[ad_1]

DKart/iStock via Getty Images

A Quick Take On Yi Po International

Yi Po International (YBZN) has filed to raise $20 million in gross proceeds from the sale of its common stock in an IPO, according to an amended registration statement.

The company provides parking lot operators in China with systems to manage and optimize their operations, and operates parking lots for its own account.

Given that Yi Po operates essentially two businesses, it is difficult to determine a reasonable valuation.

Accordingly, I’m on Hold for Yi Po’s IPO, although the low nominal price of IPO shares will probably attract day traders seeking volatility.

Yi Po International Overview

Nanjing, China-based Yi Po was founded to develop a parking management technology platform for parking lot operators who wish to enhance the efficiency and offerings for their vehicle owner customers.

Management is headed by Chairman and CEO Weiming Jin, who has been with the firm since August 2018 and was previously Chairman and CEO of Lanzhou Kangzheng Hengxin Automobile Sales Co.

The company’s primary offerings include:

-

Automatic vehicle login

-

Entrance and exit authentication

-

Vehicle monitoring

-

Charging management

-

Navigation guidance

-

Parking space search

Yi Po has booked fair market value investment of $340,000 as of December 31, 2021, from investors including Chairman and CEO Weiming Jin and others.

Yi Po – Dealer Acquisition

The firm seeks relationships with region dealers to sell its systems to parking lot operators.

Yi Po focuses its efforts on major verticals, including the transportation, property management and urban planning industries.

Selling and Marketing expenses as a percentage of total revenue have risen slightly as revenues have increased, as the figures below indicate:

|

Selling & Marketing |

Expenses vs. Revenue |

|

Period |

Percentage |

|

2021 |

0.6% |

|

2020 |

0.2% |

(Source – SEC)

The Selling and Marketing efficiency rate, defined as how many dollars of additional new revenue are generated by each dollar of Selling and Marketing spend, was 77x in the most recent reporting period. (Source – SEC)

Yi Po’s Market & Competition

According to a 2021 market research report by Mordor Intelligence, the global parking management market was an estimated $3.5 billion in 2020 and is forecast to grow to $6.5 billion by 2026.

This represents a forecast CAGR of 10.3% from 2021 to 2026.

The main drivers for this expected growth are increased urbanization resulting in growing car parking demand and a desire from operators for greater efficiencies in operation.

Also, technology improvements in providing parking lot status, capacity and other transportation related services will add to operator demand.

Major competitive or other industry participants include:

-

Beijing Yuechang Technology

-

Shenzhen Jieshun Technology Industrial Co.

-

Jiangsu Wuyang Parking Industry Group Co.

-

Xiamen Ketuo Communication Technology Co.

-

Others

Yi Po International Holdings’ Financial Performance

The company’s recent financial results can be summarized as follows:

-

Growing topline revenue, but from a small base

-

Increasing gross profit and gross margin

-

Growing operating profit

-

Reduced cash flow from operations

Below are relevant financial results derived from the firm’s registration statement:

|

Total Revenue |

||

|

Period |

Total Revenue |

% Variance vs. Prior |

|

2021 |

$ 5,277,517 |

89.4% |

|

2020 |

$ 2,786,853 |

|

|

Gross Profit (Loss) |

||

|

Period |

Gross Profit (Loss) |

% Variance vs. Prior |

|

2021 |

$ 4,260,139 |

103.1% |

|

2020 |

$ 2,097,352 |

|

|

Gross Margin |

||

|

Period |

Gross Margin |

|

|

2021 |

80.72% |

|

|

2020 |

75.26% |

|

|

Operating Profit (Loss) |

||

|

Period |

Operating Profit (Loss) |

Operating Margin |

|

2021 |

$ 2,014,927 |

38.2% |

|

2020 |

$ 652,883 |

23.4% |

|

Net Income (Loss) |

||

|

Period |

Net Income (Loss) |

Net Margin |

|

2021 |

$ 1,948,612 |

36.9% |

|

2020 |

$ 480,230 |

9.1% |

|

Cash Flow From Operations |

||

|

Period |

Cash Flow From Operations |

|

|

2021 |

$ 1,115,730 |

|

|

2020 |

$ 1,356,334 |

|

(Source – SEC)

As of December 31, 2021, Yi Po had $332,083 in cash and $14 million in total liabilities.

Free cash flow during the twelve months ended December 31, 2021, was $762,093.

Yi Po’s IPO Details

YBZN intends to sell 4 million shares of common stock at a proposed midpoint price of $5.00 per share for gross proceeds of approximately $20.0 million, not including the sale of customary underwriter options.

No existing or potentially new shareholders have indicated an interest to purchase shares at the IPO price.

Assuming a successful IPO at the midpoint of the proposed price range, the company’s enterprise value at IPO (excluding underwriter options) would approximate $58 million.

The float to outstanding shares ratio (excluding underwriter options) will be approximately 28.6%. A figure under 10% is generally considered a ‘low float’ stock which can be subject to significant price volatility.

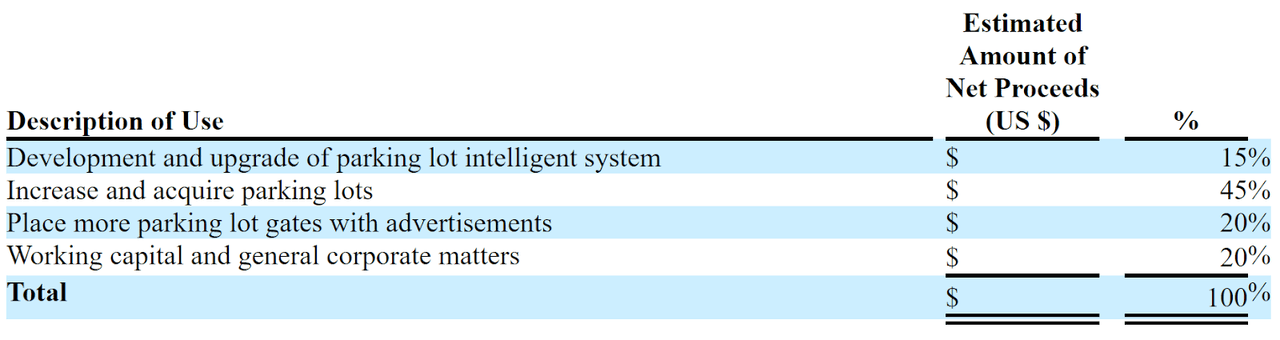

Per the firm’s most recent regulatory filing, it plans to use the net proceeds as follows:

Proposed Use Of Proceeds (SEC EDGAR)

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, other than a labor proceeding settlement totaling $98,000, management says there are no other material legal proceedings against the firm.

The sole listed bookrunner of the IPO is Boustead Securities.

Valuation Metrics For Yi Po

Below is a table of the firm’s relevant capitalization and valuation metrics at IPO, excluding the effects of underwriter options:

|

Measure [TTM] |

Amount |

|

Market Capitalization at IPO |

$70,000,000 |

|

Enterprise Value |

$58,000,000 |

|

Price / Sales |

13.26 |

|

EV / Revenue |

10.99 |

|

EV / EBITDA |

28.79 |

|

Earnings Per Share |

$0.13 |

|

Operating Margin |

38.18% |

|

Net Margin |

36.92% |

|

Float To Outstanding Shares Ratio |

28.57% |

|

Proposed IPO Midpoint Price per Share |

$5.00 |

|

Net Free Cash Flow |

$762,093 |

|

Free Cash Flow Yield Per Share |

1.09% |

|

Debt / EBITDA Multiple |

0.00 |

|

CapEx Ratio |

3.16 |

|

Revenue Growth Rate |

89.37% |

|

(Glossary Of Terms) |

(Source – SEC)

Commentary About Yi Po

Yi Po is seeking U.S. capital market investment to fund continued development of its parking lot management systems and to acquire additional parking lots for in-house management.

The company’s financials have produced increasing topline revenue, but from a small base, growing gross profit and gross margin, higher operating profit but lowered cash flow from operations.

Free cash flow for the twelve months ended December 31, 2021, was $762,093.

Selling and Marketing expenses as a percentage of total revenue have risen slightly as revenue has increased and its Selling and Marketing efficiency multiple rose sharply to 77x in 2021.

The firm currently plans to pay no cash dividends on its capital stock in the foreseeable future.

The company’s CapEx Ratio is 3.16, which indicates it is spending materially on capital expenditures as a percentage of its operating cash flow.

The market opportunity for parking lot management systems is reasonably large and is expected to grow at above 10% CAGR over the coming years.

Like other Chinese firms seeking to tap U.S. markets, the firm operates within a VIE structure or Variable Interest Entity. U.S. investors would only have an interest in an offshore firm with contractual rights to the firm’s operational results but would not own the underlying assets.

This is a legal gray area that brings the risk of management changing the terms of the contractual agreement or the Chinese government altering the legality of such arrangements. Prospective investors in the IPO would need to factor in this important structural uncertainty.

Additionally, the Chinese government crackdown on IPO company candidates combined with added reporting requirements from the U.S. side has put a serious damper on Chinese IPOs and their post-IPO performance.

Boustead Securities is the lead underwriter, and IPOs led by the firm over the last 12-month period have generated an average return of 4.9% since their IPO. This is an upper-tier performance for all major underwriters during the period.

The primary risks to the company’s outlook are the unpredictable nature of Chinese regulatory policies on the firm’s business operations or possibly on its U.S. stock listing status, given the ongoing dispute over access to auditor records by the PCAOB.

As for valuation, management is asking IPO investors to pay an EV/Revenue multiple of around 11x. While the company is growing topline revenue quickly, it is from a small base.

Also, given that Yi Po operates essentially two businesses, one a parking lot operator and another for the sale of parking lot management systems, it is difficult to determine a reasonable valuation.

Accordingly, my outlook for Yi Po is on Hold, although the low nominal price of IPO shares will probably attract day traders seeking volatility.

Expected IPO Pricing Date: To be announced

Source link