[ad_1]

4kodiak/iStock Unreleased via Getty Images

Amazon (NASDAQ:AMZN) has reported strong results in this quarter and also gave a positive forecast for the next quarter. Advertising is becoming a very important business for Amazon as the revenue share of this segment increases. There had been a massive fluctuation in many businesses of Amazon during the pandemic and during the opening up phase.

If we compare Amazon’s Q2 2022 advertising business to its performance in Q2 2019, we can see that the revenue increased from $3 billion to $8.75 billion. This is equal to 42% compound annual growth rate. On the other hand, the net sales increased from $63 billion to $121 billion during this period which is equal to 21% CAGR. The advertising business has also shown better growth than AWS during this period which grew from $8.3 billion to $19 billion with CAGR of 33%.

At the current pace, Amazon’s advertising business should be hitting $100 billion annualized rate by 2025. The recent earnings report is quite important because we saw modest advertising growth in Google (GOOG) and Meta (META). Increase in advertising revenue will help Amazon in improving its overall margins and also invest more resources in new businesses. The standalone valuation of advertising business could reach $1 trillion by 2025 which will make it a key driver in future growth momentum of Amazon stock.

Importance of advertising business

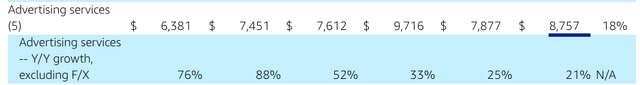

Amazon reported 18% YoY growth in advertising revenue after showing 88% growth in the year-ago quarter. Despite the macroeconomic headwinds and tougher comps, Amazon has been able to deliver growth in high teens within the advertising segment. After removing the headwinds due to the stronger dollar, the YoY growth rate was 21%.

Company Filings

Figure 1: YoY growth in advertising revenue in the past few quarters. Source: Company Filings

It is important to see the trend in advertising business by removing the fluctuations caused by the pandemic. In Q2 2019, Amazon reported advertising revenue of $3 billion. This has increased to $8.7 billion in the recent quarter. The CAGR growth over 3 years has been 42%. This is almost twice the overall revenue growth in Amazon. Hence, we can see that Amazon is able to extract more advertising revenue with lower e-commerce sales.

Company Filings

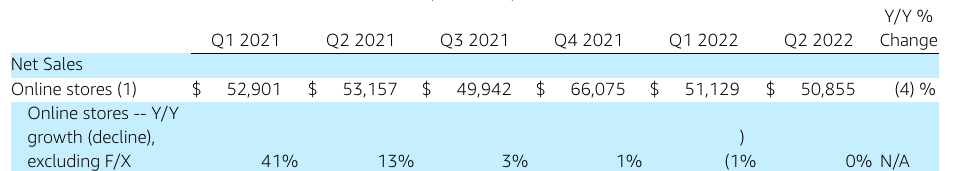

Figure 2: Advertising revenue reported by Amazon in Q2 2019 and previous quarters. Source: Company Filings

Difference in e-commerce and advertising revenue

It is likely that Amazon’s management is pushing for higher growth in advertising segment compared to its e-commerce business. This allows the company to deliver more ads for every dollar in e-commerce sales. We know that the margins in e-commerce business are wafer-thin due to massive investment in logistics and fulfillment. On the other hand, the margins in advertising business are quite high as shown by other big tech players like Google and Meta.

Company Filings

Figure 3: Growth number in online stores segment of Amazon. Source: Company Filings

We can see that there is over 20 percentage points difference in the growth rate of advertising revenue and Online Stores revenue. This should help Amazon increase its margins over the next few years and deliver better profits.

Clean platform

A significant factor that works in the favor of Amazon compared to Google and Meta is that it offers advertisers a “cleaner platform”. This means that advertisers do not have to worry about harm to their brands when their advertisements are delivered on unsuitable content. Both Google and Meta have been facing regulatory pressure in U.S. and international regions to clean up their platforms.

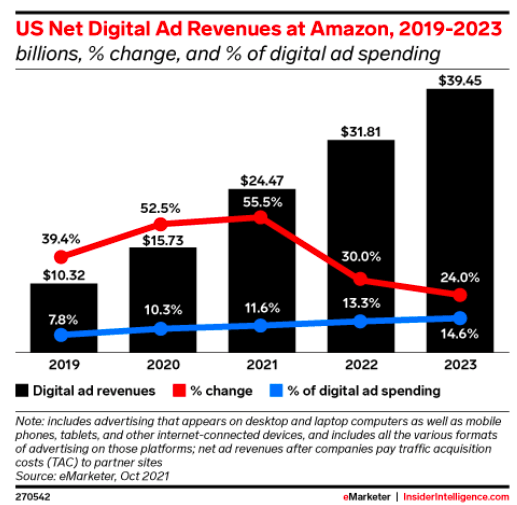

Amazon also offers advertisers a massive customer base who are on Amazon’s platform with a powerful intent to buy. This is not true in either Google or Meta where users might spend time on social interactions or getting information. Amazon is also able to offer advertisers exact information about the conversion of ads to final purchases. Hence, Amazon might be able to gain better rates than Google or Meta over the long run.

eMarketer

Figure 4: Increase in Amazon’s market share in digital ad spending. Source: eMarketer

Impact on Amazon stock

The margins within the advertising segment are very high. This business is highly scalable which allows the same tools to be used by multiple clients. The trailing twelve-month revenue base of the advertising segment has already crossed $34 billion. The CAGR growth over the past few years has been over 40%.

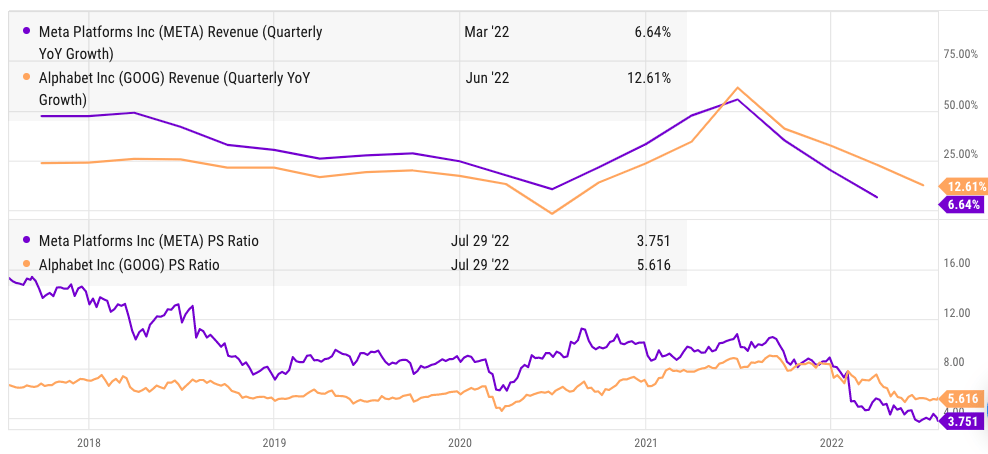

YCharts

Figure 5: YoY revenue growth rate and PS ratio of Meta and Alphabet. Source: YCharts

Despite the recent correction, Google and Meta are able to get a PS ratio of 5.6 and 3.7 respectively. It is likely that Amazon will get a higher standalone valuation than these two giants because it is showing a higher revenue growth trajectory. Amazon is also able to invest the resources from advertising segment in better logistics and content. This gives the company a flywheel effect which should allow this segment to get a higher valuation multiple on a standalone basis.

Even at a modest PS ratio of 6, the advertising business will already have a standalone valuation of over $200 billion. If Amazon is able to maintain the current revenue trajectory in advertising, this segment should be hitting $100 billion in annualized revenue rate by 2025 and could get a standalone valuation of close to $1 trillion. This makes advertising a key pillar for future stock growth.

Investor Takeaway

Amazon has delivered 42% CAGR growth in advertising business in the last three years. On the other hand, the CAGR growth in overall sales was 21%. Advertising segment is highly lucrative and has good margins. Increase in revenue share of advertising segment should improve the overall margins of Amazon and allow the management to invest resources in logistics, content, hardware, subscriptions, and other initiatives.

The growth potential of advertising business is not fully priced in by Wall Street. Amazon should be able to build new tools which will help in improving the traction among advertisers. This should help the segment get better standalone valuation and make it a key driver in building bullish momentum for Amazon stock.

Source link