[ad_1]

Kevin Frayer/Getty Images News

In this article, I analyze Baidu’s (NASDAQ:BIDU) business segments separately, including ad business, cloud business, autonomous driving business, and iQIYI. I also discuss why Baidu’s brand image is improving, what keeps the stock price low, and what the valuation should be.

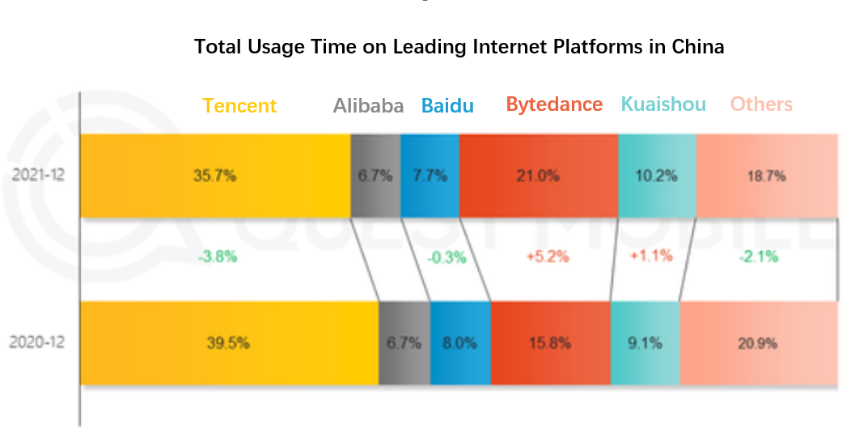

Core Ad Business – Stable And Not Much To Worry about

Over the past three years, short video platforms (such as Douyin and Kuaishou) have captured a significant portion of users’ time and took part of Baidu and Tencent’s (OTCPK:TCEHY) advertising business. However, the recent trends show that the short video platforms’ growth is starting to decelerate. According to the most recent statistics published by QuestMobile, total usage time for Bytedance (including Douyin) increased from 12% to 21% of the total population, and Kuaishou increased from 4.4% to 10.2% from September 2019 to December 2021. Social communication apps such as Tencent and other smaller players were hurt the most in usage time. However, we see usage time on Baidu Group (including iQIYI) stay relatively stable in recent years, and the 0.3% drop was mainly from iQIYI. Search engines are resilient in this competition as people’s search queries stay relatively stable.

Figure 1: Total Usage Time on Leading Internet Platforms in China

Questmobile

Questmobile

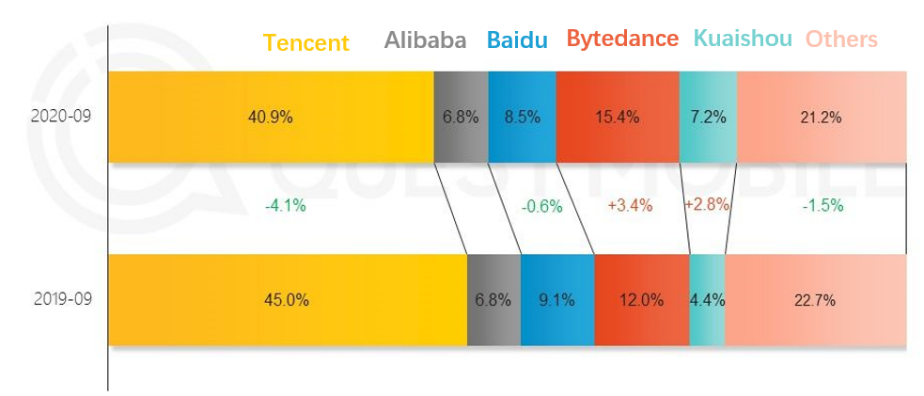

Baidu App MAU (not including iQIYI) grew at 13% YoY in the most recent quarter, which is much higher than the mobile user population growth of 2% YoY. Baidu App’s monthly active users figure currently ranks fifth, only behind WeChat (1b MAU), Douyin (670m MAU), Taobao (856m MAU), and Alipay (788m MAU), but it remains ahead of Kuaishou and Weibo in China.

Figure 2: Baidu’s MAU

Baidu Quarterly Reports

On the digital advertising revenue side, what Baidu is facing is similar to Google (GOOG) in the U.S. They both specialize in search ads and both target audiences who are already searching for certain product or service, which means they face less of a threat compared to publishers that target “cold” audiences using feed ads. For example, a hair transplant service provider can promote its business much better by placing search ads in a “hair transplant” keyword search compared with targeting broader audiences in other publishers. Despite the success of short video platforms, for certain types of products or services, search ads are always the best use of budget allocation.

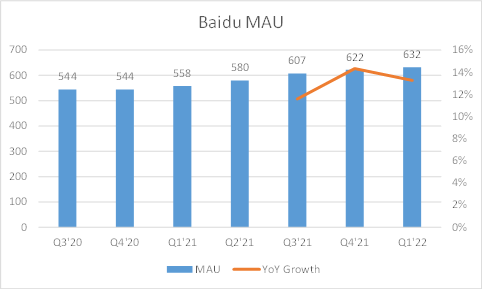

Search engine business comes with significant network effects, and its leading position is hard to break. Firstly, search engines require high cost in building the technology — natural language processing, image recognition, knowledge graphs, etc. — and it also takes years of collecting user query and user click data to optimize the algorithms. Secondly, this market difficulty can be demonstrated by the oligopolistic landscape in different countries. Google takes about 88% market share in the U.S., Yandex takes about 65% market share in Russia, Naver takes about 60% market share in Korea, Baidu takes 74% market share in China, and there are no obvious competitors to challenge this competitive landscape. Despite that, Bytedance launched its desktop search engine Toutiao Search in 2021. The search speed is about 30% slower than Baidu, does not provide as much information as Baidu, and is not used by the general public. Baidu’s search ad business is protected by a deep moat, and from the current growth, we only see the moat getting deeper.

Figure 3: Search Engine Market Share in China

StatCounter

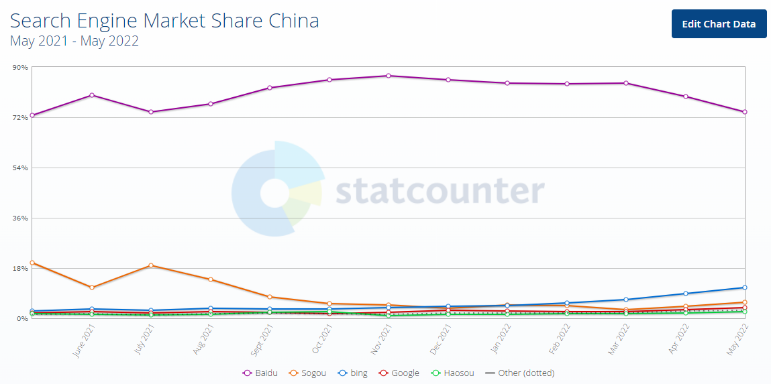

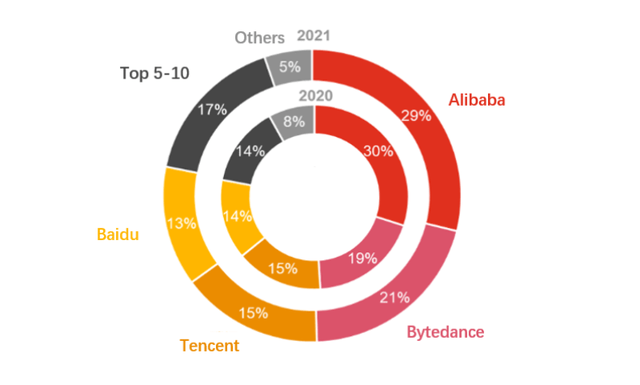

According to IMZ Lab, the digital advertising market share is getting more concentrated. Bytedance’s market share increased by 2%, and the top 5-10 players’ market share increased by 3%, primarily from Kuaishou and Meituan. Despite Douyin and Kuaishou taking the pie, Baidu still holds its market share relatively stable. In the most recent quarter, Baidu’s ad revenue only declined by 4% YoY, better than Tencent’s ad decline of 18% YoY, but still lower than Kuaishou’s ad growth of 30% YoY. Note that Kuaishou’s ad growth is decelerating and declined from 95% growth in 2021. Bytedance took part of Baidu and Tencent’s ad business, but today Bytedance’s ad revenue is already about twice that of Baidu, and 70% of its ad revenue is from Douyin. We see Bytedance’s impact has decelerated, and Baidu does not have much to worry about.

Figure 4: Digital Advertising Market Share in China

IMZ Lab

AI Cloud – Fast Growing Business with a Long Growth Runway

In the Baidu Q1’21 earnings call, its CEO Robin Li said,

“We’ve been investing in AI for more than 10 years, and in the next three years, Baidu’s non-ad business revenue could possibly exceed 50% of Baidu core revenue”.

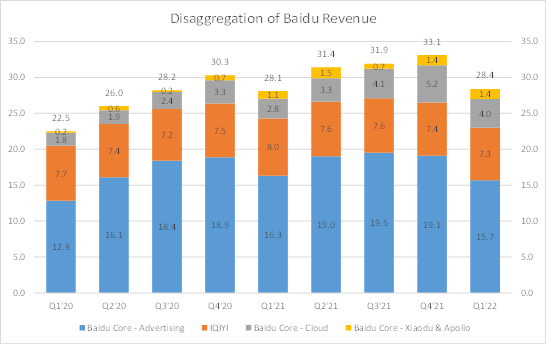

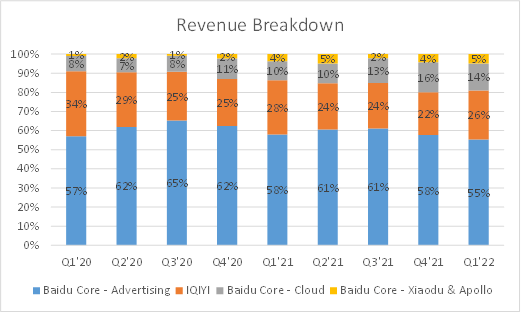

If achieved, Baidu will be valued by a much higher multiple. In the most recent quarter, the non-ad core business revenue is Rmb 5.7b, including Rmb 4b of Cloud and Rmb 1.7b of Xiaodu (DuerOS) & Apollo combined. Currently, Baidu Cloud is growing at 45% YoY, much higher than Alibaba Cloud’s (BABA) growth of 12%. If Baidu Cloud revenue keeps growing at 46% YoY over the next three years, it could make up 28% of the total non-ad core business in 2024. The revenue forecast toward the end of this article shows this is highly achievable.

Figure 5: Disaggregation of Baidu Revenue (in billions RMB)

Baidu Quarterly Reports

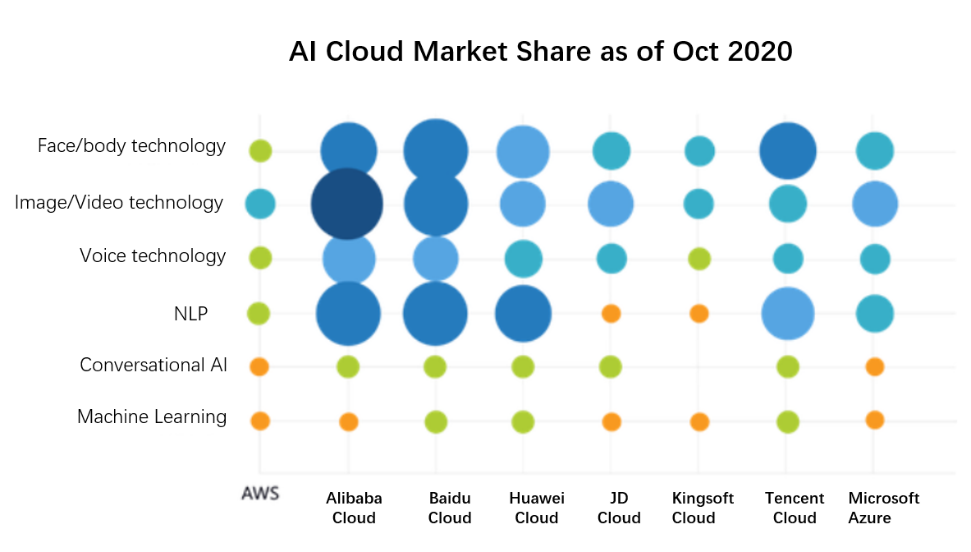

Baidu Cloud generated Rmb 9.3b revenue in 2020, or 16% of BABA’s cloud revenue in the same period. The ratio further increased to 21% in Q1’22 as Baidu Cloud’s growth accelerated (+48% YoY in Q1’22). Baidu Cloud is more focused on PaaS and SaaS, which take >50% of the total cloud revenue, while others would only have 30% total cloud revenue from PaaS or SaaS. Baidu Cloud specializes in AI, and according to IDC, Baidu Cloud is the largest player in China’s AI cloud market with a 33% market share in 2020. Despite the AI cloud market still being relatively small (RMB 18.7b in 2020, 15% of the total public cloud market), it is expected to grow faster (43% vs. 35% ’20-’25 CAGR) due to strong demand from various industries. IDC classifies six specific categories of AI cloud, including video and image recognition technology, NLP (natural language processing), conversational AI, voice recognition technology, face & body recognition technology, and machine learning. Baidu tops the specific categories of NLP, image technology, and face & body recognition technology. This success follows through to Baidu’s edge in the NLP and image recognition technology in the search engine business.

Figure 6: AI Cloud Market Share

Source: IDC

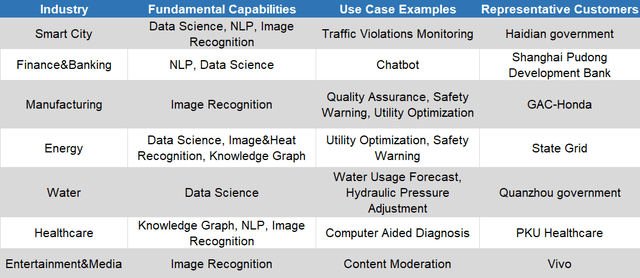

Baidu Cloud’s fundamental AI capabilities — NLP, image recognition, knowledge graph, etc., are highly transferrable, and thus can be implemented in various industries. Below is a brief summary of what Baidu AI Cloud can do in different industries. Looking into the use cases, we find Baidu AI Cloud is replacing some low-skill labor, such as defects inspectors (manufacturing), customer service specialists (banking), content moderators (media), etc. What can be expected is that AI capabilities have a long runway to become smarter and more influential in human lives. Three examples of what AI can do better than humans are shown below.

Table 1: Baidu AI Cloud Use Cases

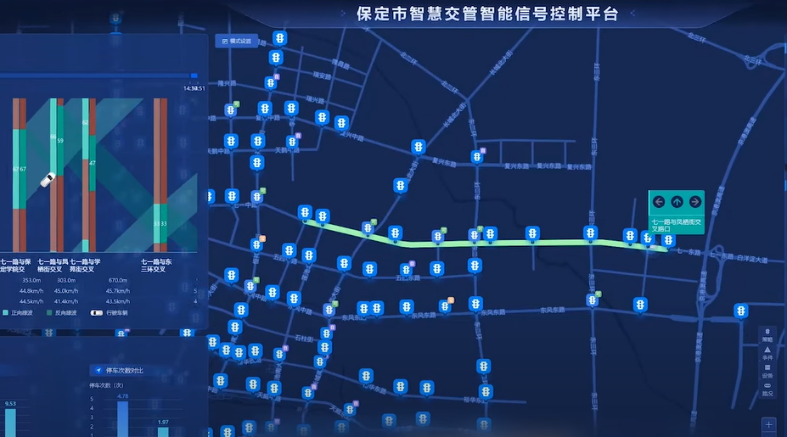

- AI Cloud Use Case Example #1: Baoding, a city of two million people, is one of the cities that adopted Baidu’s smart traffic (transportation cloud) system. The city first implemented the system in 2019, and the coverage has expanded to 176 intersections in the urban areas. It detects the traffic volume on each road through camera technology and adjusts traffic lights accordingly based on its algorithm. After implementing it, city drivers encounter more green lights and fewer red lights. The overall travel time is cut by 20%, and the average speed increases by 6.5km/h.

Figure 7: Baidu’s Smart Transportation Cloud Control Panel

Baidu YouTube

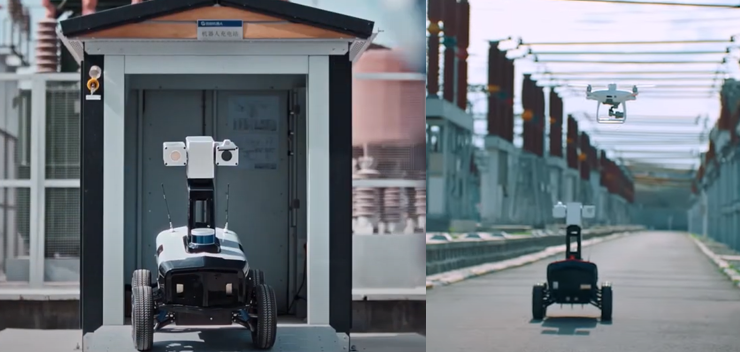

- AI Cloud Use Case Example #2: Baidu Kaiwu, its AI Cloud product targeting the manufacturing and energy fields, solves the problem of safety inspections at manufacturing sites using its smart inspector shown below. It can detect overheating problems on the grid with 95% accuracy. Baidu Kaiwu also claims that its smart energy usage optimization can save 1.55g/kWh in power plant coal usage and reduce carbon emission. Note that the current adoption rate of industrial internet platforms is low. Baidu’s Kaiwu currently serves 300 businesses in ~16 cities. China’s Fourteenth Five-Year Plan highly supports the development of digital transformation of industrial firms and targets to achieve a 45% adoption rate of the industry internet across the country by 2025. This government plan creates a long growth runway for Baidu Kaiwu for at least five years.

Figure 8: Baidu Kaiwu Smart Inspector

Source: Baidu YouTube

- AI Cloud Use Case Example #3: Baidu uses its visual recognition technology and its graphic-loaded visual AI models with zero code to perform the quality assurance checkups of Honda Odyssey’s car lights in one second. Its automated recognition accuracy is ~99%.

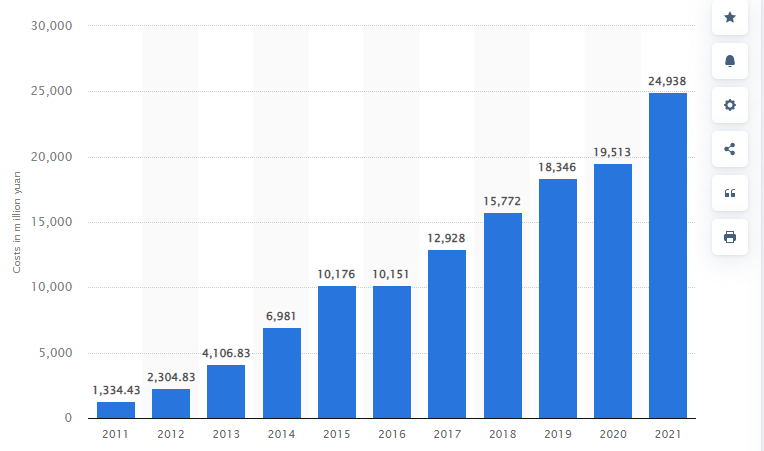

Baidu Apollo – A Clear Leader In China, And Its Robotaxi Could Monetize Faster Than Expected

Baidu did not disclose how much it has invested into autonomous driving, but since 2015, which is the year Baidu founded autonomous driving unit, Baidu cumulatively invested over $17b into R&D and $7b into CapEx (2015-2021). The majority of the R&D investment is thought to have gone into smart transportation and autonomous driving. Baidu’s cumulative investment in autonomous driving/smart transportation could exceed $10b. Looking across the world, the companies that invested this much into robotaxi business (Level 4+) are only Waymo (owned by Google) and Cruise (owned by GM), and these investment candidates are only a few in the global capital market. Both Waymo and Cruise are valued over $20b, while Baidu’s total market cap is only $50b.

Figure 9: Baidu R&D Expense(in millions RMB)

Source: Statistica

What does Baidu get out of this huge investment?

- It became one of seven companies to have driverless permits in California.

- It became one of the two companies to have commercialized driverless ride-hailing serving the public in Beijing/China.

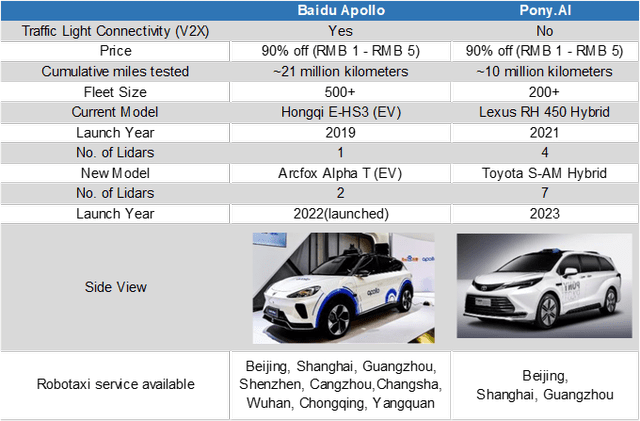

- It owns a fleet of ~500 robotaxis with cumulative testing miles of 21 million kilometers, while its closest competitor, Pony.AI, has a fleet of ~200 robotaxis and cumulative testing miles of 11 million kilometers. Baidu and Pony currently are the only two that can charge fees for robotaxi service in China. The current price is 90% cheaper than taxi fares, but they will definitely increase over time. In addition to the scale reached, Baidu also has the V2X technology that can link its robotaxis to the smart transportation cloud (ACE) product as well as autonomous driving solutions to OEMs that Pony.AI does not have.

Table 2: Baidu Apollo and Pony.AI Comparison

Source: Official websites

- Baidu Apollo Moon, the fifth generation of its robotaxi, has a cost of $72k, the lowest in China (Baidu claimed).

- One brand EV, Jidu, is about to be delivered in 2023 and looks more competitive than Xpeng.

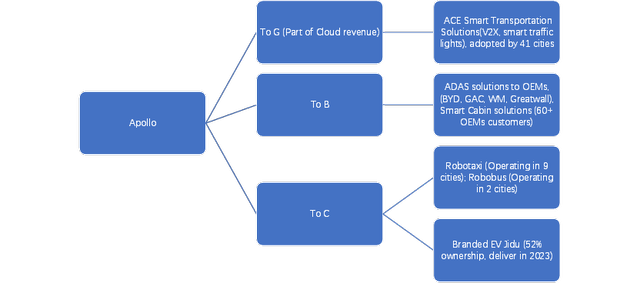

- Baidu is the only company in China that has four revenue sources: 1) Smart transportation products (to serve governments), 2) Autonomous driving solutions (to serve car manufacturers), which aim to compete with the autopilot function of Tesla, 3) Robotaxi (to serve end customers), and 4) Branded EV — Jidu

Figure 10: Three Revenue Source of Apollo

Source: Baidu Disclosures

- It is operating robotaxi services in nine cities in China (the most in China, followed by Pony), and it plans to reach 65 cities by 2025 and 100 cities by 2030.

- It provides smart transportation products for 41 cities, adding six cities during the last quarters.

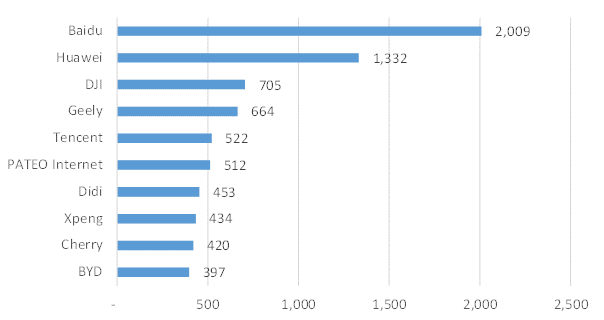

- The company has the most patents in the autonomous driving field in China.

Figure 11: Autonomous Driving Patents Ranking in China

Source: CNIPA

Baidu and Geely’s joint venture Jidu (Baidu owns 52%) launched its first concept model, Jidu Robo 1, in June 2022. This concept model follows the concept model Robocar that Baidu launched during Baidu World 2021. The highlights include:

- Two lidars, each on the side of the hood. These lidars come from Baidu’s investee, Hesai.

- One foldable wheel, indicating Jidu Robocar is capable of full self driving.

- Full voice control/communication capability.

- Estimated price of ~$30k to $40k.

- Futuristic design, which is appealing to the young generation.

Figure 12: Jidu Robo 001

Source: News Releases

Both Apollo and Pony’s robotaxi are open to the public in Beijing, and in March of this year, I tested both and was impressed by both. I was especially impressed by Baidu’s traffic lights and robotaxi connection capability, allowing Baidu’s robotaxi to synchronize the counting down seconds of the traffic lights through its V2X technology (even though the traffic light is beyond detection distance), and this could make travel time more predictable and optimize travel routes in the future. What could be improved was that Baidu sometimes performed more conservatively than Pony and had hard breaks if other cars abruptly cut into our lane, but it overall met my expectation. Robotaxi’s success is dependent on two things — technology and commercial capability. I believe Baidu has a significant edge over Pony.AI due to its sufficient cash position, the scale it has reached, and the brand it has already built.

Autonomous driving could be the next wave of technology advancement in next three years. According to Lux Research, the operating cost of a robotaxi is only ~$0.46 per mile in the U.S., and current fare is $2 per mile in the U.S., meaning that the robotaxi provider is able to earn 50% gross margin from $1 per mile offered, a 50% discount to current fare price. Moreover, it’s also much greener, as it’s powered by electricity and could have a central transportation cloud to optimize routes, which could save 52% on carbon emission. If you want to invest in autonomous driving, the best is definitely to invest in data and algorithm owners, such as Tesla, Cruise, Waymo, or Baidu, rather than lidar companies. Hardware can only get cheaper, but the data/algorithm owners have strong network effects, and their advantage could only get deeper over time. The logic is similar with search engines.

Autonomous driving could be commercialized faster than expected. In July 2021, Beijing announced that the new Daxing Airport Express Highway and partial south Fifth Ring and south Sixth Ring Roads (marked in red below) are included in the Autonomous Driving Demonstration Zone, which allows providers such as Baidu and Pony to test robotaxis. This prepares the robotaxi services to further expand their operating area from Yizhuang to the Daxing Airport and charge fares for the airport trips in the future. The Daxing Airport lacks nighttime public transportation service after 10:30pm, and a robotaxi could be best utilized then as there is almost no traffic on this highway, and a robotaxi can never be tired at night. With this service to be provided in the future, passengers could take a robotaxi at midnight at the airport and travel to the Yizhuang area. I expect this service to be provided before the end of 2023.

In June of this year, Cruise started to provide full driverless robotaxi service to the public between 10pm to 6am in a partial city area of San Francisco, which is a big step forward in U.S. autonomous driving history. I expect that its service would expand to the San Francisco airport in less than 1.5 years. Following Cruise, Baidu will provide the same type of service in Beijing, and I believe this will serve as a catalyst for Baidu’s stock.

Figure 13: Apollo Operation Area (in Blue) and New Roads Open for Testing (in Red)

Source: Apollo

Public Image Is Improving

People always underestimate how important public relations is for a company. Take Facebook as an example. After the Cambridge Analytica scandal in 2018, the company had to do more work to earn trust from both the users and the government, which led to difficulties in launching cryptocurrency initiatives, doing M&A, having users turn on tracking, etc. This partially resulted in rebranding, and the company renamed it to Meta.

After making enormous investments in AI and autonomous driving for more than 10 years, the public in China gradually realized Baidu is the tech giant that carries the technology innovation initiatives and receives praise. This is in contrast with the public’s blame of other tech giants invested in entertainment or zero-sum games, such as Tencent’s investment in games (entertainment), Bytedance’s investment in the addictive algorithm of Douyin (entertainment), or Meituan (OTCPK:MPNGY) subsidizing its fresh food business heavily to bail out competitors (zero-sum game) and merging with Dianping to dominate the locally found service business. Despite Baidu’s medical ad scandal in 2016 that was broadly criticized, we see Baidu’s image today is leaning more towards being a tech company and is getting more positive in the public eye. This public image helps Baidu execute its AI cloud and autonomous driving plans in each local area, as these involve local government support and the public’s championship.

We clearly see Baidu increasing its public exposure in the recent two years and becoming more high-profile in showcasing its technology. For example, Baidu World 2021 was hosted on state-owned television CCTV’s livestreaming to showcase its AI offerings, which lasted three hours and covered its driverless car, AI cloud, etc. Baidu launched its AI sign language anchor to offer sign language on CCTV during the Winter Olympics, and Baidu actively showcases what can be done with its AI on its social media channels, including YouTube, WeChat, etc.

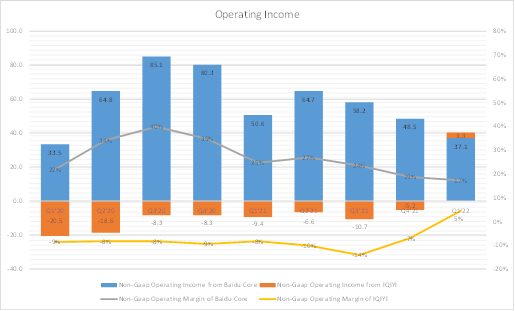

iQIYI Ends Its Loss Journey

iQIYI was a cash burning machine over the years and had a cumulative loss of $7b in its history, but it turned a profit recently for the first time since IPO. Thanks to the 7.7 basis point increase in gross margin and 9.6 basis point reduction in operating expense as percent of revenue. iQIYI currently has a non-GAAP net operating margin of 4.5%, and Baidu holds ~57% of iQIYI.

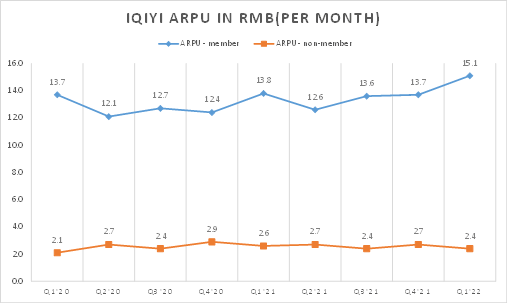

What’s also positive about iQIYI is that its ARPPU increased 8.8% to Rmb 15/month due to the recent increase in membership fee. The ARPPU increased in the past nine consecutive quarters.

Figure 14: Operating Income and ARPU of IQIYI

Source: iQIYI Earnings Release

Current Valuation – 100% Upside Potential

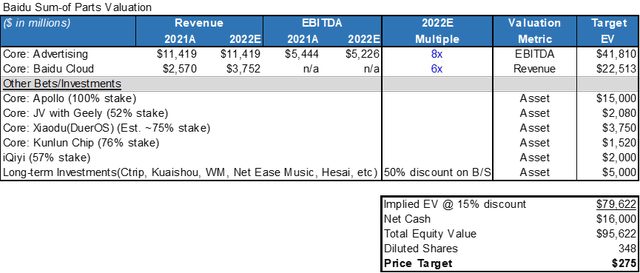

Utilizing the sum of parts valuation method, Baidu’s target price is $275, or $80b enterprise value. Under this valuation method, core advertising is valued at 8x EBITDA multiple, Baidu Cloud is valued at 6x EV/S, Xiaodu and Kunlun chip are valued according to their recent financing, and Apollo is valued conservatively at ~$15b, compared with Waymo or Cruise at ~$20b. Baidu’s current market cap is ~$50b, only covering the value of advertising business and net cash ($15b). The other critical parts (Apollo, Cloud, Xiaodu, etc.) are not priced in. Baidu’s long-term investment can also be valued at $5b, as these include some quality investees such as Net Ease Music, Hesai, and WM Motors that are about to be public. Due to Baidu having to hold a certain equity percentage to maintain the relationship with certain partners, I give a 50% discount to the fair value on balance sheet.

Stable advertising business and net cash offer a very significant downside protection, while Apollo and Cloud offer ideal upside potential.

Table 3: Sum of Parts Valuation

What Keeps Baidu’s Price Low?

There are two main factors that currently impacts Baidu’s valuation:

- The top concern the market has is that the advertising business will continue to shrink and Baidu’s AI and autonomous driving are slow to grow, leading to no revenue growth in next three years. However, this contradicts with what Robin predicts, which is that 50% of revenue will be coming from AI Cloud, autonomous driving, and Xiaodu (consumer electronics) in three years. I believe that the revenue growth concern explains 80% of the current low valuation situation here.

- Delisting is a concern as the US-China cross-country audit problems haven’t been full resolved. As is stated by PCAOB, although there have been productive discussions between U.S. and Chinese authorities regarding the right to audit workpapers, significant issues remain. If there is no progress before 2023, Baidu could face delisting. Despite that, Baidu is also listed in Hong Kong, and its shares could be converted to HK stocks. Not every fund is willing to take the HK shares, and it could create a 10-20% downside. However, I believe that Baidu could become the next one to be listed in the A share market. The previous example is Beigene (BGNE), which is listed in A share, HK, and U.S. markets. There is also a recent example of Zlab (ZLAB) completing its conversion to dual-primary listing in HK, which is in preparation to be added to Shanghai-Hong Kong Connect. The loss volume in the U.S. market could be compensated for by the new buying volume in the A share market or by being added into Shanghai-Hong Kong Stock Connect in the future. A company’s valuation is more determined by its fundamentals rather than where it is listed.

- Some political pressure is on investment in Baidu, Alibaba, and Tencent, which are viewed as the AI leaders in China. SenseTime Group, an AI leader that has a surveillance business, was added to the U.S.’s entity list due to accusations of developing facial recognition programs that can determine a target’s ethnicity, with a particular focus on identifying ethnic Uyghurs. There were voices that say Baidu has partnered with certain research institutes that might have certain ties to the military of China, even though it was not proven, and I did not find any. This could be one concern that keeps some U.S. institutional investors away. This political aspect is difficult to measure, but I believe it can be solved once Baidu is added to the Shanghai-Hong Kong Connect.

Final Thoughts

Baidu has invested heavily into AI and autonomous driving, which have not contributed much to the revenue yet. Due to the lack of revenue growth, and the market generally lacks patience in slow revenue growth companies, Baidu’s valuation multiple is low. However, in the next three years, I estimate that both AI Cloud and autonomous driving business will grow exponentially. In 2024, non-ad business could take 50% of total core revenue. Cloud business could take ~28% (46% CAGR), the rest (Apollo, Jidu, Xiaodu, Kunlun) could provide the remaining 22%. Of those, Jidu could easily contribute Rmb 17b revenue in a year (120k delivery in a year), or 10% of total. Total revenue could grow from Rmb 125b to Rmb 215b. By that time, Baidu will have a higher valuation multiple due to more tech components. The best trading strategy is to hold it for three years.

Table 4: Baidu’s 2024 Revenue Estimated

|

In RMB |

2021 |

2024E |

|

Core – Advertising |

74b |

86b (Est. 5% CAGR) |

|

Core – Cloud |

15b |

48b (Est. 46% CAGR) |

|

Core – Apollo |

0 |

4b (2b from Robotaxi) |

|

Core – Jidu |

0 |

17b (Est.120k delivery) |

|

Core – Xiaodu & Others |

5b |

15b (Est. 44% CAGR) |

|

IQIYI |

30b |

45b (Est. 15% CAGR) |

|

Total |

125b |

215b |

Source link