[ad_1]

oatawa

Investment thesis

I believe that Braze (NASDAQ:BRZE) has a strong product that is liked by experts and clients, mainly for its ease of use and price. However, I am not a big fan of the high valuation multiples of Braze.

In this article I will describe:

• An introduction of Braze

• Historical performance

• Factors influencing future performance

• Comparison of valuation and other stats

• Conclusion

Introducing Braze

Braze was co-founded in 2011 by Bill Magnuson, Jon Hyman, and Mark Ghermezian and went public in 2021. It has a market capitalization of 4 billion USD. Braze is a customer engagement platform provider that facilitates customer-centric interactions between customers and brands.

Its platform enables companies to listen to their customers, understand them, and act on that knowledge in a human and personalized manner. Brands use the Company’s platform to ingest and process real-time consumer data, coordinate, and optimize contextually relevant, cross-channel marketing campaigns, and continually update their customer engagement strategies.

Its platform allows active people to engage with it through its customers’ applications, websites, and other digital interfaces. Its platform includes features needed for modern consumer engagement, including as data intake, categorization, orchestration, personalization, and action.

Below are some examples of user cases:

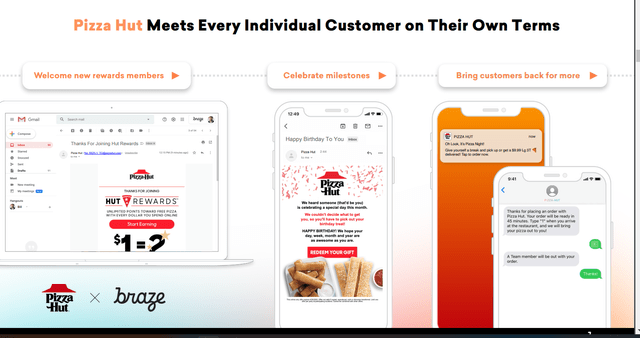

Pizza Hut user case (Latest Investor Presentation)

HBO Max user case (Latest Investor Presentation)

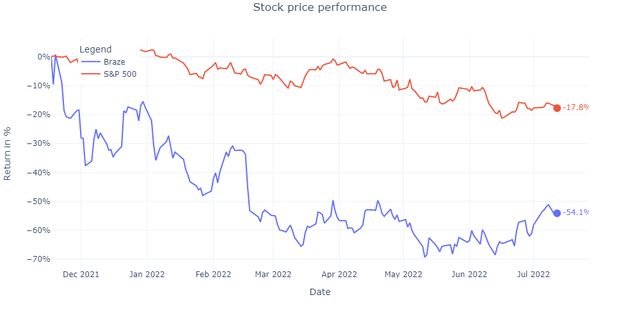

Their stock has struggled since its IPO. However, it did bounce back a little bit in the last month:

Stock price performance (Prices from Yahoo Finance)

Historical Performance

Growth rates (year-over-year)

|

Jan-21 |

Jan-22 |

Last 4 Quarters | |

| Revenues | 55.9% | 58.5% | 61.2% |

| Gross Profit | 57.7% | 66.7% | 67.2% |

Source: Seeking Alpha

Margins (% of revenue)

|

Jan-20 |

Jan-21 |

Jan-22 |

Last 4 Quarters |

|

| Gross Profit | 63.0% | 63.7% | 67.0% | 66.8% |

| Selling General & Admin Expenses | 77.7% | 65.6% | 75.0% | 80.3% |

| R&D Expenses | 21.1% | 19.4% | 24.8% | 25.7% |

| Net Income | -33.0% | -21.1% | -32.2% | -38.5% |

| Free Cash Flow Margin | -10.3% | -6.9% | -16.7% | -15.1% |

Source: Seeking Alpha

Noticeable is the astonishing growth rates that Braze managed to achieve. Furthermore, gross margin increased over time. Due to high SG&A and R&D expenses, net income and free cash flows are negative, which quite common for a high-growth company.

The increase in revenue is partly a result of an increased customer base as they had 1,119 consumers as of July 31, 2021, up from 890 customers on January 31, 2021 and 728 customers on January 31, 2020, according to its latest annual report.

Furthermore, when its clients add new channels, acquire more subscription products like Braze Currents, adopt new engagement strategies, or enroll new business units and geographies, they expand its reach inside current customers. They also expand in tandem with its clients because its pricing is heavily influenced by the number of consumers reached and the amount of communications sent. As a result, as their clients grow their usage of our platform and the number of end users reached through it, the value of the contracts with them rises.

Their ability to grow revenue within existing customers base is evidenced by its dollar-based net retention rate (recurring revenue retained from existing customers), which was 125 percent, 123 percent, and 126 percent, respectively, for all their customers for the trailing 12 months ended July 31, 2021, January 31, 2021.

Factors influencing future performance

Highly rated product, great place to work, strong customer base

Braze scores a 4.6 out of 5 on G2.com, a 4.4 out of 5 on Gartner.com and 4.6 on Capterra.com. Users especially compliment its ease of use, reliability and new effective features being implemented. One user commented:

Braze has all the functionality I need to maximize the performance and retention of users within my app. It allows me to easily create campaigns and flows that seamlessly switch between multiple channels liks email, SMS, in-app messages, and push notifications. The new user-friendly features like the drag & drop email builder make campaign creation easier than ever before.

Furthermore, Braze was named a leader in Gartner Magic Quadrant for Mobile Marketing Platforms for a second year in a row in 2019. Forbes selected the firm to its Cloud 100 list once more in 2021. Braze was also named a leader in the 2021 Forrester CCCM Wave.

Due to these awards and reviews, I conclude that Braze products are very much liked by its users and industry experts. This is in line with their revenue growth explained in the previous section.

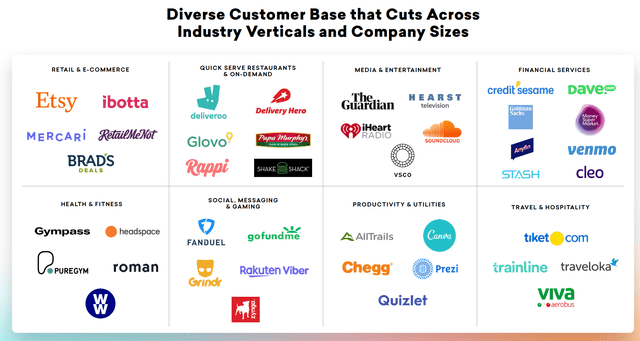

Despite Braze being in the earlier phases of a company, as a result of its product effectiveness, they managed to acquire some respectable clients across industries and company sizes:

Braze Client Base (Braze Latest Investor Presentation)

Next to being liked by its clients, the company is liked by their employees as well. Braze has been ranked #1 on Fortune’s Best Small and Medium Workplaces in New York in 2022. I always like seeing these titles as I believe it will be easier to attract and contain talent tech workers to keep improving its products.

Market opportunity

As more and more customers prioritize customer experience, I believe that the customer experience market will grow at robust rate. The global customer experience management market is projected to grow from $11.34 billion in 2022 to $ 32.53 billion in 2029 at a CAGR of 16.2%

Furthermore, New Data from Twilio Segment states that sixty-nine percent of consumers demand a personalized and consistent customer experience across different physical and digital channels. However, few firms have both the technological and organizational tools to provide a consistent, tailored omnichannel experience. The products of Braze offer the solution to this due to its effectiveness of its platform described previously.

In conclusion, I believe that market opportunity is huge.

Fierce competition

The market for customer engagement goods is changing and becoming increasingly competitive. Several existing and new rivals focus on various areas of consumer involvement. Braze faces stiff competition from marketing software businesses like as Adobe and Salesforce, as well as point solutions such as Airship, Iterable, Leanplum, MailChimp, and MoEngage. Many of its existing competitors have, and may have in the future, significant competitive advantages, such as greater brand recognition, longer operating histories, larger sales and marketing budgets and resources, greater customer support resources, lower labor and development costs, larger and more mature intellectual property portfolios, and significantly greater financial, technical, and other resources than they do.

It is claimed that Salesforce offers more advanced reporting and customer analytics than Braze does. This is in line with the bigger budgets and established products described above. The same source claims that in terms of ease of use, Braze wins due to its streamlined features and is cheaper. Braze scores a bit higher than Salesforce on Gartner. Many alternative products score relatively good as well on G2.

Overall, even though I believe Braze is a very effective and wanted product in customer engagement market, there are many other, some very established and big, companies competing.

Comparison of valuation and other stats

I compared several statistics of Braze to Salesforce (NYSE: CRM) and Twilio (NYSE: TWLO), two players that engage in the customer engagement market:

| PS ratio | Gross margin | Price to Gross Profit | Profit margin | Market Cap (Billion USD) | Revenue Growth (3Y) | |

| Braze | 14.8 | 67.2% | 22.0 | -32.2% | 4.0 | 57.2% |

| Salesforce | 6.2 | 73.0% | 8.5 | 3.6% | 165.0 | 25.9% |

| Twilio | 5.7 | 48.9% | 11.7 | -33.4% | 15.2 | 63.5% |

Source: Seeking Alpha

It can be observed that Braze is expensively price compared to its peers, looking at the Price to Gross Profit valuation ratio. As Braze does have a much smaller market cap compared to the similar companies, a great product and high historical growth rate, I do believe it is set for high growth in the future, which would justify a higher valuation multiple. Nevertheless, I do believe the valuation of Braze might be out of proportion, as its almost twice the valuation of Twilio, which posted high revenue growth rates as well. While Salesforce revenue growth is much lower, it has proven to be profitable already. Furthermore, the fierce competition could hinder sustaining the high growth rate of Braze.

Conclusion

I believe that Braze has a strong product that is liked by experts and clients, mainly for its ease of use and attractive pricing. Because it’s claimed to be a great place to work, I believe it will be able to attract talented tech workers which could further help the development of its products. Customers have complimented the effectiveness of new features. On the other hand, there are other bigger companies that provide more advanced features. Overall, the competition seems to be fierce, which could potentially hinder future growth. Nevertheless, with its proven sales success and attractive market opportunity, I do believe the company will grow its sales at a high rate.

However, I am not a big fan of the high valuation multiples of Braze. While I do take into account its high(er) growth rate, I don’t believe it should be almost twice as expensive as Twilio and more than two times expensive as Salesforce. When the valuation multiple drops a bit compared to similar companies, I am willing to take another look at Braze as a buying opportunity.

Source link