[ad_1]

Scott Olson

Thesis

DraftKings Inc. (NASDAQ:DKNG) is scheduled to report its Q2 earnings release on August 5, as the market parses the updates to its guidance on its path to profitability.

DKNG has continued to be mired in a medium- and long-term downtrend since its Q1 card. We discussed in our previous article that DKNG is likely at a near-term bottom, given the steep sell-off from September 2021. However, DKNG has maintained its May lows, as the buying support held up resolutely.

Our valuation analysis suggests that its valuation is relatively well-balanced. However, it’s predicated on DraftKings executing well through FY26. Therefore, investors still have to consider execution risks that could impact its outlook over the next four years.

Notwithstanding, we believe the increasingly constructive price action on its long-term charts seems promising of a long-term bottom.

Accordingly, we reiterate our Buy rating, with a revised medium-term price target (PT) of $19, implying a potential upside of 48% at writing (as of July 15’s close).

DraftKings Needs To Demonstrate Improved Efficiencies

The recent macro headwinds have impacted companies that rely on consumer discretionary spending. However, CEO Jason Robins reiterated that the company had not observed any significant impact on its operating model at an early June conference. He articulated (edited):

We had always heard and research has shown that gaming, especially online gaming holds up very well during times when there’s economic distress. We’re seeing absolutely no evidence of any impact of any kind of economic downturn affecting discretionary consumer spending within our category and on our platform. (Goldman Sachs 2022 Travel and Leisure Conference)

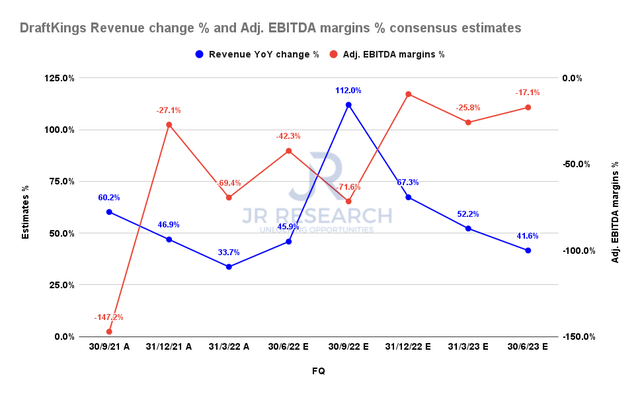

DraftKings revenue change % and adjusted EBITDA change % consensus estimates (S&P Cap IQ)

Notwithstanding, the consensus estimates (generally bullish) suggest that DraftKings’ revenue growth is projected to moderate through Q2’23, as seen above. However, it also expects DraftKings to continue gaining operating leverage rapidly, moving towards its path to profitability.

We believe that DraftKings’ lack of profits has been a critical factor driving the significant digestion in its stock since September. As the company also guided for adjusted EBITDA profitability only by Q4’23, investors must be prepared for tremendous volatility as the market parses its valuation.

However, Robins is confident that its increased ability to leverage national advertising could help drive the company markedly towards improving efficiencies. He accentuated (edited):

So one of the things that we’ve shared is that as you get to about 33%, 35% of the population with legal sports betting, there can be a shift towards national advertising, which will be more efficient because it’s at a lower cost per impression. You just need enough people out there that can actually react to those impressions to make the math work. So now that we’re kind of getting north of that, it should be a continued tailwind. We’ll still obviously heavy up locally in states when we launch, but you don’t need to do entire local plans the way it was before. (Goldman Sachs Conference)

DKNG – Long-Term Bottom Is Increasingly Likely

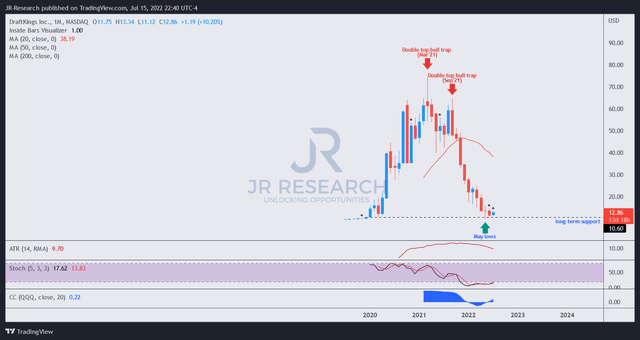

DKNG price chart (monthly) (TradingView)

As seen above, DKNG has continued to hold its May lows resiliently. If DKNG can continue to hold its May bottom, we believe that the price action suggesting a sustained bottom is constructive.

Notwithstanding, we don’t consider its May bottom a bear trap (a significant rejection of selling momentum). Therefore, we would prefer an extended consolidation zone on its long-term chart to demonstrate potential accumulation by the market.

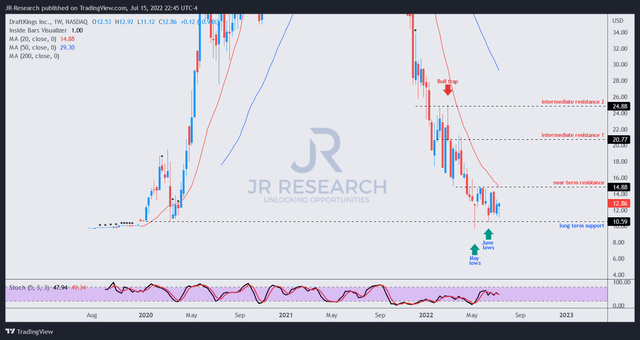

DKNG price chart (weekly) (TradingView)

Zooming into its weekly chart, we can glean how the market absorbed further selling pressure in May and June. Interestingly, the market rejected further selling in June, which attempted to break below its May lows.

Hence, we urge investors to observe how July’s price action pans out. If DKNG can continue to grind out higher lows consistently or not break May lows, the consolidation is likely an accumulation phase.

DKNG Valuation Is More Well-Balanced

| Stock | DKNG |

| Current market cap | $5.62B |

| Hurdle rate [CAGR] | 25% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 2.5% |

| Assumed TTM FCF margin in CQ4’26 | 7% |

| Implied TTM revenue by CQ4’26 | $5.44B |

DKNG reverse cash flow valuation model. Data source: S&P Cap IQ, author

We applied a market-outperform hurdle rate of 25%, which is the minimum we require for speculative stocks. We also used an FCF yield of 2.5% to model its high-growth posture. Notably, DKNG last traded at an FY25 FCF yield of 3.74%. Notwithstanding, our model assumes that DraftKings can continue executing well and meet its profitability guidance.

As a result, we require DraftKings to post a TTM revenue of $5.44B by CQ4’26. Therefore, we believe its current valuation is relatively well-balanced. However, investors can consider entering closer to its long-term support ($10.6) to improve their potential for outperformance.

Is DKNG Stock A Buy, Sell, Or Hold?

We reiterate our Buy rating on DKNG with a revised PT of $19. It implies a potential upside of 48% (as of July 15’s close).

However, we need DraftKings to demonstrate that its business model can continue to hold up in a potential recession while continuing to make progress on its path to profitability.

Our valuation model shows that DKNG valuation is quite well-balanced. Furthermore, our price action analysis indicates that DKNG is likely at a long-term bottom and holding its May lows well.

Source link