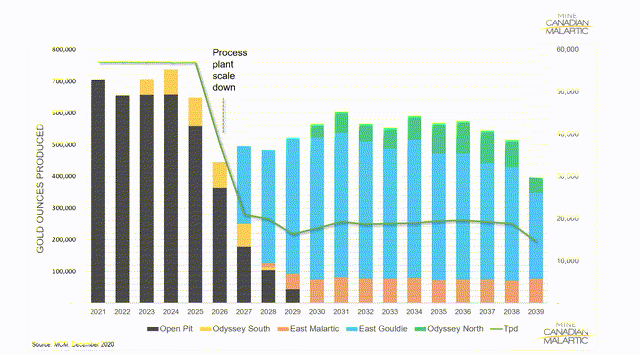

Canadian Malartic [CM] is currently a ~700,000-ounce per annum producer, but the process plant is expected to scale down materially as open-pit ounces are depleted. This will leave an additional ~40,000 tonnes of excess capacity at the mill later this decade. So, while the below chart might not inspire confidence for a company with a royalty on this asset, given that annual production is declining, it’s essential to make the following point. Although production is declining from 700,000-plus ounces to ~550,000 ounces at CM, this mine plan is two years old, and the mine may see lower production, but it’s churning out these 550,000 ounces with roughly one-third of the historical tonnes processed (given that grades are so much higher underground). The result is that there’s significant excess capacity sitting at the mill.

Canadian Malartic Mine Plan (CM Partnership Technical Report)

If the CMP had 20 rigs on the property that were miserable grades and were struggling to add any resources, I would be much less optimistic about CM’s future. However, it looks like the CMP could ultimately prove up more than 22 million ounces of resources and over 15 million ounces of reserves, which would give this mine a ~25-year life at a ~550,000-ounce run rate. There’s also the potential to delineate lower-grade material that would be economic even below 0.90 gram per tonne gold near-surface, given the sunk costs with a mill right next door. So, rather than processing all these resources over 30 years, Yamana (AUY) has been discussing the potential for a second shaft and pulling forward ounces.

This is conceptual in nature, and it’s still early days, but it would be logical given that any ounces 15-plus years in the future have little value from an NPV standpoint with a 5% discount rate applied to them. Suppose we assume a second shaft is sunk near the end of this decade and assume an additional 15,000 tonnes per day of material is fed to the mill (2.1 grams per tonne at a 91% recovery rate). In that case, this could add ~335,000 ounces to the production profile on top of the ~550,000-ounce production profile. Hence, Canadian Malartic could transform into a 900,000-ounce producer and Canada’s largest or second largest mine (depending on Detour Lake’s production profile), even bigger than it was as an open-pit operation.

Canadian Malartic Second Shaft Discussion (Yamana Gold Presentation )

While this is a longer-term opportunity, given that we’re still working on shaft No. 1, this would significantly boost OR’s production profile, with an effective 4.40% NSR royalty on 900,000 ounces translating to ~39,600 ounces per annum from this one asset alone. Compared to the ~600,000-ounce production profile this decade, this would be an additional $23 million in revenue per annum at a $1,750/oz gold price. It also would significantly boost its consolidated net asset value, with ounces brought forward having a higher value and an extension to the mine life even at a higher production rate.

Canadian Malartic Valuation

While I would not value a company or asset solely on what another company has paid in the open market for another asset, it’s clear that royalty assets held by large well-financed operators in safe jurisdictions with considerable exploration upside are seeing a high price tag. For example, Royal Gold (RGLD) just paid ~$2,000/oz for its 1.20% NSR on the Cortez Complex (Nevada Gold Mines JV) in Nevada. This is based on an estimated ~1.05 million ounces produced per annum over the next 20 years at Cortez (21.0 million ounces or 252,000 GEOs attributable to Royal Gold) with a $525 million price tag. This figure is based on dividing $525 million by 252,000 GEOs delivered to Royal Gold in the next 20 years.

If we compare this to Malartic, Malartic’s valuation alone is staggering.

Again, I would caution against using the price paid by one company to derive value for another asset. Still, the fair value likely lies somewhere between what Royal Gold paid and where it’s being valued. In my view, Malartic is arguably nearly as impressive an asset as Cortez, being in a safe jurisdiction (Quebec vs. Nevada), has a 20-year mine life, has massive exploration upside, and has two of the largest gold producers in charge of the operation. In addition, I believe it has the potential to produce an average of 750,000 ounces per annum over the next 20 years.

On the surface, one might immediately conclude that Royal Gold’s royalty on Cortez that it just purchased is more valuable, given that Cortez will ramp up to more than 1.0 million ounces of gold production per annum with Goldrush, with further growth from Fourmile. However, Royal Gold’s NSR royalty is 1.2% on a 1.0+ million ounce production profile, and Osisko GR’s royalty is 3.5x the size at ~4.40%. Hence, this more than offsets the lower production profile. Therefore, if Royal Gold was willing to pay $525 million for a 1.2% NSR on Cortez, and even if we used lower multiples, this is placing a value on Canadian Malartic of more than $1.05 billion if this royalty were held for sale and given credit for its expansion case.

To summarize, one could argue that Osisko GR’s Canadian Malartic royalty alone is worth $5.67 per share (185 million shares), meaning that investors are buying the remainder of the company for just $3.58. This valuation might make sense if Osisko GR had a weak royalty portfolio with no assets to write home about and no growth. However, this isn’t the case at all. In fact, its Mantos silver stream, Eagle gold royalty, Windfall gold royalty, and Renard Diamond stream alone are worth more than $700 million combined from a net asset value standpoint at a 1.20x NPV (5%) multiple, translating to $3.78 per share. Hence, investors get everything else in the portfolio for free.

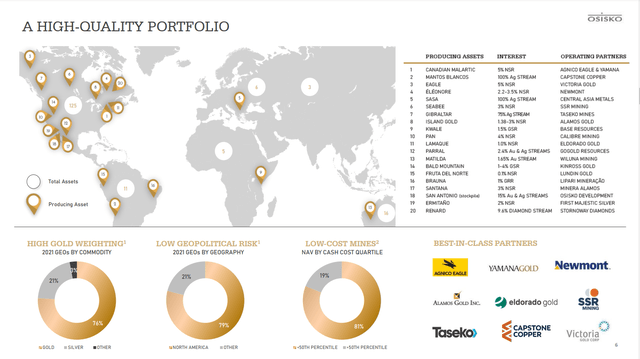

Osisko Gold Royalties – Producing Portfolio (Company Presentation)

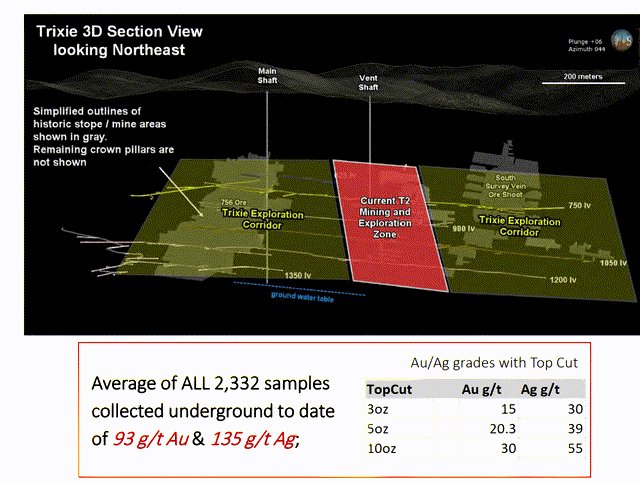

As shown above, the rest of this portfolio is very attractive, with multiple royalty/streaming assets on projects like Island Gold (undergoing an expansion and set to be Canada’s lowest-cost mine), a large royalty on Seabee held by SSR Mining (SSRM), a decent-sized royalty on Eleonore, a mid-sized royalty on Bald Mountain, and a small royalty on Eldorado’s flagship Lamaque Mine. Finally, Osisko has a new stream on the highest-grade gold mine globally, Tintic, where Osisko Development is looking to increase production materially, with the possibility that it could be a 100,000-plus ounce producer. However, what’s outside of these producing royalties/streams and optionally holds considerable value as well.

Tintic – T2/T4 Mineralization (Osisko Development Presentation)

Trixie Mine Channel Samples (Osisko Development)

These projects include:

- San Antonio (9,000+ GEOs per annum)

- Cariboo (11,000+ GEOs per annum)

- Upper Beaver (3,000+ GEOs per annum)

- West Kenya (1,500+ GEOs)

- Back Forty (9,000+ GEOs)

- CSA Mine (5,000+ GEOs

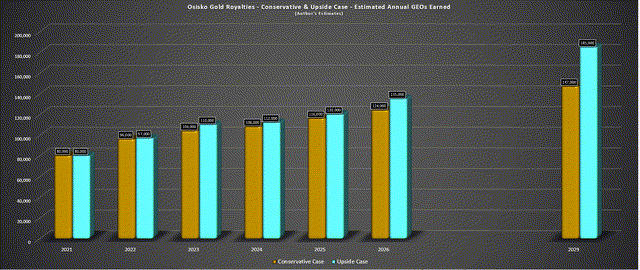

There are also many other optionality projects like Casino, Hammond Reef, Horne 5, and Hermosa that could add another 40,000-plus GEOs per annum. To be conservative, I have not modeled these projects in the five-year production profile. Still, with conservative assumptions on projects with a high probability of making it into production, I see Osisko GR growing to 135,000-plus GEOs in FY2026 without any further acquisitions. The above GEO figures are the estimated ounces attributable to Osisko GR once in production.

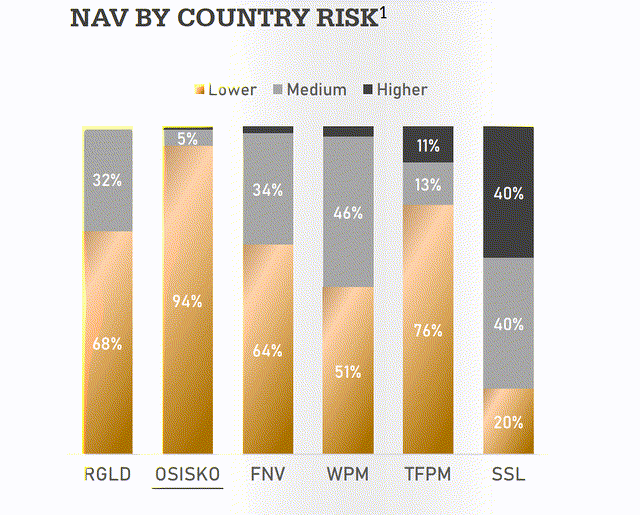

Osisko vs. Peers – NAV by Country Risk (Company Presentation)

To summarize, with Canadian Malartic, Mantos, Eagle, Windfall, and Renard making up just ~60,000 GEOs per annum, investors are getting a very attractive portfolio outside of these assets at a very low cost, depending on how one chooses to value Canadian Malartic. This makes little sense, given that these other 70,000+ GEOs per annum attributable to Osisko GR will generate over $120 million in revenue per annum at a $1,750/oz gold price. Given the position of negative real rates, I would argue that this is a conservative assumption, and I would expect gold prices to be above $2,000/oz in FY2026. Just as importantly, Osisko’s royalties are located in Tier-1 jurisdictions (Canada, Australia, United States), so there’s no worry about discounting them excessively due to jurisdictional risk.

Osisko Gold Royalties – Projected Production Profile (Company Filings, Author’s Chart)

Summary

While Osisko GR’s current financials are noisy when consolidated with Osisko Development (ODV), the valuation here could not be more attractive, and I see a path to much higher dividends post-2024 and four clear catalysts for a re-rating:

- the market realizes that Malartic is truly an 850,000+ ounce per annum asset, not ~600,000 ounces

- a de-consolidation of Osisko development which could clean up the financials

- a successful ramp up to 250,000+ ounces at Eagle or construction start at Windfall, both of which add 5,000+ GEOs per annum on an attributable basis

- continued growth in cash flow from multiple projects across the portfolio, with Osisko GR having an industry-leading organic growth profile

Given this attractive profile and an estimated net asset value (even ignoring what Royal Gold paid for Cortez) of ~$2.3 billion and a P/NAV multiple of 1.40 (well below Franco Nevada’s current multiple of 1.90), I see a fair value for Osisko GR of US$17.40. This translates to nearly 100% upside from current levels. Given that this is a high-margin (90%-plus margins) royalty/streaming business that’s inflation-resistant, I see minimal downside or execution risk. In my experience, the investments with considerable upside and limited downside are the most attractive.

For this reason, I see the stock as a Strong Buy, and I have continued to accumulate OR on weakness, making it a top-5 portfolio position. With the potential for a US$0.30 dividend long-term, Osisko GR now offers an entry into the stock with a more than 3.1% forward yield in cost and at 0.80x P/NAV, which is arguably the most attractive setup I’ve seen for a royalty/streamer of this size with organic growth in years.

Source link