[ad_1]

Michael Vi

Palantir Technologies (NYSE:PLTR) is not immune to economic cycles and its business momentum has decelerated recently, but its fundamentals remain good and is likely to report a positive bottom-line by 2025.

Background

As I’ve covered several times in previous articles, I’m bullish on Palantir over the long term as I think the upside potential is quite attractive, as the company executes on its growth strategy and becomes a much larger company over the next few years.

Despite that, the last few months have been quite negative for ‘growth’ companies, and Palantir has been no exception. Its share price has declined by more than 55% since the beginning of the year, as the market has been quite punitive for unprofitable companies. As an early growth company, Palantir’s investment case is still somewhat speculative and one of its weakest investment factors is profitability, being a key reason, in my opinion, for its share price weakness in recent months.

Moreover, due to the current economic slowdown, Palantir’s growth and profitability have been hurt lately, which has punished its share price even further. Despite that, Palantir has recently said that it maintains its growth strategy and that it’s not focused on improving margins in the short term, continuing to focus on managing the business with a long-term mentality.

I think that achieving profitability, on a GAAP basis, will be key for a higher valuation over the medium term as the company would no longer be considered ‘speculative’, being more important for its investment case than short term cycles. While in the next few months the market will look mainly at the company’s prospects over the coming quarters, for long-term investors I think it is much more important to look at the big picture and not worry too much about quarter to quarter earnings.

As Palantir’s CEO said during the last earnings conference call, management expects the company to become profitable by 2025, which would certainly be a great milestone and a key reason for a higher valuation. Therefore, in this article I analyze Palantir’s fundamentals over the next few years, to see if its claim of being a profitable company by 2025 has some merit, or if management is using that argument to distract investors from short-term woes.

Profitability Analysis of Palantir

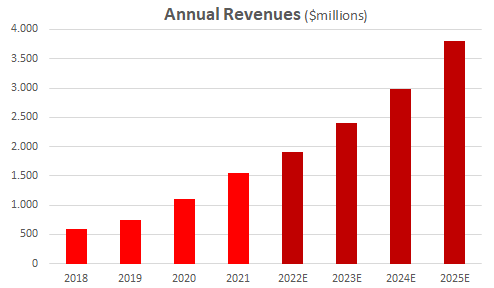

On the revenue side, Palantir’s medium-term goal is to grow its annual revenues by about 30% per year, a slower growth rate than it has achieved over the past three years. From 2019-2021, Palantir’s revenues increased from just $743 million to more than $1.5 billion last year, representing an annual growth rate, on average, of about 37%.

This growth was supported both from its government and commercial businesses, but more recently the commercial segment has been the company’s major growth engine and is expected to become its largest segment in the near future. Indeed, some 44% of its revenues were generated in the commercial segment in the last quarter, a weight that is expected to gradually increase considering that revenue growth has been higher in the commercial segment (+46% YoY in Q2 2022) compared to governments (+13% YoY) in recent quarters and this trend is not expected to reverse soon.

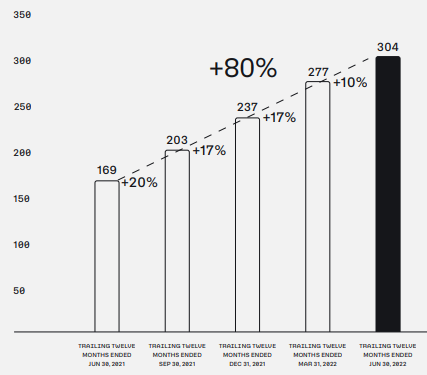

Overall revenue growth has been supported mainly by a higher customer count, which increased to more than 300 at the end of last quarter (of which 203 are in the commercial business) and represented an increase of 80% YoY, a trend that is expected to remain strong over the coming years.

Customer count (Palantir)

Strong revenue growth in the recent past and a growing customer base are strong signs that Palantir’s growth strategy is progressing well, even though it may be challenging in the current macroeconomic environment to achieve its annual revenue growth of about 30%. In fact, Palantir’s guidance is to reach annual revenue of around $1.9 billion in 2022, which is an increase of 23% compared to the previous year.

Over the next three years, revenue growth is expected to be around 28% per year and reach some $4 billion in revenue by 2025. However, this represents annual growth of 35% YoY in 2025, which may be hard to achieve, and assuming a more conservative approach I estimate that Palantir generates $3.8 billion in revenue by 2025, representing a CAGR of 26% during 2023-25.

Annual revenue (Palantir and Bloomberg)

To achieve higher revenues, particularly in the commercial business, Palantir’s strategy was to create a sales team, something that it didn’t have just a couple of years ago. Despite the recent slowdown in its business, Palantir continues to add salespeople, while other technology companies are freezing hires or reducing employees to cut costs, showing that Palantir continues focused on the company’s growth over the medium term rather than trying to beat market estimates in the next quarter. As revenue is growing slower in recent quarters than the company was expecting, this strategy is negative for Palantir’s profitability, but is necessary over the medium to long term to grow the business.

Palantir is expected to increase its headcount by about 25% during 2022, reaching around 3,700 employees by year end, compared to some 2,920 at the end of 2021. What this means is that staff costs are expected to increase significantly in the short term, and probably at a higher rate than revenue, at least until the company reaches its desired scale and starts to reap the benefits of economies of scale.

Even though this will put pressure on the company’s business margins in the next few quarters, as Palantir’s business gains scale it will become easier to reach GAAP profitability, while it will likely take at least a few more years.

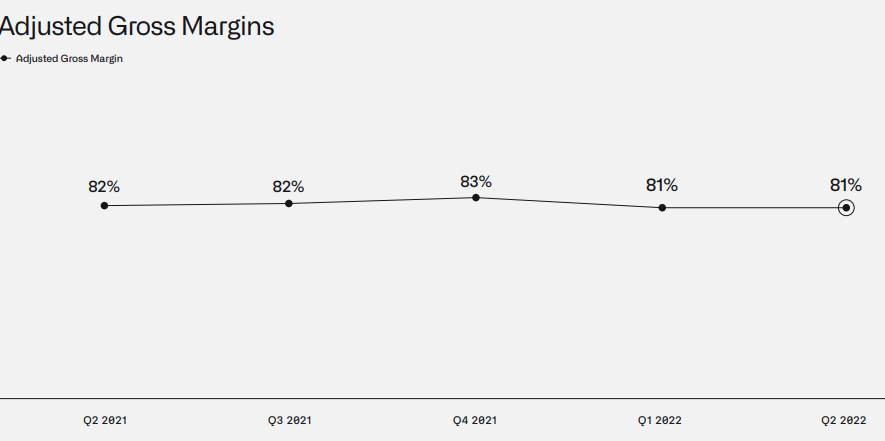

Palantir’s gross margin has been quite stable at around 80% over the past few years, thus as revenue increases its gross profit will be higher, which will gradually allow it to finance research & development expenses, a higher headcount and general expenses. In 2021, its gross profit amounted to $1.2 billion (margin of 82% excluding stock-based compensation), and this margin is not expected to change much in coming years, which means Palantir’s gross profit should increase to about $3.1 billion by 2025, on revenue of $3.8 billion.

Gross margin (Palantir)

This is a strong increase in gross profit over the next three years, but as Palantir continues to invest in business growth, staff and marketing expenses are expected to increase significantly in the next few years, plus stock-based compensation is also expected to remain a drag on GAAP profitability for some time.

As Palantir continues to invest in its software platform and improves its products, R&D expenses should continue to increase, but their weight is expected to gradually decline over the next few years. In 2021, R&D expenses increased by $34 million compared to 2020 to $237 million, and I expect similar increases in the following years of about $30 million per year, which means that Palantir’s R&D expenses should be around $350 million by 2025, and represent 9.2% of revenue (vs. 15.4% in 2021).

General expenses have not increased much in 2021 (0.7% YoY), but to be conservative I expect annual growth of about 14% from 2022-25, which means that general expenses should increase from $295 million in 2021 to about $500 million by 2025, representing some 13% of revenue compared to 19% in 2021.

Where I’m expecting much higher cost growth is regarding sales & marketing, which I expect to grow at a higher rate than revenue. This assumption may be much too conservative, but as Palantir is building its sales team and there isn’t much track record on its efficiency and capacity to leverage existing customers into increasing retention, I estimate that sales & marketing costs will increase at about 31% per year, over the next three years. Therefore, these costs should increase from $372 million in 2021 (24% of revenues) to about $1.1 billion by 2025 (29% of revenue).

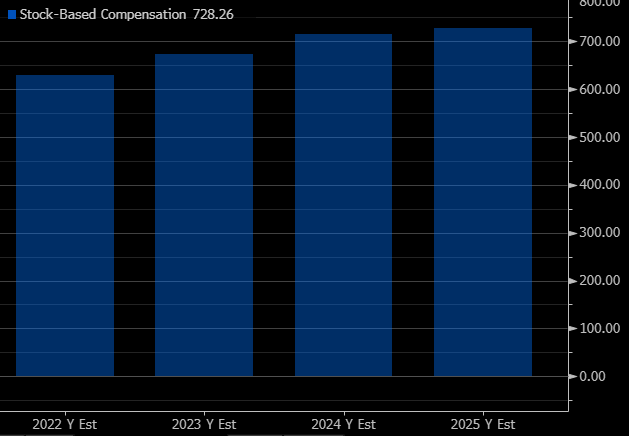

On top of these expenses, another important item is stock-based compensation (SBC) that amounted to $778 million in 2021, representing close to 50% of Palantir’s annual revenues. According to Bloomberg data, stock-based compensation should be between $628 million and $728 million during 2022-2025, which means that SBC should gradually have a lower weight on revenue being an important factor for Palantir to reach GAAP profitability.

Stock-based compensation (Bloomberg)

Taking into account these estimates, I expect Palantir to reach a small operating profit by 2024, and a positive bottom-line (based on GAAP) by 2025. However, Palantir’s net profit should be about $350 million, which is still a relatively small number, but would represent a great milestone for the company and would be a positive sign that the business can be profitable in a sustainable way over the long term.

Conclusion

While Palantir’s business prospects have deteriorated recently, due to lower revenue growth than expected, which together with rising costs is hurting profitability, long-term investors should look beyond short-term issues and care more about the company’s fundamentals over the next few years.

Palantir continues to focus on business growth and management does not seem too worried about short-term headwinds, which I think is the right approach and management clearly shows that it has a long-term view. Palantir is on the right track to grow its business and reach profitability over the next three years, which would be a great milestone and justify a higher valuation than it currently has.

Palantir is currently trading at only 6.3x forward revenues, which is attractive for a high-growth company, and therefore future growth doesn’t seem to be priced-in on Palantir’s share price. Indeed, even assuming the same multiple to 2025 revenues, Palantir’s fair value would be close to $14 per share, or 75% higher than its current share price, thus Palantir’s upside potential over the next two years is quite high if management executes well on its growth strategy.

Source link