[ad_1]

subman

Thesis

I prefer the best over the cheapest. While the best doesn’t always come at a reasonable price, in rare occasions the patient investors can accumulate shares of an industry leader at depressed prices. Then it pays to be aggressive. Looking at JPMorgan Chase & Co.’s (NYSE:JPM) risk/reward ratio, I argue the industry leader in banking is currently on sale.

JPMorgan stock is down almost 30% YTD and now trades at a P/E below x10, P/S below x3 and P/B below x1.5. While JPM is trading at a premium to US industry peers such as Citigroup (C) and Bank of America (BAC), I argue the premium is justified.

Seeking Alpha

I see material upside of almost 70% as I value JPM stock based on a residual earnings framework and analyst consensus EPS. My target price is $194.48/share.

The Leading Global Bank

JPMorgan is the U.S.’ biggest bank, with a balance sheet size of about $2.87 trillion. Thus, JPM is about $700 million bigger than the U.S.’ second biggest bank: Bank of America. However, a simple comparison of balance sheet size does not fully capture the bank’s leading position. JPMorgan is a diversified financial service provider and has interests in retail/consumer banking, private wealth management, asset management, global markets/trading, and investment banking.

While many banks have an interest in all these verticals, including Citi, BofA, and UK’s Barclays (BCS), arguably only JPMorgan is an undisputed top three, if not top one, contender in all of the above-mentioned business segments.

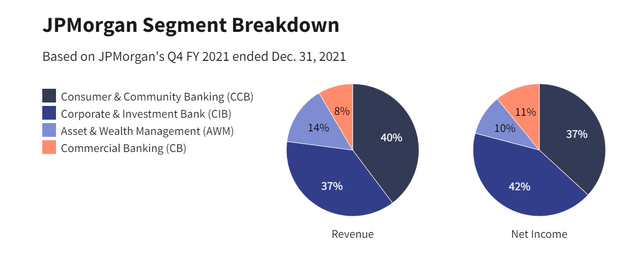

As of December 2021, JPM generates about 40% of total revenue from consumer/retail banking, 37% from corporate and investment banking (which also includes securities trading and the broader global markets segment), 14% from wealth & asset management and about 8% from commercial banking.

Investopedia

JPMorgan’s diversified revenue exposure is important, and arguably underappreciated. It makes the bank much less vulnerable to cyclical downturns as many market participants think. For example, in low interest rate environments and steady markets, the investment banking and wealth management arm is poised to deliver a strong performance. In a stressed market, trading and global market activities outperform. And rising interest rates stimulate income from consumer lending exposure.

Not Cheap But Very Attractive

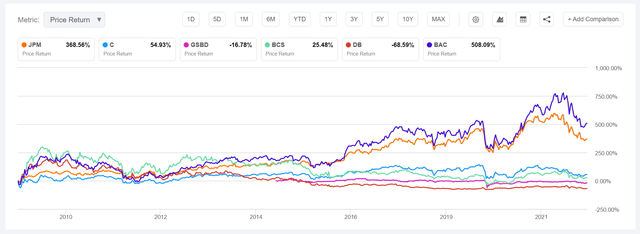

Buying JPMorgan stock is not cheap when compared to the US’ and European banking peers. Specifically, JPM trades at a P/E of about x10, P/S of about x2.5 and P/B of almost x1.5. For reference, Citi trades at a P/E of x7 and a P/B of x0.55. Similarly, Deutsche Bank (DB) is valued at a P/E of x6 and a P/B of x0.25.

But buying cheap can be expensive — especially in the banking industry. This has been demonstrated by the “cheap banks,” who have underperformed the market and JPMorgan for many years.

Seeking Alpha

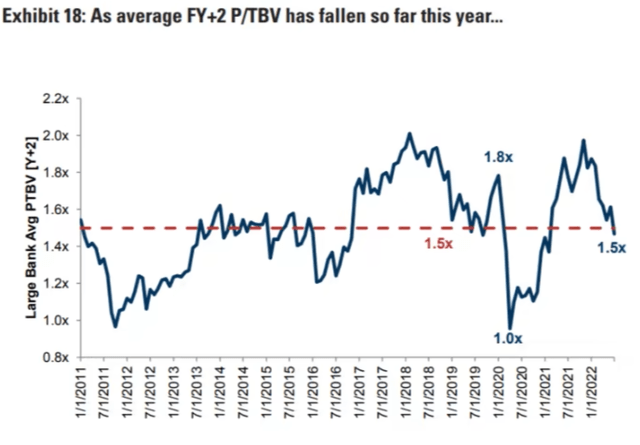

Moreover, please ignore JPM’s relative premium for a moment and focus on the company’s absolute valuation and risk/reward. According to research by Goldman Sachs, the cyclical low for bank stocks is usually around the x1 P/B multiple, and the historical average is somewhere around x1.5.

That said, JPM–the industry leader–is currently trading at levels equal to the historical average of the banks. Or in other words, JPM is currently valued like a “normal” bank, not like the leader.

Goldman Sachs Research, Financial Times Graph

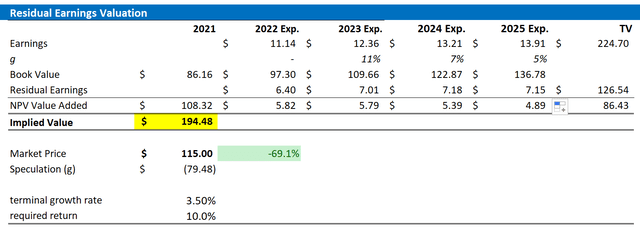

Residual Earnings Valuation

In my opinion, banks are prime candidates to be valued with a residual earnings (“RE”) valuation, given that the RE framework anchors on both the income statement and the balance sheet as well as accrual accounting. That said, I apply the following assumptions:

- To forecast EPS, I anchor on consensus analyst forecast as available on the Bloomberg Terminal ’till 2023. In my opinion, any estimate beyond 2023 is too speculative to include in a valuation framework – especially for banks.

- To estimate the cost of capital, I use the WACC framework. I model a three-year regression against the S&P 500 to find the stock’s beta. For the risk-free rate, I used the U.S. 10-year treasury yield as of July 29, 2022. My calculation indicates a fair required return of about 10%.

- To derive JPM’s tax rate, I extrapolate the 3-year average effective tax-rate from 2019, 2020 and 2021.

- For the terminal growth rate, I apply 3% percentage points, approximately the nominal GDP growth, which I think is a fair assumption for an industry leader.

Based on the above assumptions, my calculation returns a base-case target price for JPM of $194.48/share, implying material upside of almost 70%.

Analyst Consensus EPS; Author’s Calculation

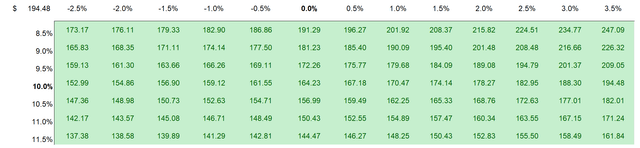

I understand that investors might have different assumptions with regards to JPM’s required return and terminal business growth. Thus, I also enclose a sensitivity table to test varying assumptions. For reference, red-cells imply an overvaluation as compared to the current market price, and green-cells imply an undervaluation.

Analyst Consensus EPS; Author’s Calculation

Risks

While I believe that investments in banks are less risky than the market implies, the tail-risk exposure is still elevated and if materialized this might depreciate JPM share-price significantly. For reference, take the great financial crisis as an example, which crippled many bank stocks for multiple year, if not decades. In any case, JPM’s 12% CET1 ratio should puffer the company for most market stress scenarios, even severe ones.

Conclusion

Given depressed valuation paired with attractive fundamentals, I am bullish on diversified financial service companies — including all US bulge bracket banks and Barclays. However, JPMorgan stands out. In my opinion, CEO Jamie Dimon’s bank is the clear industry leader and having the opportunity to accumulate JPM shares at x1.5 P/B, I love the risk/reward. As I value the bank based on a residual earnings model, I see about 70% upside. My target price is $194.48/share.

Source link