[ad_1]

peterschreiber.media

Thesis

I am bullish on Glencore (OTCPK:GLCNF) as I believe the company is undervalued relative to fundamentals. While I acknowledge a slowing commodity cycle, I strongly believe that the company can deliver shareholder value also at much lower commodity prices. For reference, the company currently trades at x5.5 P/E and x0.34 EV/Sales. In this article, I value GLCNF shares based on a residual earnings model and calculate a fair implied target price of $10.98/share. Thus, my analysis indicates material upside of almost 100%.

About Glencore

Glencore is one of the world’s leading diversified mining conglomerate, formed through the combination of Glencore and Xstrata in April 2013. The company has interest across the world in activities relating to mining, smelting, refining, processing, trading, and marketing (and financing) of commodity products. Or in other words, Glencore captures the full spectrum of the commodity value chain. Notably, Glencore operates three key segments: metals and minerals, energy products, and agricultural products. The energy division is mainly engaged in coal mining and is the company’s second-highest contributor to EBITDA (after copper mining).

Strong Performance YTD

Given the raging bull market across the entire commodities spectrum, Glencore enjoyed a generational profit windfall. Notably, for the past twelve months Glencore generated about $244 billion of revenues, which represents an increase of about 80% as compared to the company’s revenues in 2020. Respectively, net-income was $15.78 billion versus a loss of $1.9 billion in 2020. Given these results, it is no surprise that Glencore shares have rallied and strongly outperformed the market. For reference, Glencore shares are up about 25% year to date, versus a loss of about 11% for the S&P 500.

Seeking Alpha

Glencore stock has retracted by some 20% since late May 2020, amidst recessionary headwinds driven by rising interest rates, high inflation, a slowing economy in China, falling asset prices and low consumer confidence. While I acknowledge the headwinds, I am confident that Glencore is poised for sustained business performance.

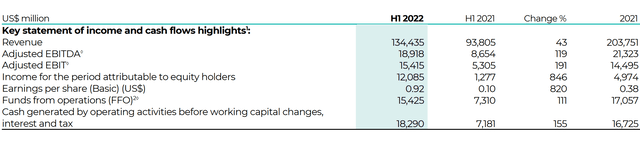

Bullish H1 and Outlook

Glencore announced earnings for the June quarter and H1 2022 on August 4th and posted record results, beating most analysts estimates for both revenue and net income. Glencore reported revenues for the H1 of 2022 of $134.4 billion, which reflects an increase of about 40% year over year. EBITDA increased by about 119% to $18.92 billion, and net income attributable to shareholders jumped by an unbelievable 846% year over year to $12.09 billion. Glencore’s CEO Gary Nagle commented:

Notwithstanding what has clearly been a very complex environment for our markets, our operations, and the world in general, we are pleased to report an exceptional financial performance for Glencore over the period.

Glencore 1H 2022 results

All that said, I estimate that Glencore could easily surpass $15 billion of free cash flow in 2022, and likely also in 2023. And given the company’s relatively strong balance sheet — with net debt only being about 50% of market capitalization at about $30 billion – I argue that shareholders will enjoy significant capital distributions in excess of Glencore’s 5% dividend yield. If we consider $20 billion of cumulative buybacks in the coming four years, Glencore would effectively repurchase one third of the company’s outstanding float.

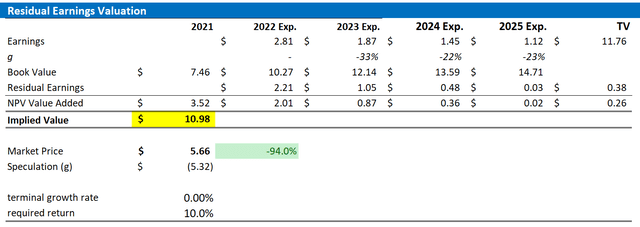

Residual Earnings Valuation

Let us now look at the valuation. What could be a fair per-share value for Glencore’s stock? To answer the question, I have constructed a Residual Earnings framework and anchor on the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2025. In my opinion, any estimate beyond 2025 is too speculative to include in a valuation framework. But for 2-3 years, analyst consensus is usually quite precise. That said, EPS are estimated at $2.81 $1.87, $1.45 and $1.12 for 2022, 2023, 2024, and 2025, respectively.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 30, 2022. My calculation indicates a fair required return of 10%.

- To derive GLCNF’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply a 0-percentage point to reflect the balance of a secular decline for Glencore’s coal mining business in oil and the transition towards more sustainable commodities mining.

Based on the above assumptions, my calculation returns a base-case target price for GLCNF of $10.98/share, implying material upside of almost 100%.

Analyst Consensus Estimates; Author’s Calculation

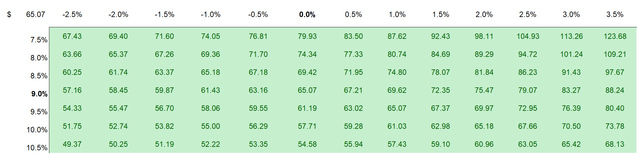

I understand that investors might have different assumptions with regard to GLCNF’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus Estimates; Author’s Calculation

Risks To My Thesis

In my opinion, Glencore stock is significantly de-risked at a P/E below x10 and the risk/reward looks favorable. In addition, the greater than 5% dividend yield should cushion investors from further downside. However, I advise monitoring the following: First, much of Glencore’s earnings strength is connected to supply/demand balances in commodities such as copper, zinc and coal, which can fluctuate significantly over time. Second, Glencore is an international mining company and trades commodities across the world. That said, the company is exposed to the risk of currency exchange fluctuations. Third, macroeconomic uncertainty relating to the health of the global economy, government actions against Russia could impact Glencore’s business operations.

Conclusion

At $5.66/share, Glencore stock is valued at a highly attractive risk/reward level — too attractive to pass. Investors should consider that Glencore currently trades at a x5.5 P/E, 0.34 EV/Sales and x3.9 EV/EBITDA. This incredibly cheap, in my opinion — even if investors might assume peak earnings cycle for mining companies. I see almost 100% upside based on a residual earnings valuation model. My target price is $10.98/share.

Source link