[ad_1]

sankai

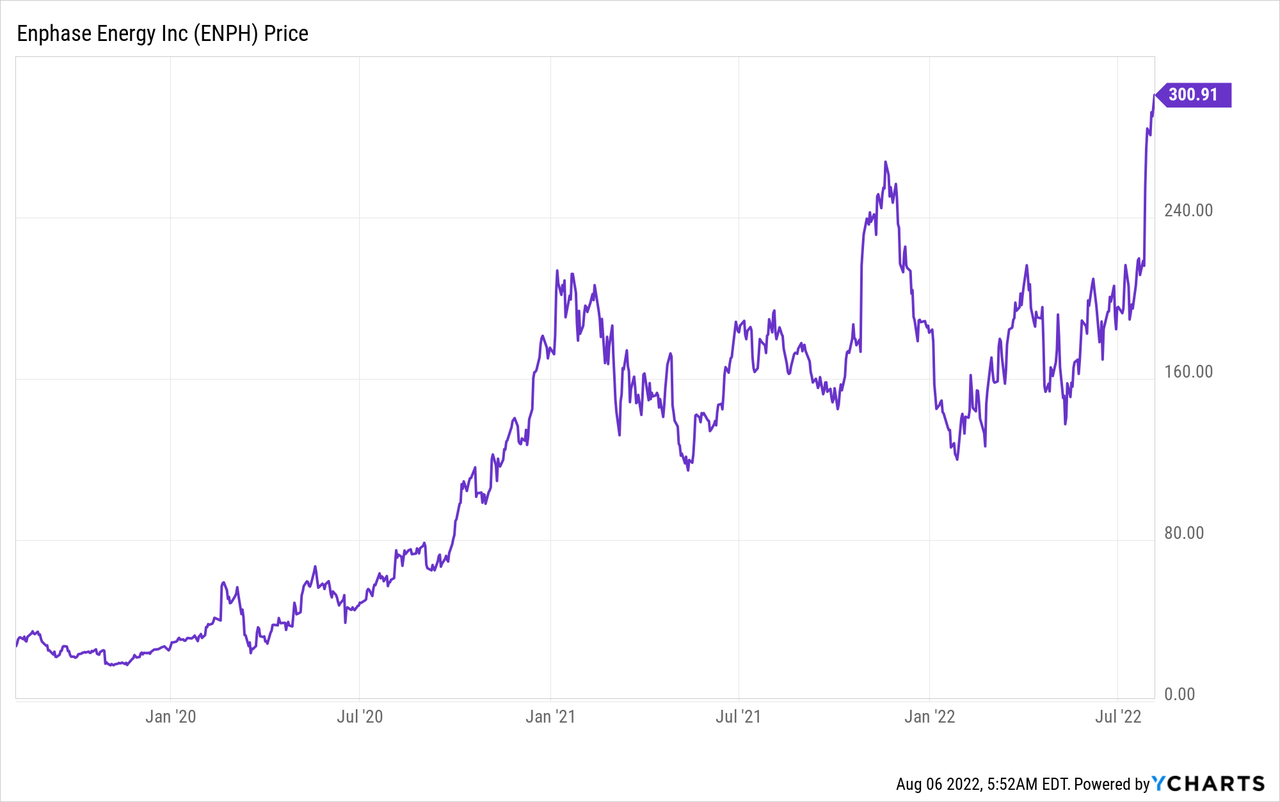

Enphase (NASDAQ:ENPH) is a fantastic company with outstanding leadership and products. It’s active in a steaming hot sector: solar inverters, residential energy storage, and EV chargers. It just posted yet another blow-out quarter and the stock market rewarded it rightly with a new ATH.

I bought more shares of Enphase in January. The recent spike made me reduce my position again as the valuation is less attractive. It remains a great company, though.

I’ve discussed Enphase before as a company dealing with inflation without trouble. I also talked about its expanding markets and outstanding products. These articles give more background about this strong performer.

Outstanding Second Quarter And Outlook

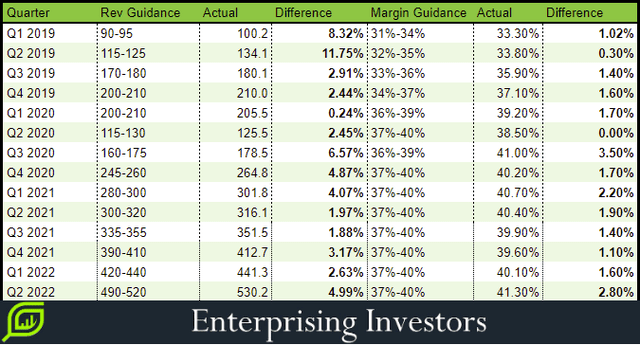

Enphase showcased its strength once again in the second quarter. Revenue grew 67% YoY, and its margins improved. It produced a record free cash flow of $192M, one of its best revenue to cash conversion rates so far. The outlook is also astonishing, with 73% revenue growth at the midpoint of guidance. The forward GAAP margin guidance also increased to 38%-41%.

Author

Enphase has a strong history of ending at the high end of its guidance. The improved margins come from its latest inverter, the IQ8. The technological edge of Enphase remains a key advantage that both provide customers with the best experience and give Enphase best-in-class financial results.

Growth: Mostly Organic, Some External

As I just discussed, the past growth of Enphase is undeniable swift and recently even accelerated. The company is already very profitable and should be able to keep this profitability. Growth comes both organically and with acquisitions. The company has a targeted acquisition policy that aims at margins equal to its current products and high compatibility with its business. An overview of its latest acquisitions:

- March 15, 2022: The SolarLeadFactory adds lead generation capabilities for Enphase’s installers.

- January 3, 2022: Enphase adds EV chargers by acquiring ClipperCreek. It now looks to acquire additional charger software.

- December 21, 2021: 365 Pronto is a software platform that connects installers, asset owners, and service providers.

I expect more small acquisitions that add value to customers and installers. The acquisitions constantly expand Enphase’s proposition in its current markets.

Organic Growth

Enphase Energy

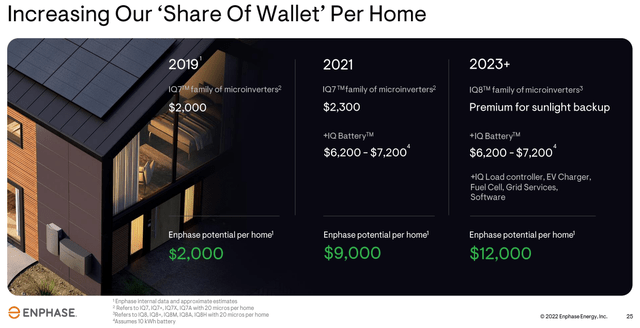

Organic growth remains to look promising for Enphase. In the U.S., a total of 4.2 GW was installed in 2021. The forecast for 2022 is 6 GW and 7 GW in 2023. Enphase should at least keep its market share and profits from the increased battery and EV charger demand. Batteries, grid services, and EV chargers improve Enphase’s potential revenue per home. An increasing amount of houses and more revenue per home create a flywheel effect.

The 2022 revenue growth rate will be around 60%-65% based on the current Q3 forecast and assuming a solid Q4. 2023 could easily be north of 30% growth as Enphase introduces a portable battery and an improved home battery.

Free Cash Flow And Shareholder Returns

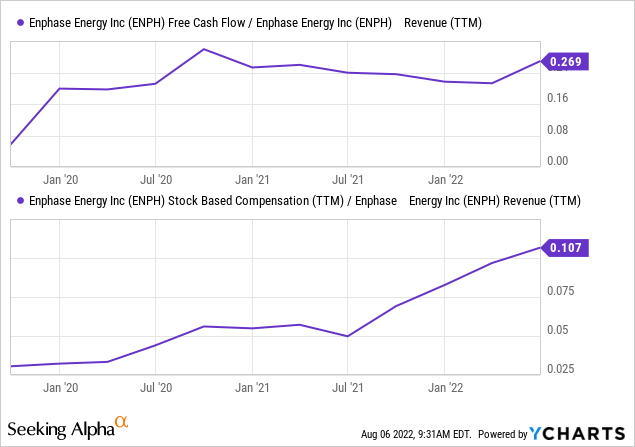

Free cash flow is vital as this is what a company could use for shareholder returns. Potential buybacks or dividends are only possible if the company produces enough cash. I also look at stock-based compensation because this could deform the free cash flow. SBC isn’t a cash expense but does impact shareholders.

Enphase has a robust free cash flow conversion as it turns 0.27 of every dollar of revenue into cash. It also uses a lot of SBC to pay employees. Correcting for SBC, the FCF is still healthy but a lot less.

Shareholder Returns

Enphase used share repurchase programs to return cash to shareholders in the past. In Q4 2021, it bought back $300M of shares at an average price of $196.98 per share. There is $200M available under the program to repurchase more shares. Management stated the following on the earnings call about those potential buybacks:

If those two are taken care of, then we look at buying back shares, there we look at is our share price, do we believe our share price is below a conservatively estimated intrinsic value? And it’s not my idea. This is Warren Buffett has taught everybody.

It doesn’t sound like Enphase will buy back more shares at the current price.

The dividend policy also clearly states that it doesn’t plan to distribute any cash to shareholders now.

I expect Enphase will accumulate more cash until it can repurchase shares at a reasonable price.

Balance Sheet

Enphase’s balance sheet is in prime shape. It has about $1.25B in cash and marketable securities for Capex, acquisitions, and buybacks. The $1.2B long-term convertible debt is only due in 2026 and 2028. The current shape of the business should make it easy to refinance the debt as the payment dates get closer.

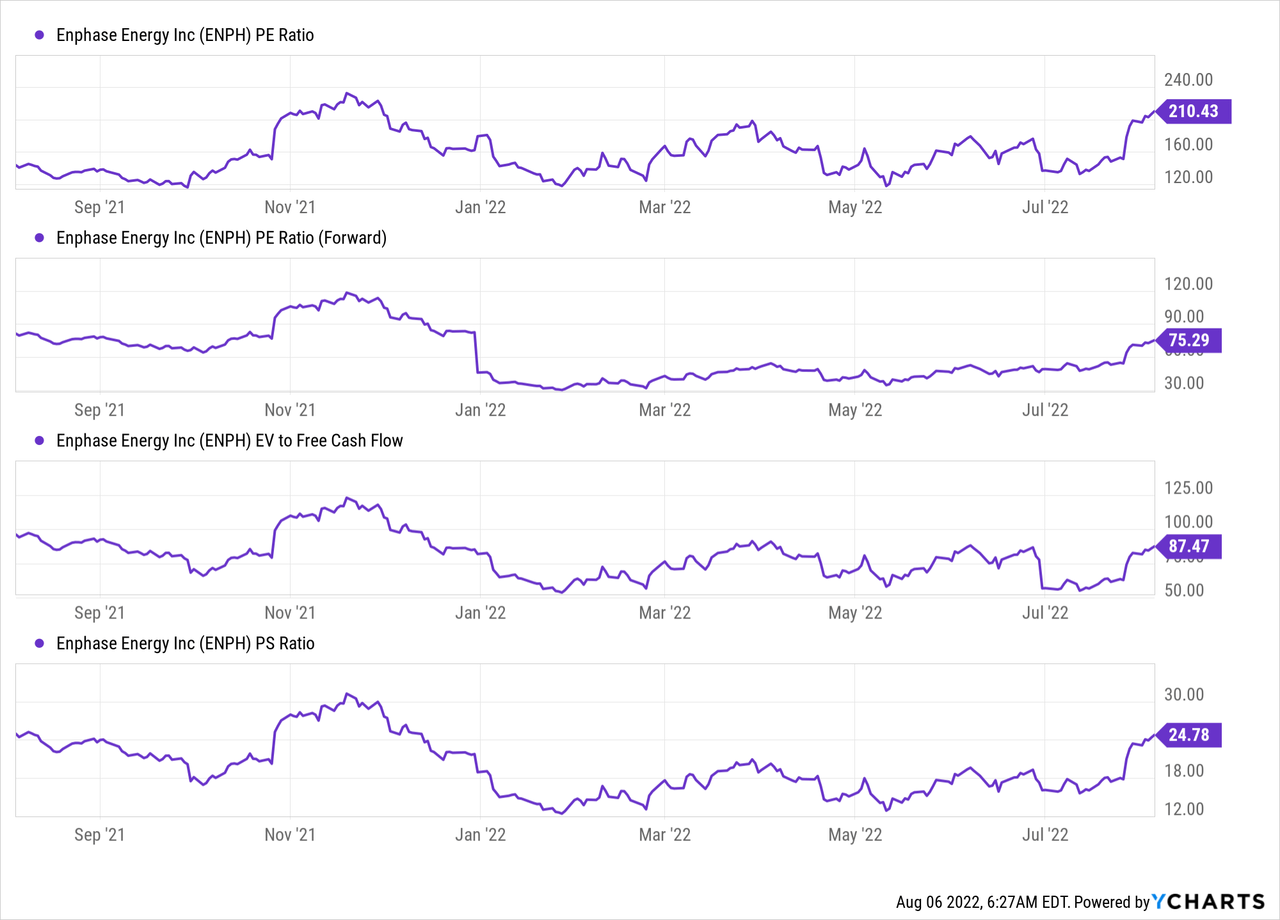

Valuation

Enphase is a fast-growing company that won’t be cheap soon. It traded at high ratios for the past two years, and with good reason. The company executed its strategy of rapid, profitable growth perfectly.

I consider Enphase buyable at an EV/FCF ratio below 70 and reduce my position further if EV/FCF rises above 100. The chart shows EV/FCF still well below 100. If I’d correct FCF for the SBC, it goes up significantly to ~145. Looking forward, I estimate FCF-SBC in 2022 at ~$400M. Enphase currently is around a 100 EV/FCF ratio based on this estimate.

Even a great company can become overvalued, and Enphase is moving to the overvaluation zone. These metrics come down quickly as it has more outstanding quarters.

Risks

As I just described, the most significant risk to the stock is the current valuation. Enphase is a great company but an expensive stock. That makes me cautious about the company today.

Renewable energy and solar get a lot of government support. The evolution of potential tax credits often influenced Enphase’s stock price heavily. The U.S. tariffs on Chinese solar panels also often moved Enphase shares. The business of Enphase is robust and often doesn’t get affected much by these policies.

Conclusion

I like Enphase as a company. It outperforms its guidance and analyst expectations consequently quarter after quarter. It builds excellent products with loyal installers and happy customers. It made targeted value-adding acquisitions that fit perfectly into its business. The sector proliferates, and Enphase goes even faster.

The share price is also worth considering, primarily how it measures up on valuation metrics. I feel it’s rather expensive at the moment and trimmed my position. Long-term investors will argue against this, but even great companies can get too expensive. When I wrote about Enphase in May, some investors already found it too expensive, and the shares are up 72% since then.

Source link