[ad_1]

jiefeng jiang

Micron (NASDAQ:MU) dipped after giving a disappointing update on forward guidance. While the stock continues to trade at low single-digit multiples of earnings, I caution investors against using that metric because the company has historically invested heavily in capital expenditures. Even based on free cash flow, the stock is not necessarily expensive, and the company’s financial position has been transformed over the past several years. I remain hesitant to recommend buying the stock as I would not be surprised to see much better valuations in the near to medium future.

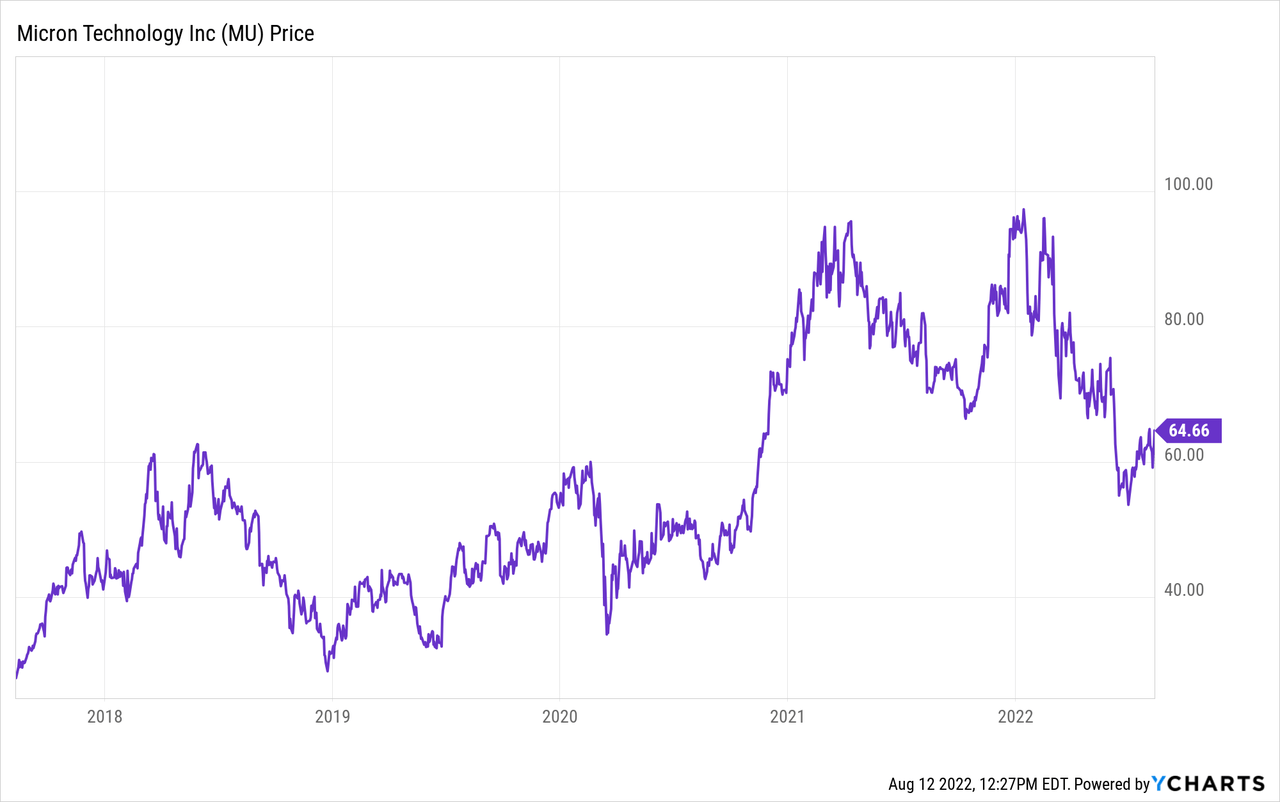

MU Stock Price

Like many other tech stocks, MU has seen its stock materially pull back from recent highs.

I last covered MU in April, where I discussed why the valuation is deceiving. The stock has since fallen 10%, marginally improving the valuation proposition.

MU Stock Key Metrics

MU’s latest quarter saw revenue growth decelerate from the sequential quarter, with the growth rate compressing from 25% to 16%. That deceleration was understandable due to lapping tough comparables. MU ended up generating $8.6 billion of revenue, $3 billion of operating income, and $2.59 in non-GAAP earnings per share. I note that equity-based compensation makes up an insignificant portion of non-GAAP earnings.

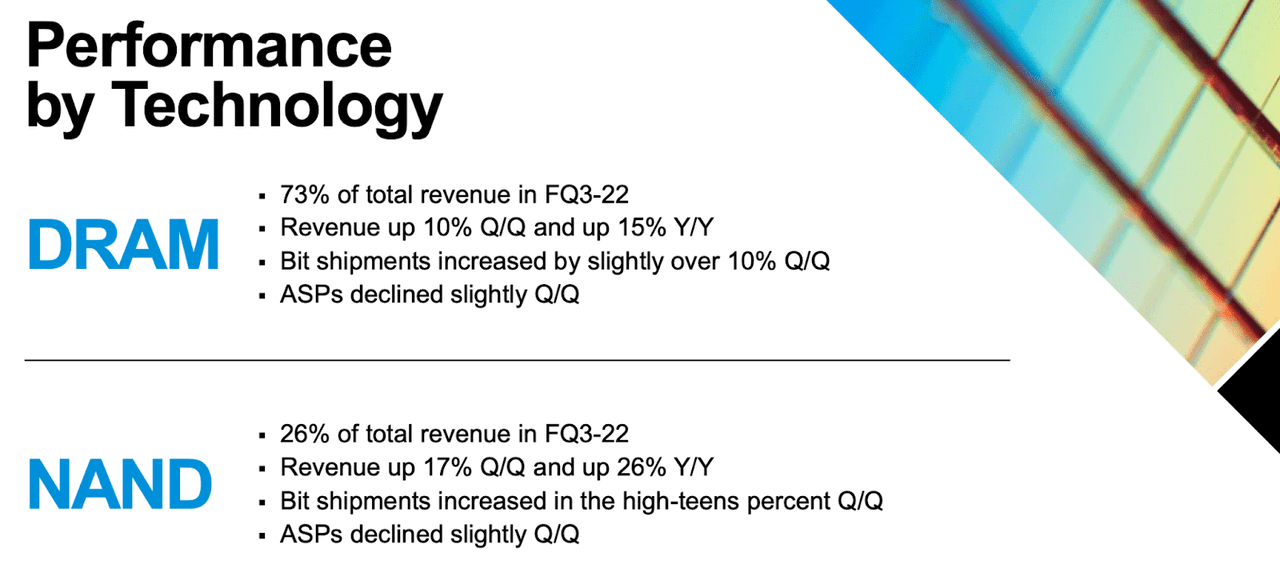

DRAM, which made up 73% of total revenues, grew by 15% YOY whereas NAND grew faster at 26% YOY.

2022 Q3 Slides

We can see below that it was the mobile business unit which dragged on growth, with revenues declining 2% YOY.

2022 Q3 Slides

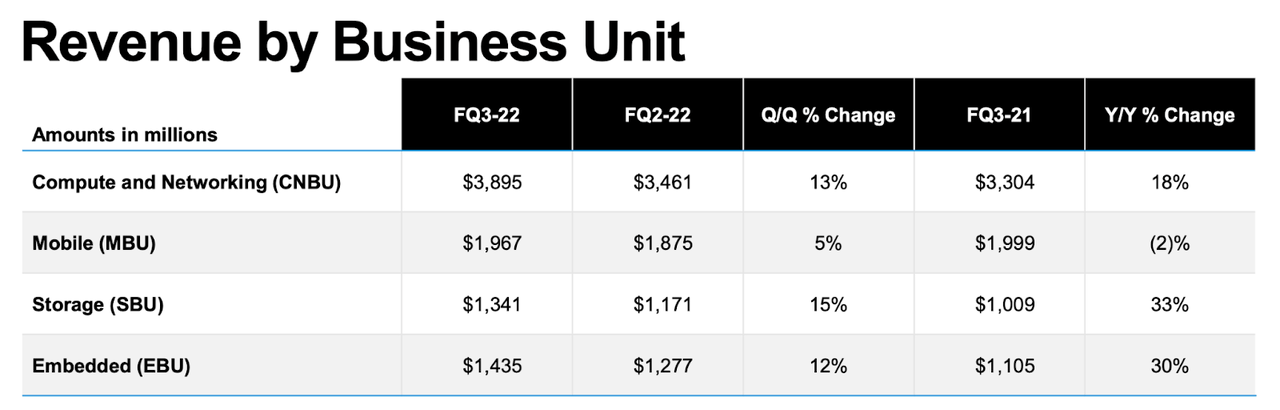

In the quarter, MU generated $1.3 billion of free cash flow (versus $2.9 billion of non-GAAP net income) and purchased $981 million of stock.

2022 Q3 Slides

On the conference call, management stated this in regards to the share repurchase program:

Given our long-term financial outlook and the strength of our balance sheet, we see the current share price as very attractive and, at these levels, intend to repurchase shares more aggressively in fiscal Q4.

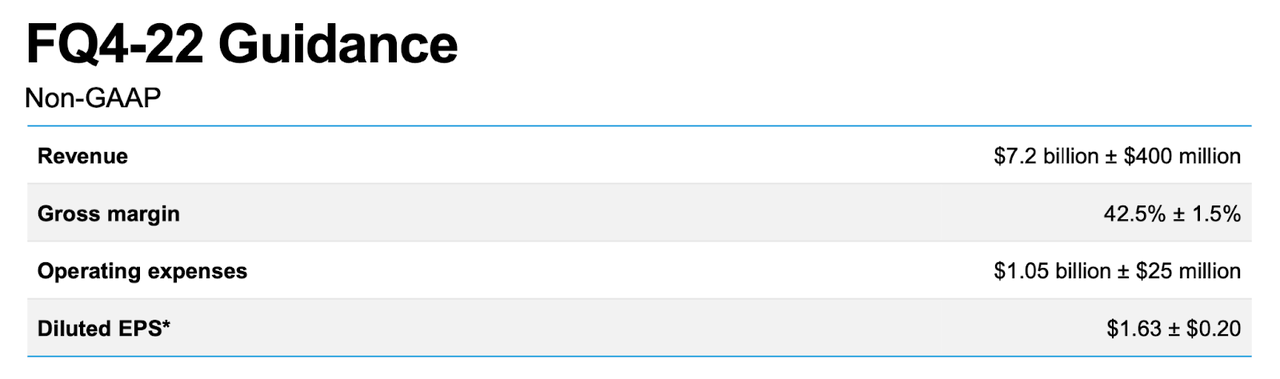

Looking ahead, MU gave guidance for around $7.2 billion of revenue.

2022 Q3 Slides

But after semiconductor peer Nvidia (NVDA) reported disappointing results, MU issued a warning that it expects revenue to come in at or below the low end of the revenue guidance range.

Is MU Stock A Buy, Sell, or Hold?

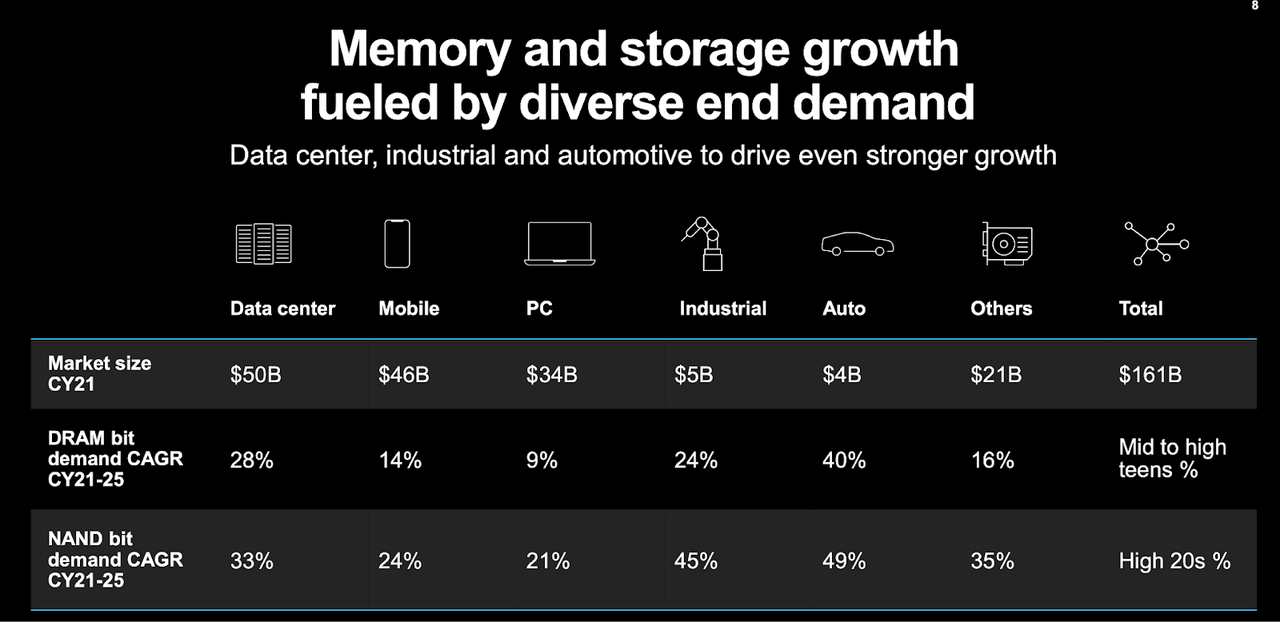

I expect the disappointment to prove short-lived, as MU still benefits from strong secular growth tailwinds ranging from the growth of data centers to self-driving cars.

2022 Q3 Slides

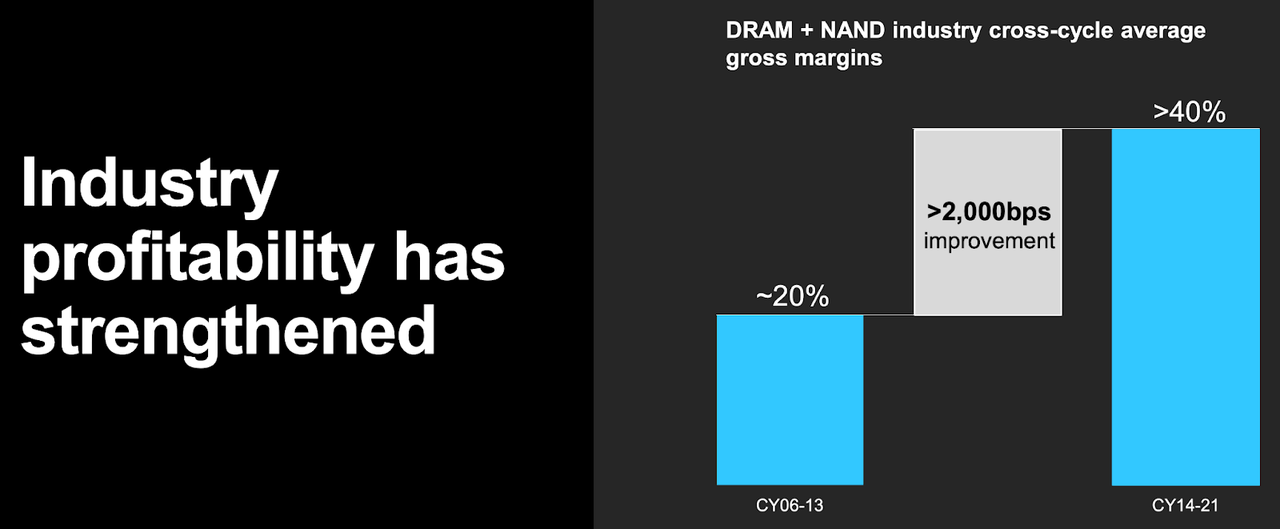

Long time MU shareholders know that the company typically sees cyclical results, though MU notes that its gross margins have improved dramatically since pre-2013 times.

2022 Q3 Slides

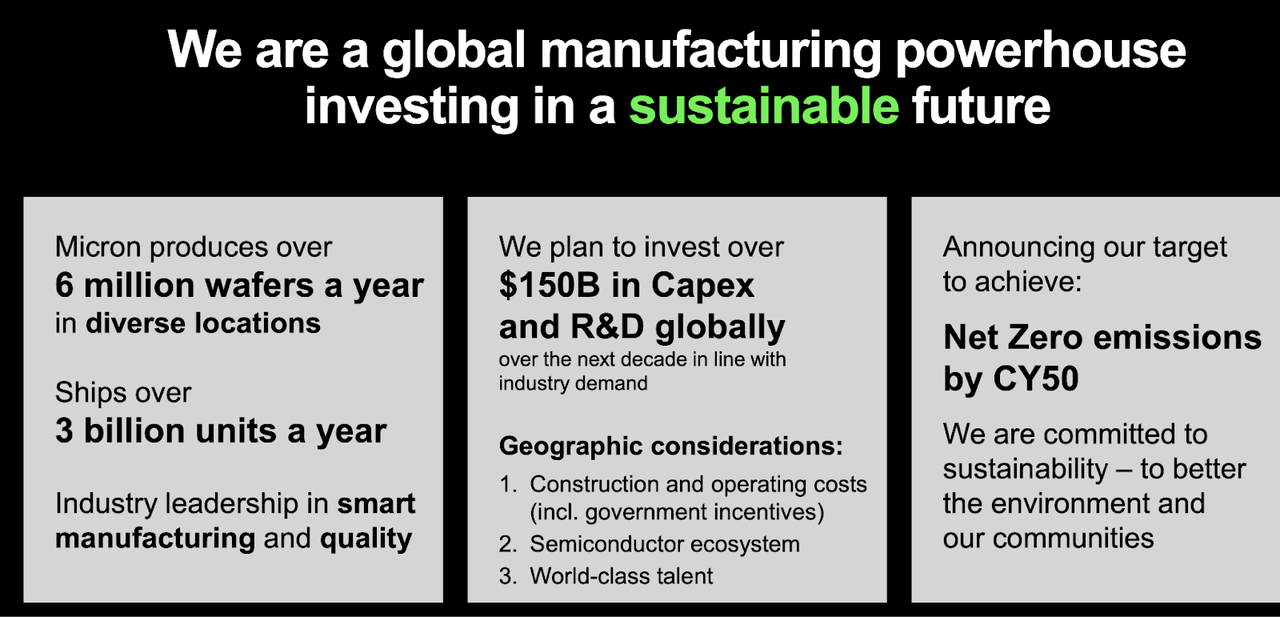

I view the gains as being sustainable, as it is possible that the results were previously cyclical largely due to the world not having yet embarked on the digital transformation taking place today. Looking ahead, MU expects to invest around $150 billion in capex and R&D over the next decade.

2022 Q3 Slides

MU typically spends around $2.5 billion on R&D annually, implying upwards of $10 billion of annual capex spend.

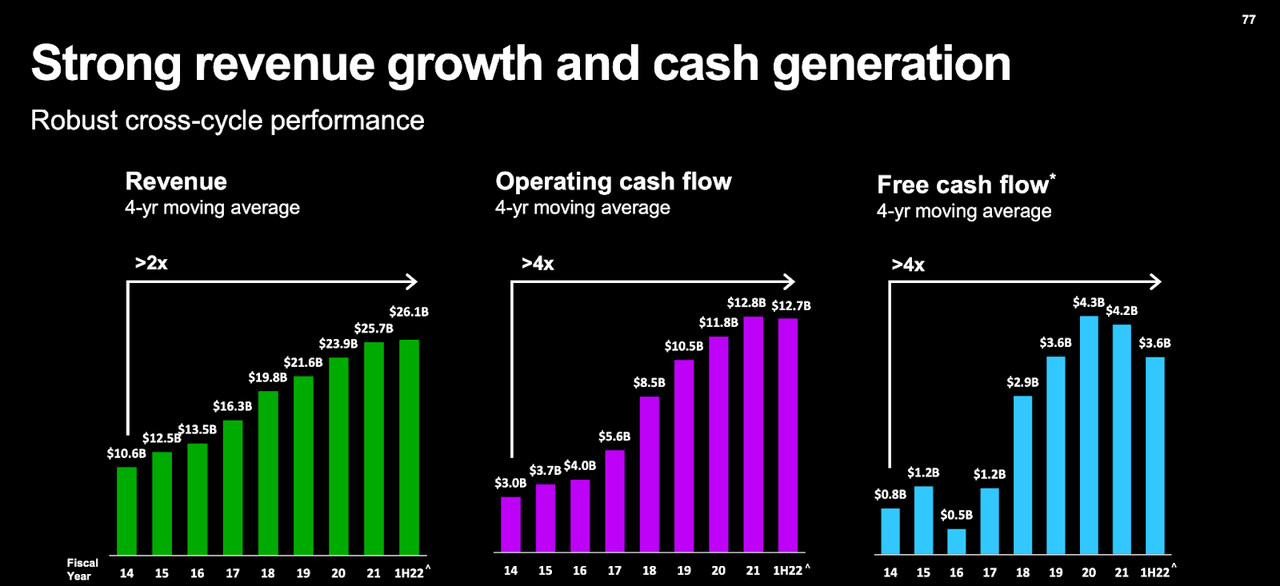

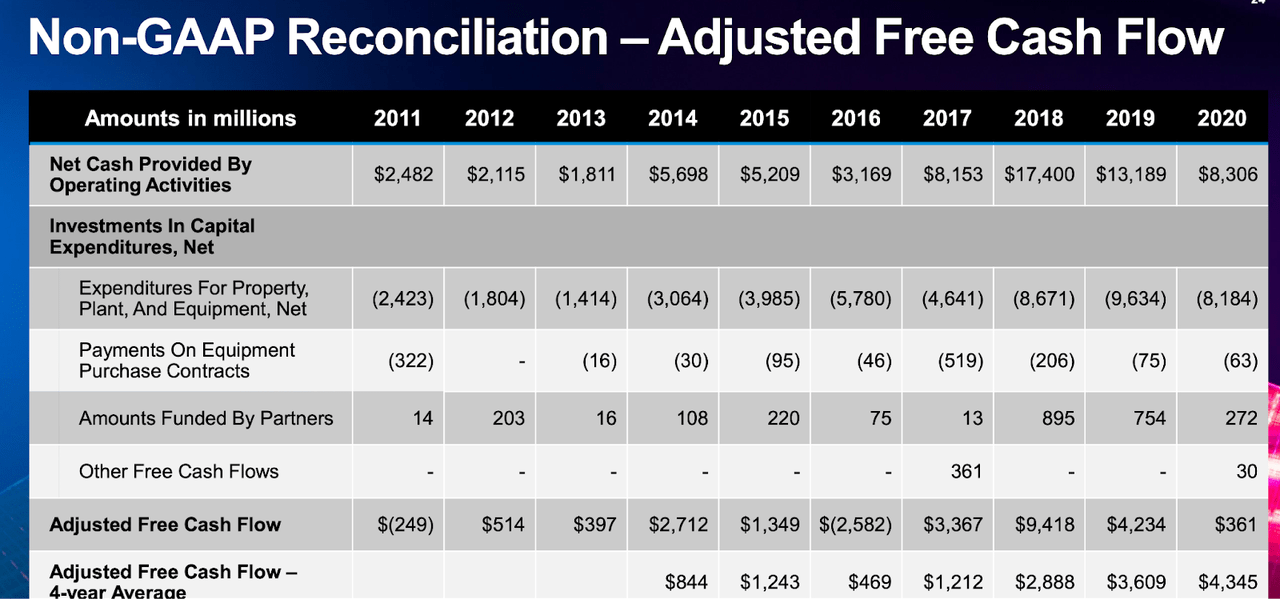

Investors should focus squarely on free cash flow because unlike many other companies, MU’s capex spend tends to outpace depreciation & amortization costs (leading to free cash flow to materially lag net income). MU has generated around $4 billion of annual free cash flow based on a 4-year moving average.

2022 Q3 Slides

That said, I note that the average is heavily influenced by the 2018 year where MU saw an outsized $9.4 billion in free cash flow.

2022 Q3 Slides

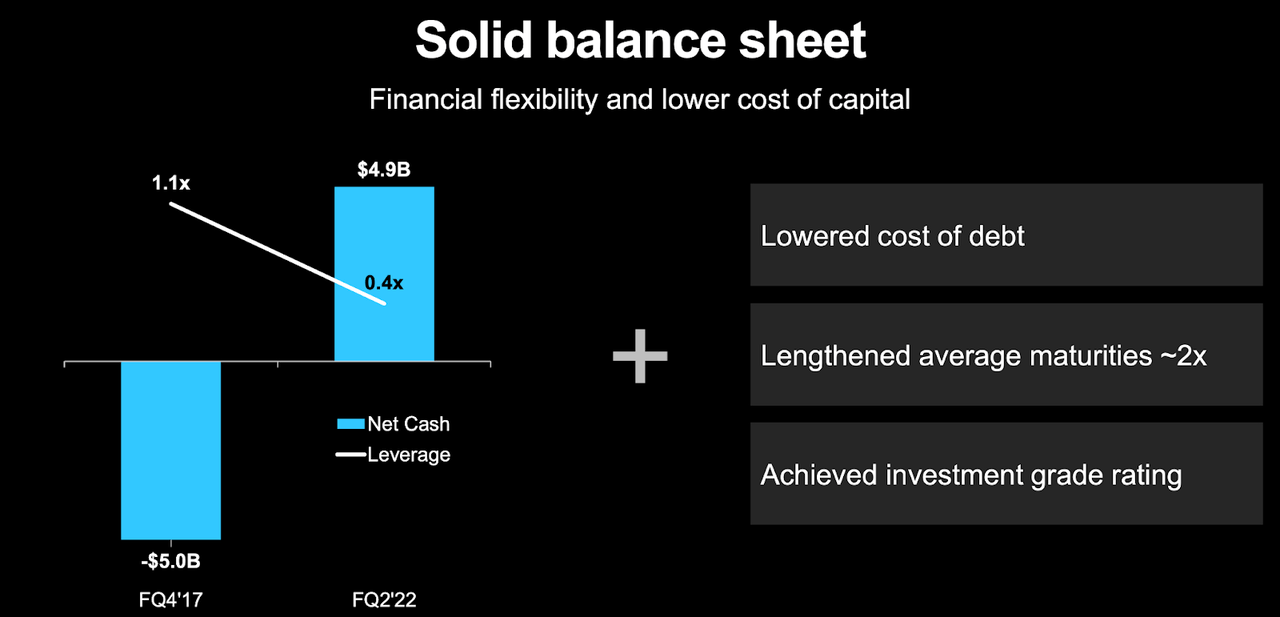

I would not be surprised if its “true” free cash flow profile hovers around $2.5 billion to $3.5 billion. Over the last several years, MU has transformed its balance sheet from $5 billion of net debt to $5 billion of net cash.

2022 Q3 Slides

MU had previously invested heavily in improving its balance sheet, which had a drag on shareholder returns – I do not expect that drag to persist moving forward.

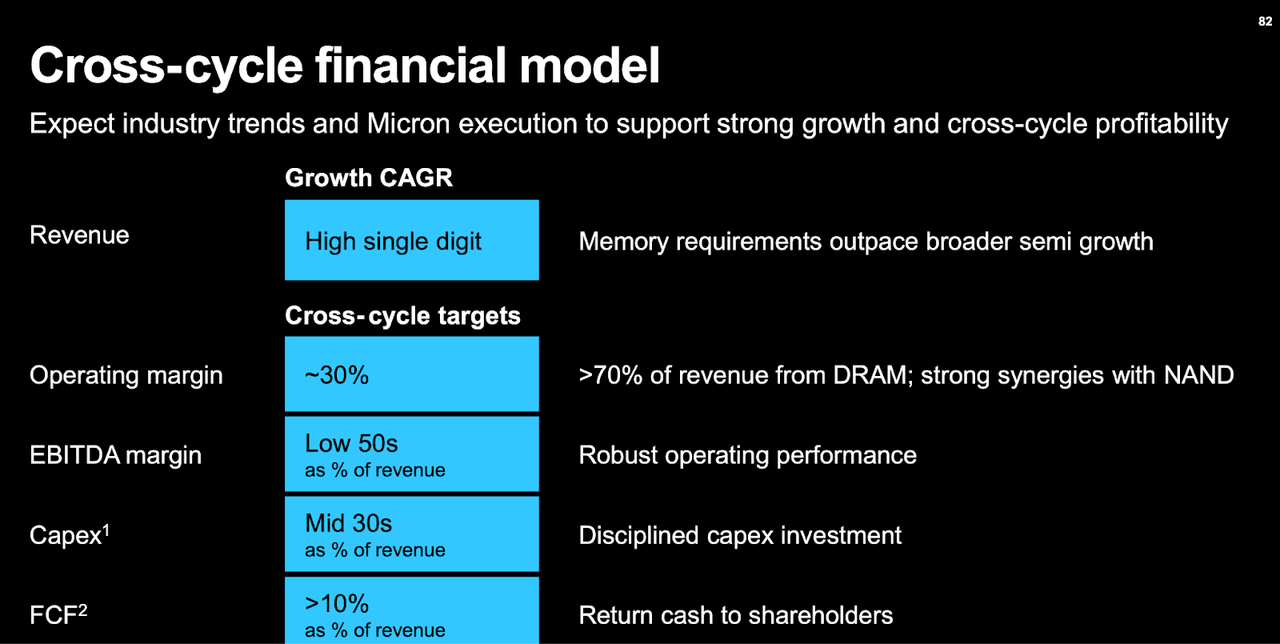

MU has guided for high single digit revenue growth with greater than 10% free cash flow margins over the medium term.

2022 Q3 Slides

The stock is trading at under 8x forward earnings, but I have already discussed why earnings are not an ideal metric. Based on an estimated free cash flow range of $2.5 billion to $4.5 billion, the stock is trading at around 15x to 28x free cash flow. Even at the high end of that free cash flow range, MU stock is not obviously cheap based on the projected high single digit revenue growth rate. The balance sheet and shareholder return program are clear positives, but one mustn’t ignore the risk that pricing pressures return which may result in depressed margins as well as elevated capex spend. This is a name which I would feel more comfortable buying at 10x free cash flow (utilizing the middle part of the free cash flow range). Based on $3.2 billion in free cash flow, that would place the stock at around $32 per share, or 50% lower. I note that MU previously traded below 10x free cash flow prior to the pandemic. I suspect that MU’s re-rating of the past few years may have something to do with famed investor Mohnish Pabrai’s concentrated bet on the stock and less to do with any fundamental change in the business model. I would change my rating upwards if MU can give greater clarity into its projected annual capex spend or if growth unexpectedly accelerates. I rate the stock a hold.

Source link