[ad_1]

Vladimir Zakharov

Investment Thesis

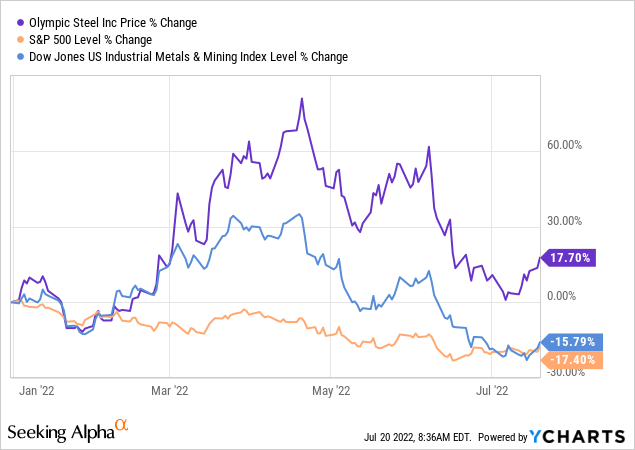

Olympic Steel, Inc. (NASDAQ:ZEUS) has been expanding its operations aggressively by acquiring companies closely related to its business segments. Its revenue has increased in the past year due to the commodity super-cycle, but recently, Olympic Steel was challenged by falling metal prices, devaluating its inventory. The stock’s price outpaced the S&P 500 and Dow Jones Industrial Metals & Mining index (DJUSIM) by well over 30%.

Even though Olympic Steel showed a strong positive correlation with metal price indexes during the metal boom, which started during the COVID-19 pandemic, the question of the hour is, will the company be able to sustain its growth and let its sail determine the direction rather than the direction of the wind?

Despite the company being a good buy under normal circumstances, I am neutral in the current recessionary environment until the commodity prices retreat to their normal levels by at least the year-end.

Company Overview

Olympic Steel, Inc., a small-cap public company with a market capitalization of $293.77M, is a metals service center engaged in metal processing and distribution across the USA. The company deals in three separate business segments;

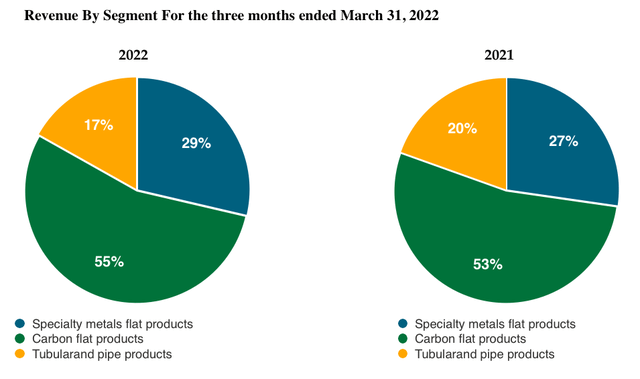

Specialty metals flat products and Flat carbon products: Both these segments are often consolidated because of the similar nature of resources utilized for these two segments, resulting in shared costs. According to the company’s annual reports, both segments’ products are stored in the shared facilities and, in some locations, processed on shared equipment. The carbon flat product and specialty metal segments generated the majority of the revenue for Olympic Steel, accounting for 55% & 29% of the revenue in the MRQ.

The carbon and specialty metals flat products segments combined have 33 strategically located processing and distribution facilities in the United States and one in Monterrey, Mexico.

The third segment of the company, Tubular pipe products, has 8 facilities and accounts for 16% of the MRQ revenue. The company is slowly diverting its focus toward the specialty metal products segment, clearly visible from the revenue YoY revenue figures, where the revenue of flat products increased. In contrast, the tubular and pipe products decreased.

Author

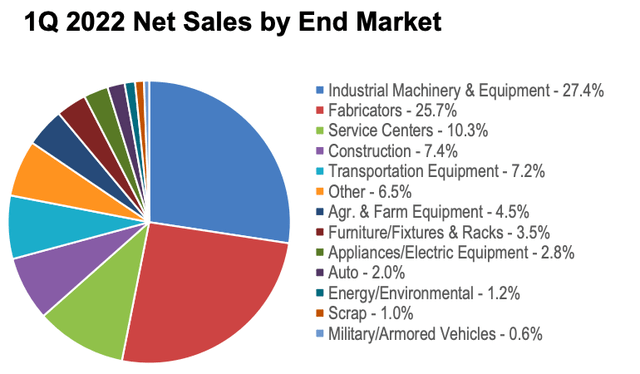

Company services are mostly availed by industrial machinery and equipment manufacturers, automobile manufacturers, fabricators, electrical equipment, and agricultural equipment manufacturers.

The company’s most important customers are industrial machinery and equipment manufacturers, which account for more than 27.4% of the net sales in the MRQ. Other relevant numbers are also given in the chart presented below.

ZEUS Investor Presentation May 2022

Sale of the Detroit Business Unit

In September 2021, Olympic Steel sold its Detroit business unit to Venture Steel Inc. for $58.4 million plus a working capital adjustment, estimated at $13.5 million, which was settled in early 2022. This signifies an improving cash flow from investing activities in their financial statements, which was reduced by more than 50% and totaled a loss of $13.5 Million at year-end 2021 from $28.1 Million in 2020.

The CEO, Richard T. Marabito, stated regarding this sale,

“We remain focused on our long-term strategy to further diversify our business, deliver consistent profitability and enhance shareholder value. The proceeds from the sale of the Detroit operations will be used to reduce debt, generating greater flexibility to pursue additional acquisitions and investments in organic growth initiatives and automation.”

ZEUS 2019 Annual Report

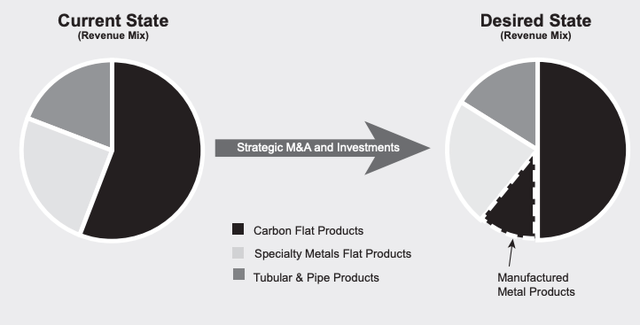

Olympic Steel has shifted its focus from carbon flat products to the specialty metal flat products segment for the past few years. It aims to integrate metal-intensive manufacturers into its business model by acquiring businesses in the same industry.

Detroit operations were focused on distributing carbon flat-rolled steel to domestic automotive manufacturers and their suppliers and were primarily included in the carbon flat-rolled segment. Olympic Steel reported that less than 3% of their sales were to automotive manufacturers or manufacturers of automotive components and parts after the sale.

Acquisitions

Right after Detroit’s carbon-centric operations sale, Olympic Steel used some of the sale proceeds to acquire another stainless steel and aluminum distribution business, Shaw Stainless Steel & Alloy, Inc., for $12.1 Million. In 2019, Olympic Steel also acquired Action Stainless & Alloys for $19.5 Million. Similarly, Olympic Steel acquired one of the largest North American service centers for processing and distribution of prime tin mill products and stainless steel strips in slit coil form, Berlin Metals, back in 2018.

Expansion through acquisitions for economies of scale and diversifying its portfolio has been the focus of Olympic Steel in the last five years, and it has acquired more than five companies, including four in the last 5 years. These horizontal acquisitions clearly show that Olympic Steel intends to focus on expanding and diversifying its portfolio and lessen the cyclicality in its existing business.

Olympic Steel Website

Demand in China has already hit this month, and we may see a trickle-down effect for US companies soon. According to CNBC, steel prices and its main ingredient, iron ore, were volatile during the Shanghai lockdown but headed on a downward trajectory earlier this month. Allied Market Research estimated the market for specialty metals to grow at 3.50% CAGR and reach $276 Billion by 2031. This kind of growth estimate seems conservative for a small market cap company like Olympic Steel Inc.

Most metals, mining, and materials industry stocks observed a surge in prices and may continue the momentum as far as the inflation numbers are reported to be higher than expected. Accordingly, ZEUS’s price movement hovered around $27 during the previous year, with a 52-week high of slightly over $43.

Investors are now looking to invest in resilient stocks in this sector, those which will be able to endure through tougher times if exposed to a riskier environment. Strong fundamentals with healthier balance sheets and backup liquidity for operations would be some of the key factors to look upon during tough market conditions because there are chances that the price momentum may not reflect the real situation of the company.

Risk-Reward Dynamic

The company reported an EPS of $3.10 in the MRQ, $0.84 higher than the estimated earnings, leading to a P/E multiple of 2.06x for the trailing twelve months. This P/E ratio is significantly better than its competitors, which averaged a multiple of 11.76x. Similarly, all major relative valuation metrics are significantly lower than its peers, with an average discount of all metrics at 70%, exhibiting an upside price potential for Olympic Steel.

Seeking Alpha

Additionally, In May 2022, BOD approved a regular quarterly dividend of $0.09 per share, which was paid on June 15, 2022, to shareholders of record as of June 1, 2022.

Similarly, the ROE of 35% and the ROTA of 13% signifies a better-than-industry use of resources at over double the industry median of 12.86% and 5.22%.

I expect the inventory valuation to come down during the third quarter of 2022 as the prices of metals have decreased drastically recently. The price and fundamental momentum are correlating until now. If the fundamentals remain strong, then significant returns, for a low market cap stock, in longer terms, would be an unbiased and logical opinion.

What Does The Future Hold For ZEUS?

One point of concern is that Olympic Steel has a considerably high debt to equity ratio of 73.41%, with most of the debt classified as secured long-term debt, even though it decreased from the previous year by 5.83% from $360 million to $339 million in the MRQ.

Olympic Steel entered into a $455 million loan agreement with Bank of America (BAC) in 2017, which is due in December 2022. A revolver agreement extended the maturity of its existing $475 million, five-year asset-based revolving credit facility through June 2026, primarily secured by the company’s accounts receivable, inventory, and property and equipment. The facility includes an increase option of up to $200 million.

As a company in a cyclical industry, Olympic Steel is more exposed to systemic risks. This high leverage has caused the company to have a higher beta of 1.51, resulting in even higher volatility.

The company’s capital structure needs to be in an equilibrium where the high debt of the company ideally needs to have a lower cost of capital, taking advantage of the cycle by locking in lower interest rates before the down cycle.

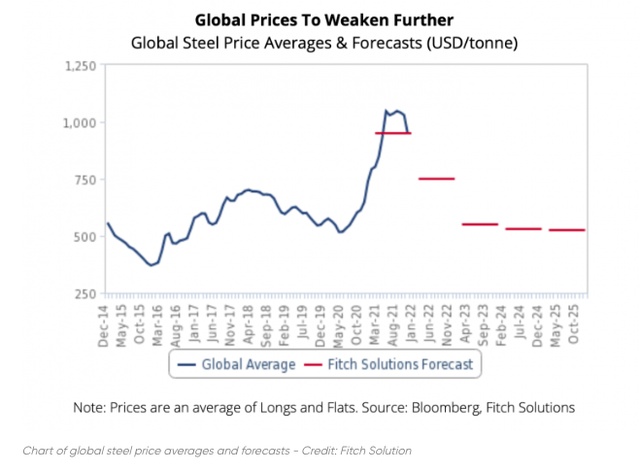

According to Fitch, world steel prices are forecasted to retreat in 2022 as the global price rally ends.

Fitch Solutions

Outside China, the US has significantly lagged behind its global peers in restarting capacity following Covid-19 disruptions and production cuts. In the future, Fitch expects more US supply to come back online and imports to improve over the coming months, gradually stabilizing US steel prices in 2022.

- Olympic Steel faces fluctuations in its inventory valuation as the company maintains the LIFO inventory method. These fluctuations are due to the cyclical nature of the industry as well as inflationary market conditions.

- The company has to carry sufficient inventory as most customers seek to purchase metals on shorter lead times and with more frequent and reliable deliveries.

- One red flag which needs to be addressed is the levered FCF of negative $133.15 Million. This is mainly attributable to slower payment of receivables, increased uncollectible receivables, and higher values of inventories due to higher inventory costs, indicating poor current assets management.

Conclusion

Olympic Steel has been pushing hard to expand its operations countrywide and abroad, but if the company wants a seat at the table with the big players in the coming years, it needs to expand its operations where the estimated CAGR is greater than that of specialty metals, i.e., 3.5%. Olympic Steel has a high leverage risk to increase shareholder value, which makes the investment in the company a high risk-reward scenario due to its relatively small market cap.

Given the company’s history, it has taken bold steps in acquiring and expanding its operations. But now it’s time for Olympic Steel to lower its debt and bring its capital structure to an optimal level where the volatility in revenues and profits gradually settles down with time, sustaining organic growth.

With the current market volatility and the cyclical nature of the industry in which Olympic Steel operates, we might observe a bumpy road ahead. The macro factors like higher inflation levels, COVID-related lockdowns in China, and recessionary pressures have increased market jitters, pushing me to rate the stock as a “hold” for Olympic Steel until things calm down and a little stability is observed.

Source link