[ad_1]

Justin Sullivan/Getty Images News

Introduction

We are initiating our coverage of News Corp (NASDAQ:NWSA) with a Buy rating and an expectation of a 20-30% upside.

News Corp. is a NASDAQ-listed media conglomerate with a market capitalization of $9.2bn. Shares have fallen more than 40% since their peak in March 2021, and are now at their lowest since November 2020:

|

News Corp Class A Share Price (Last 5 Years)  Source: Google Finance (05-Jul-22). |

(News Corp has two classes of shares, Class A and Class B (NASDAQ:NWS), with both having the same economic rights but only Class B having voting rights in most situations. We prefer Class A for being slightly cheaper.)

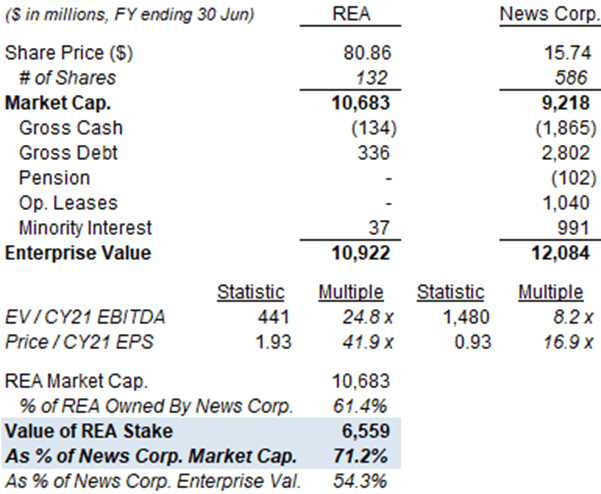

The best risk/reward is available from going long News Corp and short REA Group (OTC:RPGRY), a listed Australian company in which News Corp holds a 61.4% stake. The stake is worth $6.6bn, equivalent to 71% of News Corp’s current market capitalization, which means the rest of News Corp is too cheap at a double-digit Free Cash Flow Yield.

Long-only investors can also profit by holding News Corp shares outright. News Corp has a number of high-quality assets and should be able to grow its EPS at mid-to-high single-digits over time. Shares are trading at a P/E of 15.7x, which we believe is 20-30% too low. Share buybacks should help generate a high-single-digit EPS growth and the Dividend Yield is 2.6%, generating a low-teens annualized return even if valuation changes do not materialize.

Company Overview

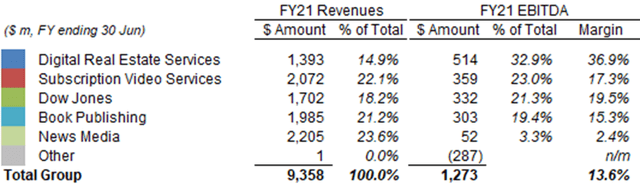

News Corp. is a media conglomerate with interests in property listings, print and television. The company operates primarily in the U.S., Australia and the U.K., and reports in five main segments:

|

News Corp Revenues & EBITDA by Segment (FY21)  Source: News Corp company filings. |

- Digital Real Estate Services – property listings websites in Australia, the U.S. and parts of Southeast Asia

- Subscription Video Services – pay TV and video streaming in Australia, including the Foxtel Group

- Dow Jones – consumer publications and professional information products, including The Wall Street Journal

- Book Publishing – primarily the consumer publisher HarperCollins, with more than 120 branded imprints

- News Media – newspapers in Australia, the U.K. and the U.S., as well as a U.K. radio network business

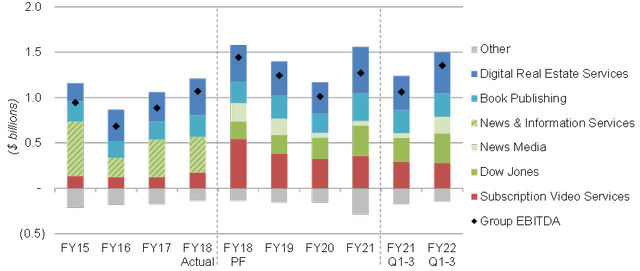

Advertising was as much as 27% of group revenues before COVID-19. Because of this, as well as currency and acquisitions/disposals, News Corp’s EBITDA can be volatile, though it has been rebounding strong since FY21:

|

News Corp EBITDA by Segment (Since FY15)  Source: News Corp company filings. NB. FY ends 30 Jun. Figures include impact of currency and acquisitions/disposals. |

Many of News Corp’s segments are in entirely separate sectors and have little synergies with each other. This has likely created a conglomerate discount in its valuation and also a pair trade opportunity.

Long News Corp, Short REA

The pair trade opportunity is to go long News Corp and short REA.

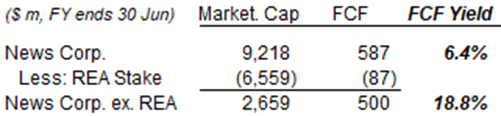

The main asset in the Digital Real Estate Services segment is a 61.4% stake in listed Australian property listings company REA Group. REA currently has a market capitalization of $10.7bn, larger than that of News Corp, and the implied value of the stake is equivalent to 71% of News Corp’s current market capitalization:

|

Valuation – News Corp vs. REA  Source: Company filings. |

Excluding REA’s implied value and contribution, News Corp has a market capitalization of just $2.6bn and a Last-Twelve-Month (“LTM”) (ending March 31, 2022) Free Cash Flow (“FCF”) of $500m, which implies a FCF Yield of 19%:

|

FCF & FCF Yield – News Corp vs. REA  Source: Company filings. NB. Figures are LTM as of 31-Mar-22. |

This “News Corp ex. REA” FCF Yield is far too high and should eventually shrink. If the FCF Yield were to shrink by 50% to 9.4%, then the value of “News Corp ex. REA” even if FCF remains unchanged.

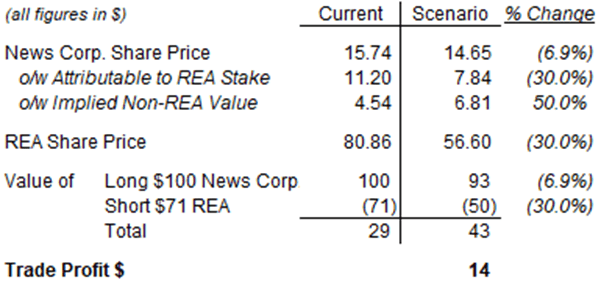

Investors can benefit from this by going long News Corp and short REA. The actual ratio to be used depends on subjective judgment, but each News Corp share owns 0.1385 REA shares indirectly, which implies a dollar ratio of 100:71. We look at an example where we buy $100 of News Corp and sell short $71 of REA below:

|

Example Long News Corp / Short REA Trade  Source: Librarian Capital estimates. |

In this example, suppose REA’s share price were to fall by 30% while the theoretical value of the non-REA part of News Corp were to increase by 50%. These should translate into a 7% decline in the theoretical value of each News Corp share, which means we would lose $7 on the long side but gain $21 on the short side, resulting in a net profit of $14 from the trade. This would represent an upside of 49% from the original $29 net exposure.

Upside of 20-30% can be achieved with smaller changes in the “News Corp ex. REA” FCF Yield.

Owning News Corp Shares Outright

Long-only investors can also profit by holding News Corp shares outright

News Corp has a mix of assets, some of which are high-quality while others are more mediocre. We believe overall EBIT can grow at mid-to-high single-digits annually on average, based on:

- Digital Real Estate Services – EBIT growth at 10%+

- Subscription Video Services – EBIT decline of 2-3%

- Dow Jones – EBIT growth at 10%+

- Book Publishing – EBIT growth at 3-4%

- News Media – EBIT growth at 4-6%

Our assumptions are based on each segment’s track record, outlined below.

Digital Real Estate Services Segment

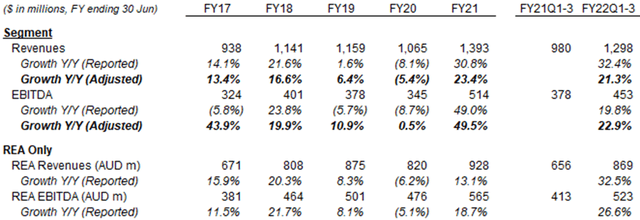

Digital Real Estate Services is a strong business capable of growing EBITDA at 10%+ annually in our view.

The segment’s main asset is a 61.4% stake in REA Group, a listed property listings company in Australia; it also owns an 80% stake in Move, a similar business in the U.S. that competes with Zillow. (REA owns the other 20% of Move, as well as stakes in certain property listing businesses in Southeast Asia.)

The segment generates revenues from listings, advertising, referrals and related financial products such as mortgages. Segment revenues and EBITDA have been growing strongly, helped by acquisitions, though they did fall significantly in FY20 due to the impact of COVID-19 on listing and project volumes, currency as well as a transition to a referral model in the U.S.; REA-only revenues (in AUD) show a similar pattern:

|

Segment Revenues & EBIT – Digital Real Estate Services  Source: News Corp & REA company filings. |

We expect strong revenue and EBITDA growth to continue in this segment, though a downturn in the Australian property market may create some temporary negative headwinds.

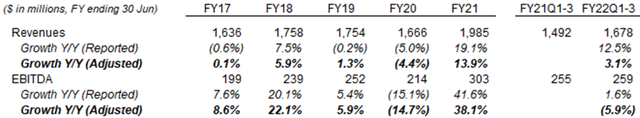

Subscription Video Services Segment

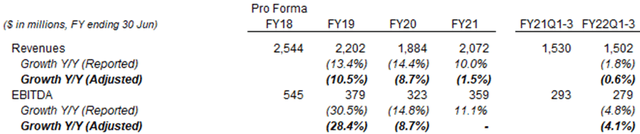

Subscription Video Services is structurally challenged, but EBITDA declines are likely limited to 2-3% annually.

The segment includes News Corp’s 65% stake in Foxtel Group (the other 35% is held by Telstra (OTCPK:TLSYY)) and the wholly-owned Australia News Channel. It is mostly a traditional pay TV business, more recently augmented several new streaming services. Revenues and EBITDA have been falling for several years, as the traditional pay TV subscriber base continues to shrink. The decline decelerated in FY19-21 but picked up again in FY22 year-to-date:

|

Segment Revenues & EBIT – Subscription Video Services  Source: News Corp company filings. |

We expect further subscriber and revenue declines, mitigated by continuing cost control, resulting in small EBITDA declines.

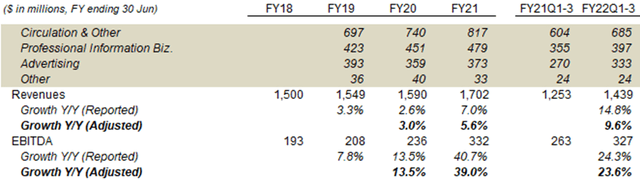

Dow Jones Segment

Dow Jones is a strong business capable of growing EBITDA at 10%+ annually in our view.

The segment includes both consumer publications such as The Wall Street Journal and Barron’s and professional information products such as Dow Jones Risk & Compliance and Factiva. In 2022, the segment entered the commodities information market by acquiring OPIS for $1.15bn and Base Chemicals for $295m from S&P Global (SPGI).

The segment has been growing its Circulation & Other and Professional Information Business revenues steadily, helped by acquisitions. Circulation revenue growth has been driven by an expanding subscriber base, with a 48% increase in total subscribers between Q4 FY19 and Q3 FY22. Advertising was 21% of segment revenues in FY21, having declined during the pandemic. EBITDA will likely have doubled from its FY18 level by the end of FY22:

|

Segment Revenues & EBIT – Dow Jones  Source: News Corp company filings. |

We expect strong growth in circulation and professional information revenues to continue to drive EBITDA growth.

Book Publishing Segment

Book Publishing is a mediocre business likely to see EBITDA growth limited to 3-4% annually in our view.

The segment consists primarily of HarperCollins, the #2 consumer publisher globally. In FY21, it generated 96% of its revenues from consumers, and only 22% of these revenues are digital sales. Consumer print publishing faces poor secular demand trends and Amazon’s pricing power.

EBITDA has been range-bound through FY18-20; FY21 was helped by a boost in demand from COVID lockdowns, hits including the Bridgerton series as well as two acquisitions; FY22 year-to-date saw EBITDA decline again, as rising costs more than offset slightly higher revenues:

|

Segment Revenues & EBIT – Book Publishing  Source: News Corp company filings. |

The segment is likely stable due to its scale advantage, with earnings growing slightly faster than inflation.

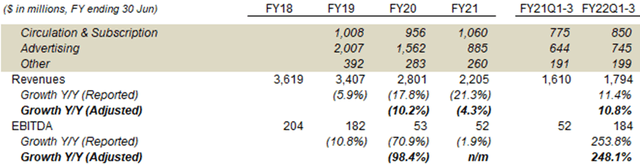

News Media Segment

News Media is a solid business capable of growing EBITDA at 4-6% annually in our view.

The segment consists of newspapers in Australia (including The Australian), the U.K. (including The Sun and The Times) and the U.S. (primarily New York Post). Advertising was 59% of segment revenues in FY19, but had shrunk substantially in FY20-21 due to the disposal of News American Marketing (a newspaper ad and in-store coupon business) and COVID-19. These led to a collapse in EBITDA from $204m in FY18 to $52m in FY21:

|

Segment Revenues & EBIT – News Media  Source: News Corp company filings. |

However, Circulation & Subscription revenues were relatively resilient through FY19-21, and has risen substantially in FY22 year-to-date. Total circulation has been rising at the segment’s marquee papers, and revenues have also started to benefit materially from content payments from Alphabet (GOOG) and Meta Platforms’ (META) in Australia in FY22, as mandated by new legislation passed in February 2021.

Details on the agreements with Alphabet and Meta have not been disclosed, but the payments to News Corp have been described as “clearly into nine figures” and mostly paid to the Dow Jones and News Media segments. We expect News Media to be by far the bigger beneficiary, due to its portfolio of Australian newspapers.

We expect the segment to generate steady EBITDA growth, helped by growing circulation and content payments.

News Corp Valuation

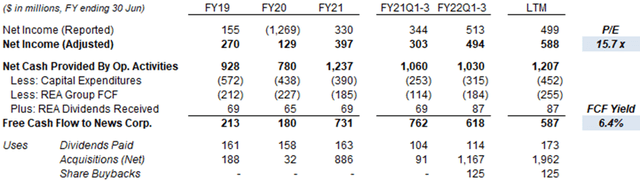

At $15.63, relative to LTM earnings, News Corp shares are trading at a P/E of 15.7x and an FCF Yield of 6.4%:

|

News Corp Earnings, Cashflows & Valuation (Since FY19)  Source: Google Finance, company filings & Librarian Capital estimates. |

The Dividend Yield is 2.5%, from a quarterly dividend of $0.10 per share ($0.40 annualized).

The company has announced an $1bn share repurchase in September 2021, and $873m remained outstanding as of the end of March, equivalent to 9.5% of the current market capitalization. We expect buybacks to reduce the share count by a low single digit each year.

News Corp Conglomerate Discount

News Corp’s mix of businesses of varying quality and in separate sectors has resulted in a conglomerate discount.

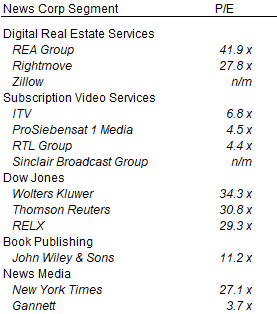

Some of News Corp’s segments are high-quality businesses whose peers trade at high P/E multiples:

|

Peer P/E Multiples for News Corp Segments  Source: Google Finance, company filings & Librarian Capital estimates. |

The Digital Real Estate Services is comparable to U.K. property portal Rightmove (OTCPK:RTMVY), which has a 28x P/E, while Dow Jones is comparable to professional information companies such as Wolters Kluwer (OTCPK:WTKWY) and Thomson Reuters (TRI), which have P/E multiples approximately in the 30-35x range

Subscription Video Services is a poor business with few direct comparables, but European TV broadcasters currently have mid-single-digit P/E multiples. Book Publishing’s closest peer is John Wiley (WLY), which has a 11x P/E. The News Media segment is closer to the New York Times (NYT) (27x P/E) than Gannett (GCI) (4x) P/E in our view.

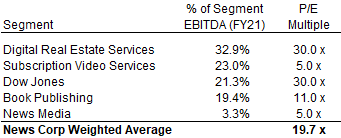

We list what we believe to be fair P/E multiples for each segment below:

|

News Corp Assumed P/E Multiples by Segment  Source: Librarian Capital estimates. |

Their weighted average gives a blended P/E of approximately 20x for News Corp, compared with the current 15.7x. Should the P/E move towards 20x, the re-rating would generate an upside of 20-30% from the current share price.

Discount Can Be Unlocked But Will Take Time

This conglomerate discount can be unlocked by further corporate actions, some of which have begun.

As described above, the REA stake in Digital Real Estate Services has a visible valuation from public markets each day (REA has been listed since 1999), but the discount for the rest of News Corp remains substantial. Management can remedy this by distributing REA shares to shareholders.

Management can also simplify News Corp by selling off lower-quality segments. Subscription Video Services had started to prepare for an IPO for Foxtel, its main asset, in late 2021; however, the process was reportedly suspended in April 2022 due to market volatility. Book Publishing is another segment that is a drag on valuation and should be sold.

Valuation discounts can also be narrowed by buybacks. The $1bn new share buyback program announced in September 2021 is still in its early stages, with just $127m repurchases by the end of March.

Corporate Governance Risks

Corporate governance is a risk as family control may prevent corporate actions needed to unlock News Corp’s valuation discount.

The Murdoch family effectively controls the company, despite owning just 13.9% of all shares. This is because the family controls 39.4% of the voting Class B shares (but just 1% of the non-voting Class A shares). Rupert Murdoch is the executive chairman and his son Lachlan Murdoch is the co-chairman.

Is News Corp A Buy? Conclusion

We believe investors can expect a 20-30% upside in News Corp shares by one of the following:

- Long News Corp, short REA to gain exposure to the undervalued non-REA part of the business

- Own News Corp shares outright, and benefit from a potential 20-30% upward re-rating in its P/E

Should valuation changes fail to materialize, we believe News Corp shares would generate a low-teens annualized return over time, leading to the same 20-30% upside after a few years. The low-teens annualized return would represent the sum of a high-single-digit EPS growth (from EBIT growing at mid-to-high single-digits and buybacks reducing the share count by a low-single-digit each year) and the current 2.6% Dividend Yield.

We initiate a Buy rating on New Corp. stock.

Source link