[ad_1]

jetcityimage/iStock Editorial via Getty Images

Introduction: Why Is AT&T Stock Falling?

AT&T Inc. (NYSE:T) shares fell 7.6% on Thursday (July 21) after the company released Q2 2022 results, and are down another 2.9% as of 11:50 am EST on Friday.

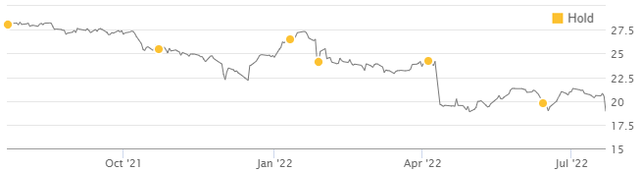

We initiated a Hold rating on AT&T in July 2021, expressing our view that shares should be avoided. Since then AT&T shares have lost 10.6% in a year (adjusted for the $5.92 day-1 value of Warner Bros. Discovery (WBD) shares):

Q2 results showed the poor quality of AT&T’s businesses when facing macro challenges. EBITDA was essentially flat. 2022 FCF outlook was cut from $16bn to $14bn. The Mobility segment had weak pricing despite high inflation, and the capital intensity of its growth contributed to the FCF downgrade. Business Wireline is now expected to see a low-double-digits EBITDA decline in 2022 and not expected to stabilize until H2 2024. Consumer Wireline had better pricing growth, but its broadband customer net loss rose to 25k.

AT&T stock is now at a 7.5x P/E, a 10.1% Free Cash Flow (“FCF”) Yield and a 6.0% Dividend Yield, but we do not believe it is cheap enough to compensate for AT&T’s structural risks. Avoid.

Cautious AT&T Rating Recap

Our longstanding caution on AT&T stems from what we consider structural problems in its businesses:

- Mobility operates in a commoditized market, with low revenue and EBITDA growth despite large volume growth, and faces an increasing threat from Mobile Virtual Network Operators (“MVNO”) owned by U.S. Cable

- Business Wireline is in structural decline, due to losses in legacy services as well as market share gains by U.S. Cable among SMB customers

- Consumer Wireline is only partially upgraded to fiber and is still losing subscribers to U.S. Cable; EBITDA has hit a lower plateau in 2021 after an effective price cut, when AT&T added HBO Max to its Internet bundle

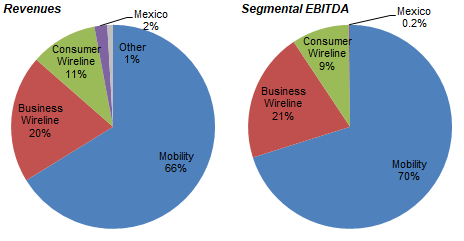

As a reminder, after the WarnerMedia spin-off in April, the new AT&T generates approximately 70% of its EBITDA from Mobility, 21% from Business Wireline and 9% from Consumer Wireline:

|

AT&T Pro Forma Revenues & EBITDA by Segment (2021)  AT&T company filings. NB. Negative EBITDA figures in corporate & other not shown. |

In addition, AT&T holds a 70% economic interest in DirecTV (with the other 30% held by private equity firm TPG) and receives cash dividends each year (including approx. $4bn expected in 2022 and $3bn expected in 2023).

2022 Free Cash Flow Outlook Cut

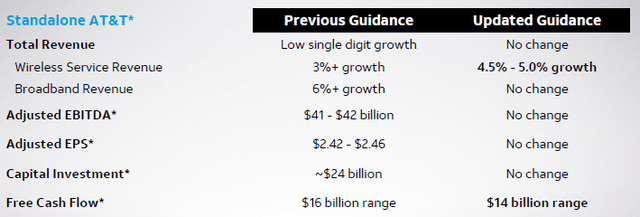

The key headline from Q2 2022 results was that full-year FCF outlook was cut, from $16bn to $14bn, which represents an even larger decline from 2021, when pro forma FCF was $19.2bn:

The outlook for 2022 Wireline Service Revenue growth was raised from 3%+ to 4.5-5.0%, but with no benefits to earnings. Expected EBITDA in Business Wireline was reduced, offset by increased expectations in Mobility, while Consumer Wireline is “trending on plan”. (We will discuss each segment in more detail below.)

AT&T did not provide an updated outlook for 2023.

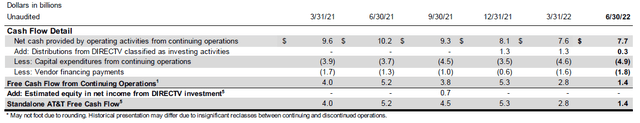

FCF was just $1.4bn in Q2 2022, compared to $2.8bn in Q1 and $5.2bn in the prior-year quarter, and below expectations. Operating Cashflow was $7.7bn in Q2, compared to $7.6bn in Q1 and $10.2bn in the prior-year quarter:

Management gave several reasons for the deterioration in cashflows, including:

- The timing of “success-based investments” that are driven by customer growth

- The front-loading of CapEx in H1 for growth initiatives

- Longer collection cycles and inflationary costs that AT&T was unable to fully offset

- Expectations of a weaker macroeconomic environment in H2 2022

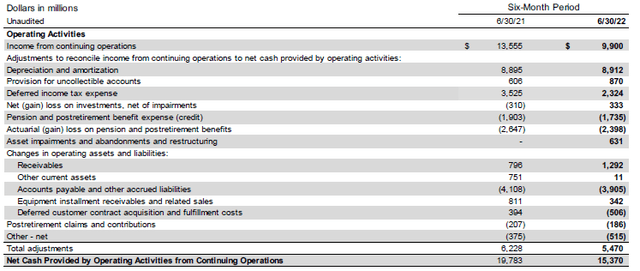

“Success-based investments” in AT&T jargon means customer device subsidies and other incentives. We can see the effect of these, as well as that of longer collection cycles, in AT&T’s H1 cashflows:

Working capital represented a cash outflow of $2.77bn in H1 2022, twice as much as in the year before ($1.36bn), with “Deferred Customer Contract Acquisition and Fulfillment Costs” worsening by $900m.

Cashflows worsening on a flattish EBITDA shows that AT&T’s growth is capital-intensive, a sign of poor business quality.

AT&T EBITDA Was Flattish in Q2

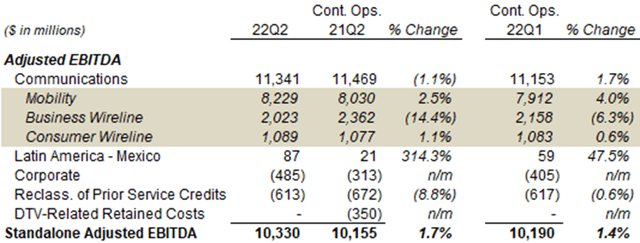

For Q2 2022, AT&T reported a standalone EBITDA of $10.3bn, 1.7% higher year-on-year and 1.4% higher sequentially on a continuing operations basis:

|

AT&T EBITDA by Segment (Q2 2022 vs. Prior Periods)  AT&T results supplement (Q1 2022). NB. Q1 2022 other one-offs included absence of FirstNet and CAF II reimbursements. |

However, the comparisons were flattered by a number of one-off items. The year-on-year comparison benefited from $350m of DirecTV-related retained costs in the prior-year quarter, offset by $100m lower Connect America Fund (“CAF”) II reimbursements in Q2 2022; excluding this, EBITDA was down 0.7% year-on-year. Similarly, the sequential comparison benefited from 3G shutdown costs peaking in Q1; these could be up to $300m but not disclosed precisely; excluding this, EBITDA could be flat or even down from Q1.

We review each AT&T business in more detail below.

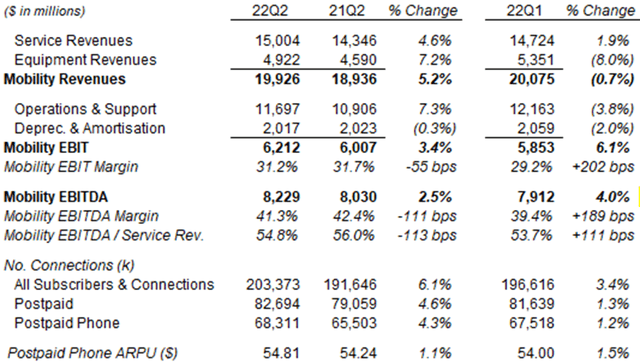

Mobility: Weak Pricing & Capital-Intensive

The Mobility segment reported a year-on-year EBITDA growth of 2.5%, or 3.8% excluding the $100m lower CAF II reimbursements this quarter.

Revenues grew 5.2% year-on-year, largely driven by subscriber growth. EBITDA Margin fell 1.1 ppt year-on-year to 41.3%. Despite record inflation, Postpaid Phone Average Revenue Per User (“ARPU”) only rose 1.1% year-on-year and 1.5% sequentially, attributed to customer upgrades and improved roaming. Pricing actions were taken in June, so the effects will not be felt until H2.

Mobility subscriber growth benefited from more than 300k of net adds from FirstNet. It was also likely to have benefited from the decision to frontload CapEx in H1 (with mid-band coverage reaching the 70m POPs originally targeted for year-end two quarters early) and continuing “success-based investments” (i.e., subsidies and incentives). The latter two factors were negative for AT&T’s cash flows as described above.

We continue to see Mobility as a commoditized business that will struggle in the face of macro headwinds.

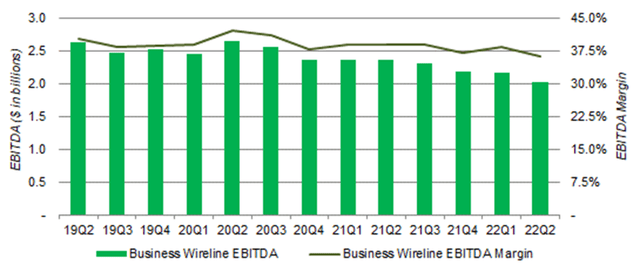

Business Wireline: Decline Re-accelerated

Business Wireline EBITDA fell 4.9% sequentially and was down 7.0% year-on-year in Q2, re-accelerating its decline (from a sequential fall of 1.6% in Q1):

Management attributed the decline in Q2 to continuing pressures on government sector spending and inflationary increases in wholesale network access charges (which AT&T seemed unable to pass on to customers).

Business Wireline EBITDA is now expected to decline by “low-double-digits” in 2022 (was “mid-single-digits”), and to stabilize only in H2 of 2024 (was “as we exit 2023 … to be stabilized into 2024”).

We continue to see Business Wireline as a structurally-challenged business with further profit declines.

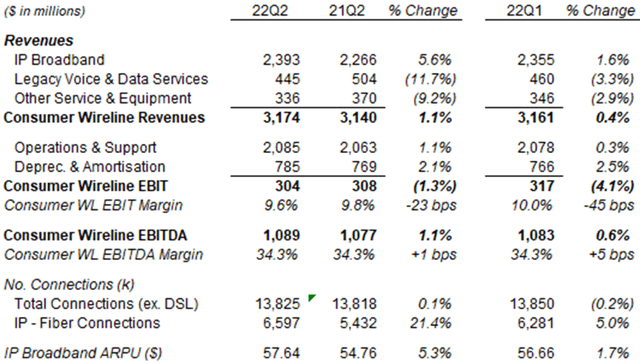

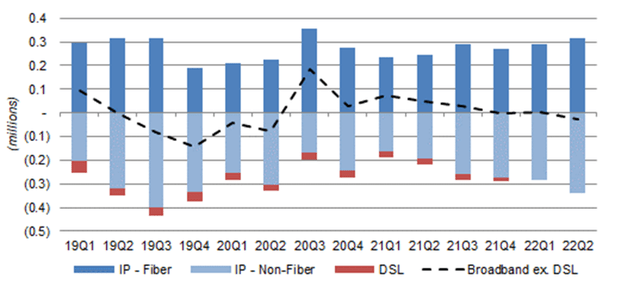

Consumer Wireline: 25k Broadband Net Loss

The Consumer Wireline segment reported year-on-year growth of 1.1% in revenues and 1.1% in EBITDA:

Revenue growth in IP Broadband was offset by declines in Legacy Voice & Data Services and other products. Within IP Broadband, AT&T’s total connections were flat (up 0.1%) year-on-year, despite a 21.4% increase in Fiber Connections, but ARPU growth was strong at 5.3%, “driven by a customer mix shift to fiber and recent broadband pricing actions”.

During Q2 2022, AT&T had a total broadband (excluding DSL) net loss of 25k subscribers, compared to net adds of 5k in Q1 and 28k in the prior-year quarter. Growth in fiber net adds was more than offset by rising non-fiber losses.

Total fiber locations reached 18.0m at the end of Q2, up from 16.2m at the start of the year. Despite the continuing fiber roll-out, AT&T’s total broadband net add (excluding DSL) has been worsening since Q1 2021.

We continue to expect Consumer Wireline EBITDA growth to remain modest in the future.

Cost “Savings” Still Being “Reinvested”

Management again claimed credit for progress in AT&T’s cost savings program but also acknowledged that gross savings achieved so far had been reinvested and so had not benefited earnings:

We have strong visibility on achieving more than $4 billion of our $6 billion transformation cost savings run rate target by the end of this year. As we shared before, we’ve initially reinvested these savings to fuel growth in our core connectivity businesses. However, as we enter the back half of this year, we expect these savings to start to contribute to the bottom line.”

John Stankey (AT&T CEO, Q2 2022 earnings call)

The promise of cost savings finally flowing to the bottom line in the “back half” of 2022 may also be at risk, given rising inflation. Current inflation has already pushed AT&T costs $1bn above original expectations for 2022.

AT&T Dividend Yield And Valuation

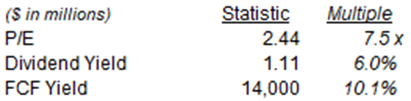

With shares at $18.38, relative to the mid-point of 2022 EPS guidance ($2.42-2.46), AT&T stock is trading at a 7.5x P/E; relative to the 2022 FCF outlook ($14bn), the FCF Yield is 10.2%:

|

AT&T Valuation Metrics (2022E)  AT&T company filings. |

The dividend is $0.2775 per quarter ($1.11 annualized), implying a Dividend Yield of 6.0%.

While these metrics appear superficially attractive, we believe they are outweighed by the risks from the long-term challenges in AT&T’s businesses.

Is AT&T Stock A Buy Now? Conclusion

AT&T shares have fallen more than 10% since Q2 results on Thursday, and are now at a 7.5x P/E and a 6.0% Dividend Yield.

Q2 results showed the poor quality of its businesses when facing macro challenges. EBITDA was flat and 2022 Free Cash Flow was cut.

Mobility had weak pricing despite high inflation, its EBITDA margin fell and its growth required large CapEx and working capital.

Business Wireline EBITDA is now expected to fall low-double-digits in 2022. Consumer Wireline lost 25k broadband subscribers in Q2.

With the stock at $18.38, while valuation appears superficially attractive, they are outweighed by AT&T’s structural challenges. Avoid.

AT&T’s risks outweigh its superficially cheap valuation, and we reiterate our Holding rating.

Source link