[ad_1]

yuriz

I decided to throw my hat in the ring for Seeking Alpha’s latest competition: Top Stock With A Catalyst. It’s been a while since I published an article and I figured this would be a fun way to make a comeback. Let’s get straight to the point.

My submission for the contest is Spectrum Brands Holdings Inc (NYSE:SPB). Spectrum Brands Holdings is a leading global branded consumer products and home essentials company. In other words, they sell stuff you need or use at home. Their slogan is “We Make Living Better at Home”. They sell everything from kitchen faucets to indoor grills and curling irons.

The name Spectrum Brands probably doesn’t mean much to you (former Rayovac) but you probably used some of their products. You are most likely familiar with some of their brands such as: Kwikset, Baldwin, Pfister, Weiser, Black Flag, Hot Shot, Spectracide, Remington, George Foreman (the grill), Black + Decker, PowerXL… and there are many more. I just listed some of the ones I recognized.

SPB operates as a holding company and is basically four businesses:

-

Global Pet Care (GPC)

-

Home & Garden (H&G)

-

Home & Personal Care (HPC) – now called “Empower Brands”

-

Hardware & Home Improvement (HHI)

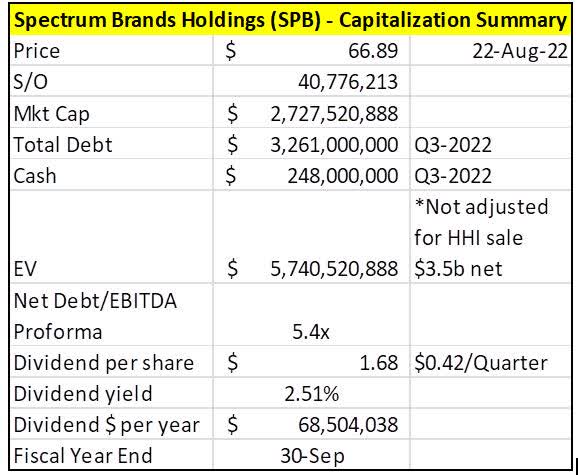

Here’s a snapshot of SPB’s capitalization summary:

Author’s Work

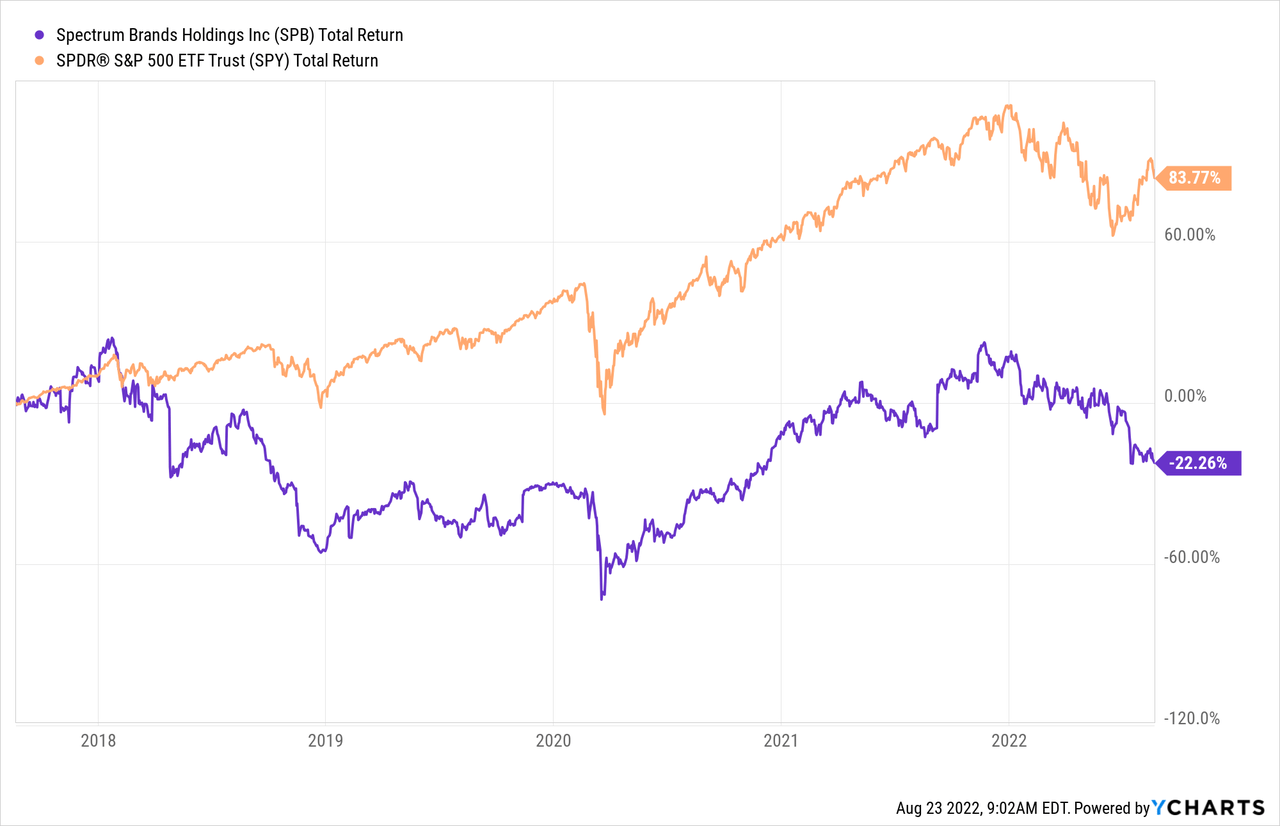

SPB’s stock has been a laggard. If you are a long-term shareholder, you weren’t well rewarded. This year SPB has sold off along with other housing-related names, on fears that interest-rate hikes will sink its business. SPB is down -33.95% YTD, -37% from its peak of $107.22, and -28% since the HHI sale was announced.

The 5-year chart indicates that SPB hasn’t done much and lags the S&P 500. I wouldn’t try to form a conclusion by looking at past performance. Spectrum is putting behind them a legacy of problems. The future looks brighter.

For investors, it’s time to stop thinking about what Spectrum was and instead look ahead to what it will be. Let me lay out the thesis.

Thesis/Catalysts

Spectrum has two “hard” catalysts that I can identify that the market hasn’t already fully anticipated or understood.

-

Spectrum is currently selling their Hardware & Home Improvement (HHI) business to ASSA ABLOY (OTCPK:ASAZY) for $4.3 billion in cash ($3.5b net).

-

Spectrum is exploring the idea of separating their Home & Personal Care (HPC) business. That could be through a potential spin-off or other transaction. At the moment they have “carved-out” the business.

Because of these two developments, I believe that the shares of SPB will be driven higher for the following reasons:

-

SPB is in the process of creating a pure play Global Pet Care (GPC) and Home & Garden Company (H&G). These two businesses are the gem of SPB. Once the catalysts are completed the narrative around SPB will change from an “overstretched levered complicated consumer product conglomerate company” to a pure play GPC and H&G company.

-

A more focused, leaner, and simpler business should warrant a higher valuation from the market. The math behind the Sum-of-The-Parts is compelling. Including a 20% margin of safety, I believe there’s a minimum upside of 21.6%. There’s a detailed valuation below.

-

The catalysts should unlock significant shareholder value. SPB is getting a great price for their HHI segment. ASSA ABLOY is paying 14x FY21 Adjusted EBITDA for $4.3 billion. SPB expects to receive approximately $3.5 billion in net proceeds. That’s more than the current market cap of $2.7b. SPB bought the division for $1.4b in 2012. This makes sense from a value creation perspective.

-

Once the transaction closes, SPB’s balance sheet will be transformed. SPB will go from a Net Debt position to Gross Cash. SPD targets a gross leverage ratio of ~2.5x Net Debt/Adjusted EBITDA. Currently proforma net leverage was at 5.4x for Q3-2022.

-

SPB expects to have a cash balance of roughly $2b once existing indebtedness is paid off.

-

Excess proceeds will be used to invest for organic growth, fund complementary acquisitions, and return capital to shareholders. In other words, more efficient capital allocation.

-

The Global Pet Care business is their “crown jewel” asset. It’s the segment that will drive the company forward and it’s not being properly valued by the market. A similar comp, Central Garden & Pet Company (CENT), is trading upward of 10.5x EV/EBITDA.

-

The business rationale for keeping Global Pet Care and Home & Garden is that capital can be more efficiently allocated. These businesses have a different growth trajectory and risk profile. HHI grows with the housing market. Selling the HHI segment will make them less correlated with the housing market. HPC is linked to the consumer economy. GPC is benefiting from the current pet boom. H&G showed that it’s recession resilient.

-

Each business will also have their own shareholder base. Individually they are good businesses, but because the financials are complex, the many moving parts, and investors spending an inordinate amount of time evaluating it, investors are not seeing the full potential. SPB 2.0 will be simpler.

And if you may, there are some “softer” catalysts to consider. SPB completed their “Global Productivity Improvement Program”. It’s basically a fancy term for a cost saving program and a revamped business model. The plan aimed at improving the company’s operating efficiency and effectiveness. The original goal was to achieve $150m in savings, by the end of FY2022 (September 30). That was raised $200m and is largely completed. The savings are likely to be reinvested into growth initiatives and consumer insights, R&D, and marketing across each business. Also last quarter, Spectrum eliminated 17% of its global salaried positions during the quarter, and that will drive over $30 million of annualized savings. But let’s work with $200m in savings. A 10x multiple would imply $2b in additional value. A 15x multiple would mean $1.5b. However I don’t think we are seeing the full benefit. The implementation of the Program is recent and SPB has been hit by supply chain issues and inflation. Once the catalysts are completed, we should have access to “cleaner” and simpler financial statements.

Risks & Uncertainties

This is not a perfect story. There are hiccups. Here are some of the reasons why the market is not fully appreciating the story. The Spectrum Brands story has been bumpy and messy.

-

The transaction with ASSA ABLOY is taking longer than expected. Announced in September 2021, the transaction was originally expected to close in 2022. However, the US regulator continues to review the proposed acquisition. Both companies agreed to extend their agreement to June 30, 2023. The 4.3 billion dollar question is “Will it take that long?” Both companies have reiterated that they are confident that the transaction will close.

-

There’s a risk that the transaction falls through. That wouldn’t be the end of the world because there’s other potential buyers for that division (they conducted an auction). In case this happens, it would push the thesis out and SPB would likely get a lower price.

-

SPB is selling their largest business. HHI accounts for the largest portion of sales and earnings (~43% EBITDA Q3-21). Investors have questions. Why? And what will this new business look like in terms of growth and FCF generation. But it makes sense from a pure value-creation perspective. SPB bought the division for $1.4b in 2012. You are getting 14x EBITDA and pivoting the balance sheet from a net debt to gross cash.

-

The ghosts from the past are still there. SPB filed for bankruptcy in 2009 and high debt was the issue. Since then, the debt has fluctuated a lot. Today’s debt is manageable. The debt is covered by operating earnings (~1.5x to ~3x depending on the quarter) and net debt has been trending down over the last few years. This perspective problem should reverse once the balance sheet is gross cash.

-

Investors are thinking about the old Spectrum. Instead they should look ahead to what it will be. But I don’t blame them for the reasons mentioned above.

- Who knows where consumer demand will be in 6 months? Like most consumer product companies and retailers, they are facing consumer demand unpredictability and softer demand. Just ask Walmart (WMT) and Target (TGT). It’s quite a headache.

-

Spectrum is no stranger to transactions. They acquire and divest all the time. It can be hard to follow. Sometimes a transaction is strategic, sometimes it’s to reduce leverage. Sometimes they sell “non-core” assets, sometimes they buy to pad a portfolio (like the Tristar acquisition). All this adds a layer of complexity to the story.

-

SPB is a very seasonal business. SPB generates virtually all its cash in the fiscal third and fourth quarters (which ends on September 30).

Short-term worries dominate the stock performance. The market likes visibility and certitude. Money flows in the opposite direction. Money likes a good story. Money likes growth. And right now with SPB it’s complicated. Here we have incertitude on three fronts: 1) if and when the deal will close 2) the challenging consumer behavior and deteriorating macro backdrop 3) what will the post-transaction business look like when you remove 43% of EBITDA and 35% of revenues and have carved out HPC. So it’s cloudy and the market hates it.

A lack of “visibility” combined with recurrent “non-recurrent” issues has plagued SPB for years. You have to be a financial statement ninja to make sense of their reporting. “One-time” issues such as recognition of loss on asset sale, write-off of impairment of intangible assets and goodwill, non-cash expenses here and there are too common.

It was apparent that SPB suffered from underlying structural issues that took years to resolve and lots of money. Which led to the “Global Productivity Improvement Program”. SPB is not out of the woods yet, but there’s light at the end of the tunnel.

When you add all of this up, I understand why the market is down on SPB.

But if you are patient this works in your favor. Because once we move past all of that, you are left with a much better business. Also all this cloudiness provides an opportunity to buy SPB at a moment when the market is not pricing in the catalysts.

Global Pet Care (GPC) – Home & Garden (H&G)

Here’s a brief overview of what the future company will look like.

After the two transactions are completed, Spectrum will have two businesses, 1) Global Pet Care and 2) Home & Garden. These are Spectrum’s two best businesses. Practically speaking, that means it’s growing, it has high margins, high-velocity consumable businesses that have historically been recession-resilient.

GPC should continue to benefit from the current pet boom. The demographics of pet ownership have trended towards millennials and Gen Z, and they spend a lot on their pets. According to a 2021 survey from the American Pet Products Association (APPA), the percentage of U.S. households that had pets increased in 2020 from 67% to an all-time high of 70%. The survey also says that they are spending 11% more on pet food.

For Q3-2022, GPC delivered a record 15th consecutive quarter of revenue growth. The business delivered another strong revenue quarter with reported and organic net sales growth of 12.8% and 17.3%. The pet business is a historically recession-resistant business with tremendous upside potential. The current EBITDA run-rate for GPC is $200m/year.

As for the H&G business, unfavorable weather conditions across the United States took a hit on Q3-2022 results. H&G might be recession resilient, but it’s not weather resilient. Despite drought conditions in large parts of the US, they did alright. Bad weather impacts consumer demand and retailer replenishment (less visits to the store). H&G is a diversified segment. You have a collection of cleaning products, pest control products which includes repellant, herbicides and insecticides, and you have soil and plant stuff. But pest control is a key driver and it’s safe to say that people hating bugs is not going away. Cleaning and pest control are interesting categories because they are more relevant to repeat high-velocity purchases versus categories such as light bulbs. This segment has been recession-resistant in the past as outdoor living and gardening both typically do well in tough economic times (it grew in the last recession). One of the good news is that H&G is winning a lot of distribution for next year. Management believes that H&G can generate more than $120 million of EBITDA per year.

Despite the near-term headwinds, these businesses remain competitively positioned. Unencumbered by the past, the new Spectrum has the potential to compete more fiercely than the old cumbersome company it was. What’s more, a better balance sheet and more efficient capital allocation decisions should earn the new Spectrum a higher stock market valuation.

Dividends & Share Buybacks

SPB pays a dividend of $0.42 per quarter which equals to $1.68 on an annual basis. This is a $68m annual commitment. It has been the same payout since 2018. SPB has been a regular buyer of their own shares too. Because earnings and FCF are all over the place quarter to quarter, it’s hard to make sense of the payout ratio. Wouldn’t it have made more sense to pay down some debt instead of buybacks? SPB spent $121m on buybacks in 2021, $268m in 2020, and $134m for the first three quarters of FY2022.

As for the dividend, management’s language suggests they are non-committal (“subject to review from time to time”). My interpretation is they would explore the idea of “resetting” the dividend once the HHI is sold and HPC is carved out.

Spectrum seems carnivorous in its own nature. My take is to look how much stock they bought with a levered business. Imagine once they are in a gross cash position.

CEO David Maura did add this gem during the Q3-21 earning call:

Hypothetically, to answer your question, I mean, if we came into a bunch of cash today, if it just fell out of a helicopter, I would buy back a lot of stock. I know everyone knows this, and I know that I still look wrong in the short term, but I think our security — I think our stock price is materially undervalued.

Valuation

Let’s add it all up. The easy approach would be to apply a multiple to a normalized adjusted EBITDA and call it a day. Not only am I weary of companies with complex financials using adjusted EBITDA, that approach wouldn’t give you a proper valuation assessment of Spectrum. SPB is four businesses with different cash flow profiles, risk, and margins. On the top of that you have to take into consideration the two catalysts that will change the narrative and profile of the business.

My preferred valuation method is counting the free cash flow. But over the last couple years, there have been many mis-steps and the script for SPB has changed from reliable FCF generation to a more cyclical company in “transition”. Given the cyclicality of the portfolio likely resulting in unsteady cash flows over time, I use a EV/EBITDA approach for the different parts of the business to derive value.

As for the EBITDA, if you look at Q2 and Q3 results, it’s a little bit of a mess. I wouldn’t try to read too much into these numbers and form a conclusion. For Q3-2022 sales increased 10% (4.4% organic). But SPB has been hit by inflationary pressure. Some of the increase in cost is short-term, such as higher transportation and distribution cost, as well as additional storage cost. SPB has responded by eliminating 17% of their global salaried positions and that will drive over $30m of annualized savings. On the top of that SPB has been trimming down inventory level and ran operations to maximize cash flow instead of reported earnings. This negatively impacted margins and contributed to the shortfall to their original earnings outlook. SPB also increases prices to meet their targeted inflation coverage that will start to show in Q4. Management said that things have stabilized in July, the first month of Q4. I know it’s just one month, but with prices going up and costs stabilizing, we should expect expanded EBITDA margins going forward.

In other words, for SPD to better position themselves for FY2023 and longer term success, they decided to maximize cash flow generation at the expense of near-term EBITDA. As CEO David Maura put it on the recent analyst call:

“And so there is no question that we have probably taken actions that are more Draconian than our competitors. But my view of the world is, I want to take my medicine fast because I want to get healthy faster.”

SPB took some aggressive steps because they want to enter the new fiscal year as lean from an expense and inventory position as possible. SPB’s fiscal year ends on September 30. That’s just a couple weeks away. Then it’s the holiday season. SPB likely wants to enter the holiday season in a good position.

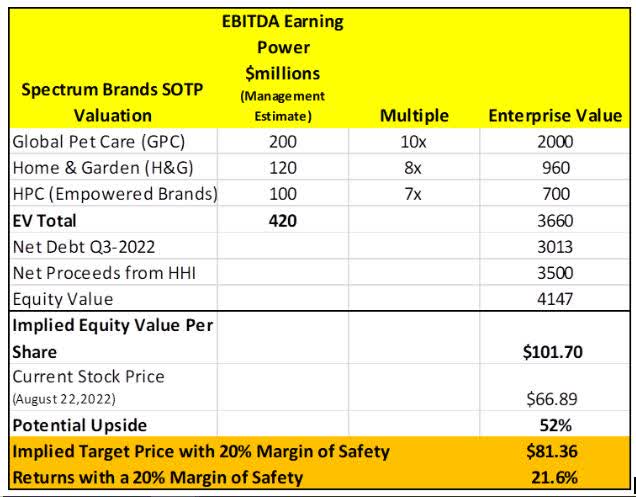

Back to EBITDA. Because of the many adjustments required, the different moving parts, and the difficulty pinning down the exact mix of business unit contribution, I have instead relied on what management calls EBITDA earning power. Management firmly believes SPB has over $400m of EBITDA earning power (excluding HHI).

Management believes GPC has the ability to generate greater than $200m of EBITDA per year, H&G can generate greater than $120m of EBITDA per year, and HPC (now called Empowered Brands) has the ability to generate at least $100m per year. These numbers don’t come out of thin air. GPC already has a $200m/yr EBITDA run rate.

Here’s a Sum-Of-The-Parts (SOTP) approach:

Author’s Work

Under this approach, Spectrum is worth between $81.36 a share to $101.70, which implies a return between 21.6% and 52%. The range gap is due to a 20% of margin safety I applied. The margin of safety is highly subjective from investor to investor, and from companies to companies. I used 20% to be conservative, to take into account potential errors of judgment, the uncertainty surrounding Spectrum, and the messy macro backdrop (inflation, economic slowdown, rising rates, lack of consumer predictability, and Spectrum doing Spectrum things). I also believe that using a 10x multiple of Globe Pet Care business is conservative considering the growth profile and quality of the business. A takeover would warrant a higher multiple.

I also used this approach for simplicity’s sake. I could develop bull-base-bear scenarios and run an 800 line spreadsheet, but I have enough experience that at the end of the day only a few key variables drive values.

The lazy back of the napkin approach is applying a multiple of 7x to an estimated adjusted EBITDA of $420m. That would imply a share price of $84 per share or a 25% upside.

As for the comparable:

Author’s Work

The ratios suggest that Spectrum is trading below its comps. SPB trades at 0.9x Price/Sales, below the comps average of 1.5x. And the average EV/EBITDA ratio of 13x is way higher than what I used for my valuation (7x-10x).

Spectrum is one of those companies where you can slice and dice the numbers for a really long time. At the end of the day, a conservative approach with a margin of safety suggests that Spectrum is undervalued by at least 21.6%. The combination of management executing well and catalysts unlocking value could reward shareholders even more. Once SPB 2.0 is established, investors should expect better visibility on FCF, more buybacks, and the market properly valuing the remaining business.

Summary

Time is your friend here. Getting to that higher valuation will mean persevering through some tricky times. Spectrum is dealing with some of the same supply-chain and inflation-related issues that have hurt other companies. Those pressures are starting to wane, and SPB has been able to pass along cost increases to consumers. We should start seeing price hikes hitting the bottom line in the next couple quarters.

Even if you clearly identify value, very often the market doesn’t fully embrace it unless there’s an event or an action to unlock, which is often referred to as a catalyst.

This article has identified that Spectrum has two hard catalysts that will unlock significant shareholder value. I also explained why the market hasn’t already fully anticipated or understood the situation.

Spectrum is where it is today because of decisions made in the past. Today Spectrum is making decisions that are transformational. There’s Spectrum today and where it will be. In between these two points is time. You have to wait for the catalysts to be completed and for the market to reassess.

If you want different investment results from the crowd, you have to be investing in things that others haven’t flocked to, causing it to be fully valued. SPB is one of those opportunities that I like to say fell off the orbit. It’s off the orbit because nobody is paying attention. Nobody cares. A quick glance is enough to turn you off. Hence the opportunity. The market will come back once everything is squeaky clean. By then it will be too late. What the market is not fully appreciating is the makeover story. Fundamentals win. And the fundamentals are getting better.

The old SPB offers an eclectic and diversified portfolio of mishmash products. After years of working through challenges in part due to insufficient capital allocation to innovation and marketing, operational missteps, and a highly levered balance sheet, Spectrum Brands is refocusing to become a pure play Global Pet Care and Home & Garden business. Once that happens, the markets will re-rate the valuation of the company.

I’m convinced over time that the size of the discount between how the market values SPB today and the SOTP will narrow once the picture is clearer.

The future new SPB will be more focused, leaner, and simpler with improved fundamentals and a stronger foundation. As we look ahead, Spectrum’s future looks brighter.

Source link