[ad_1]

Mohammed Haneefa Nizamudeen/iStock via Getty Images

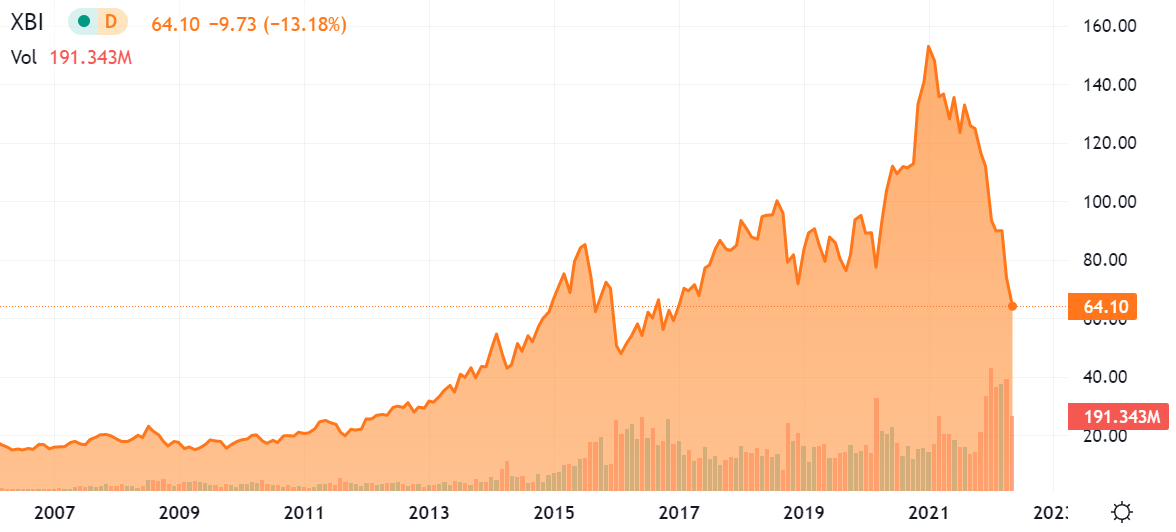

I-Mab (NASDAQ:IMAB) shares are trading near cash and represent a value proposition. Over the past year, the biotech indices have seen their worst selloff ever. A speculative rally between 2020 – 2021 coupled with changing fiscal policies and a potential recession has caused many of the biotech stocks to fall almost ubiquitously, many falling 50-90% over the course of the past 15 months. Regardless of the merit of their technology, many biotech’s are trading below cash value, giving their business and assets a negative enterprise value.

This downturn is so extreme that companies are trading well below their positive net cash position factoring in all debt repayments. Never before, have biotech stocks been this inexpensive, and even in a bear market now is the time to start looking into biotech. IMAB is a classic example of an innovative diversified biotech company that had decoupled from its intrinsic asset valuation with a pipeline that is significant de-risked.

XBI chart (Seeking Alpha)

XBI All Time Chart.

A lot of the biotech sell-off is because speculative and small and microcap stocks have sold off heavily in sympathy with the main indices. Other reasons could be due to a fear of raising capital in a weak market; as interest rates rise, investors may be looking less to biotech’s with their decade-long R&D processes before finally making money.

However, with I-Mab, we have a company that has sold off almost 90% from its 2021 highs in the $80s and now trades near its cash (including near-term expected cash from licensing deals) of $671 million (versus $554.5 actual cash at the end of the year). The company had a $365.9m net loss in 2021 but with existing licensing deals and expected commercialization expects their cash position to last through to 2025, at which point the company should have 3-4 drug launches underway (felzartamab, eftansomatropin alfa, and potentially lemzoparlimab (potential blockbuster) with the company continuing to consider the addition of a pre-BLA product to be in-licensed)

Currently, the company is expecting cumulative revenues of $300-$400 million in the 2023 to 2025 timeframe, ramping up to $1.3-$1.6 billion for the period of 2026 to 2028, approximately. Investors may be concerned that they will need more cash; however, the company has been very successful in raising capital since their inception and have additional options and leverage if/when they reach that point in a few years since revenues are expected to be somewhat robust.

There are risks with respect to the company being a Chinese company, but the stock is cheap, trading below total capital raised since 2016, and somewhat close to cash value with a market cap of about $700 million. To mitigate risks associated with Chinese ADRs, the company is planning to switch auditors to a US-based auditor that is PCAOB compliant in 2H22. The company has also stated it potentially will be bringing up to $1 billion in revenue by 2025; debt financing should be possible at this point, so the share price falling is of little concern.

Business Model

I-Mab is a clinical-stage, but soon-to-be commercial-stage biopharmaceutical company focusing on novel or highly differentiated biologics for oncology applications. The company is focusing on monoclonal antibodies, bispecific antibodies, and “super antibodies.” The company engages in various in-licensing and out-licensing deals to build its China-focused but global footprint, with numerous sites in China and the U.S.

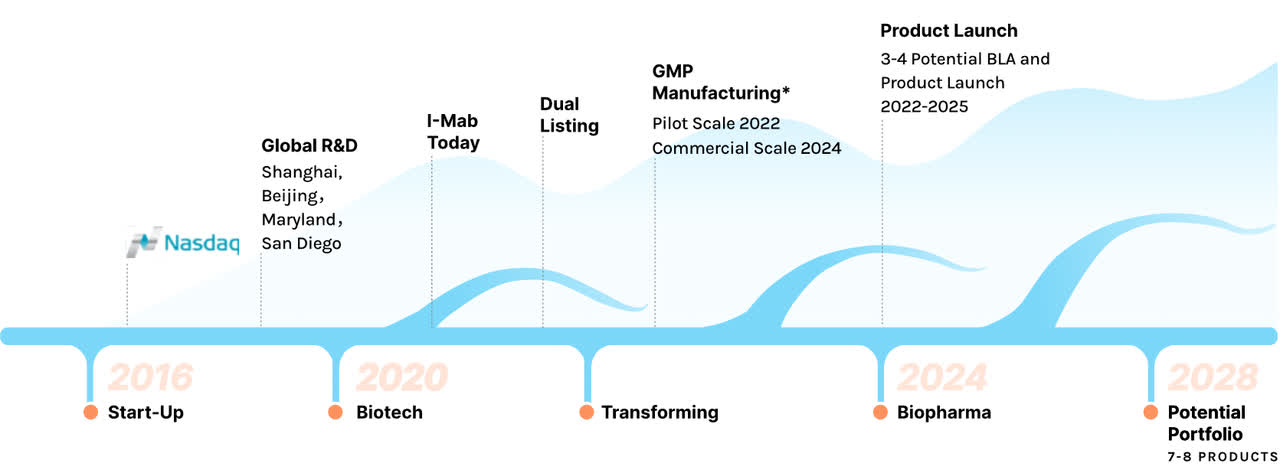

I-Mab Story (I-Mab website)

The company is focused on cancer and immunology, as these represent a large and growing market opportunity, with the company citing a $31 billion (2020) Chinese oncology market growing to $108 billion in 2030, versus the world’s $150 billion growing to $483 billion (according to Frost and Sullivan). The company hopes to have 7-8 products on the market by 2028 and capture significant market share in China.

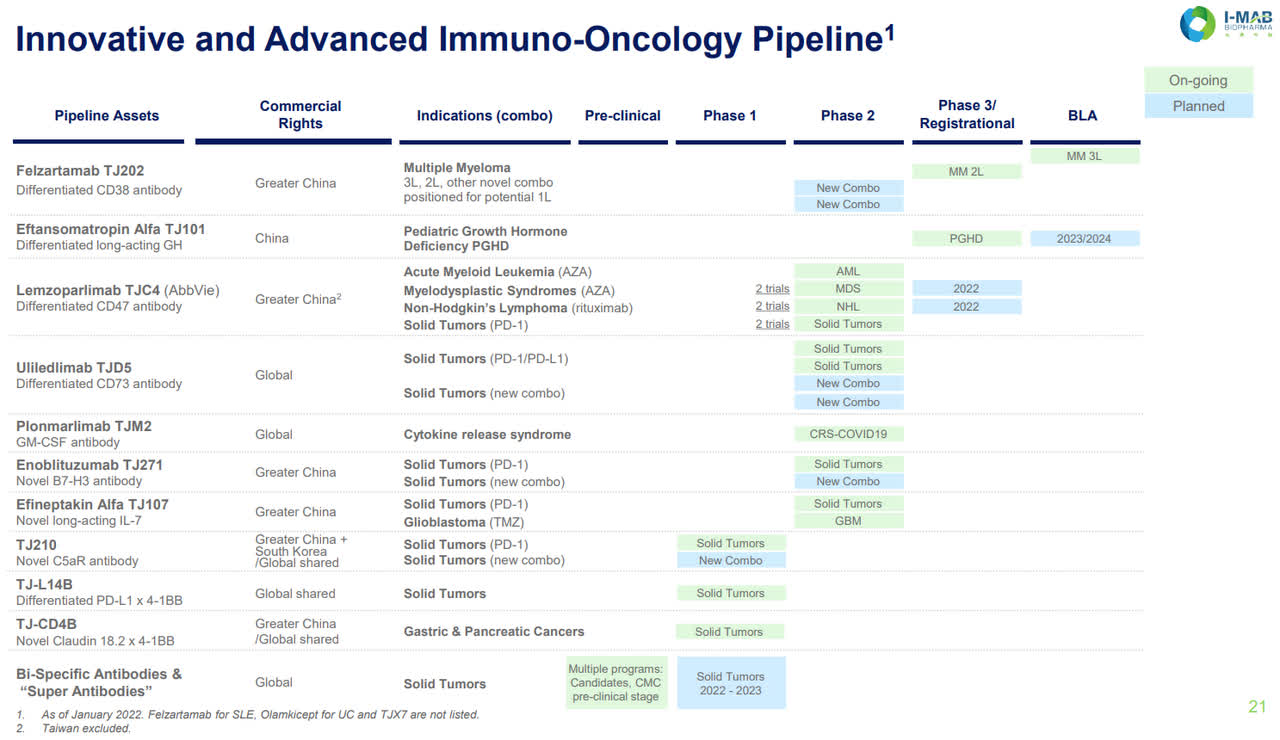

Pipeline

I-Mab Pipeline (I-Mab website)

The company’s pipeline is, of course, bigger than the 7-8 products mentioned that they want to have marketed in the next 6 years. The focus is on their lead candidates which are entering or currently in phase 3 studies or being submitted for regulatory approval. One of these, Felzaramab, is a potential blockbuster to compete in the large CD38 antibody market. The CD38 antibody market is big, with Janssen’s (of Johnson & Johnson) (JNJ) CD38 antibody, daratumumab (licensed from Genmab (GMAB), first approved for third-line multiple myeloma in 2015a. Since then, Janssen’s drug has ramped its net sales to 6.02 billion in 2021 despite competitors entering the scene, such as Sanofi (SNY) with its isatuximab-irfc (Sarclisa) launching and doing $186 million in sales last year, with other competitors developing CD38-targeting therapies. Daratumumab is currently the only CD38 antibody approved for multiple myeloma in China. If felzartamab receives approval, it would be the first locally manufactured CD38 antibody.

Felzartamab, Lead Asset, Licensed from MorphoSys AG (MOR)

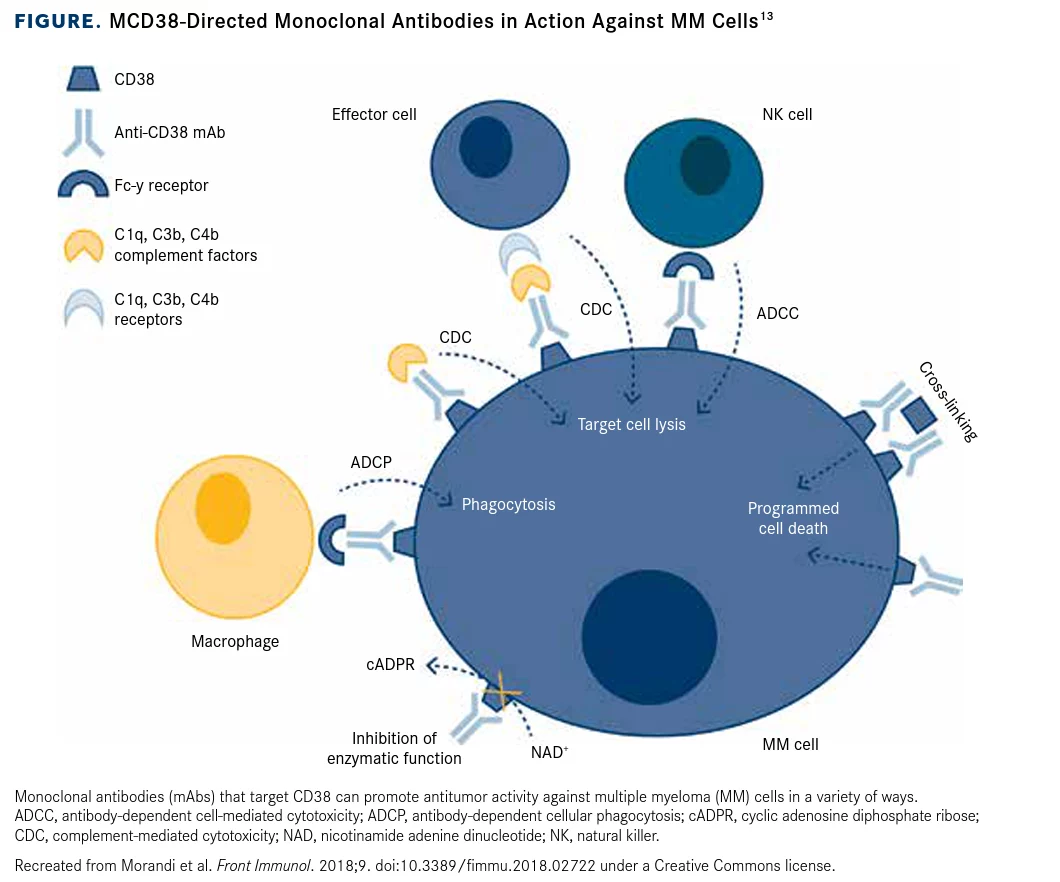

Felzartamab is an ADCC-enabled CD38 (target and destroy) antibody also initially awaiting regulatory approval for 3L-MM. CD38 is expressed on mature immune cells with highest expression on plasma cells, the cells that proliferate out of control during multiple myeloma. The antibody directs the killing of these plasma cells by host immune cells. Additionally, CD38 targeting acts as an immunotherapy of sorts by eliminating regulatory T cells, regulatory B cells, and myeloid-derived suppressor cells, cells that hold back the host’s immune response.

This drug has the potential to be the first-in-class CD38 antibody approved in China, with the global CD38 antibody market expected to reach $10 billion. What may have some investors spooked on the program, though, is that a few years ago, Celgene (of Bristol-Myers) (BMY) terminated its co-development agreement with MorphoSys, which was focused on felzartamab as a potentially best-in-class CD38 antibody. However, since this point in time, I-Mab has generated positive phase 3 data demonstrating lower injection site reactions and infusion times with key primary and secondary endpoints met.

Notably, global bestselling drug Humira made by AbbVie (ABBV) was the third TNF inhibitor approved for autoimmune diseases, not the first, due to its best-in-class status. Even though felzartamab might not be the first-to-market in the United States, its prospects are very good. The ease of administration with shorter infusion times and lower injection site reactions will enable it to be positioned in the outpatient setting. As an aside, I-Mab licensed the Greater China rights from MorphoSys so it doesn’t have the opportunity to out-license felzartamab globally.

Monoclonal AB (OncLive Website)

OncLive, New Strategies for Targeting CD38 in Multiple Myeloma Take Root

One key issue plaguing CD38 antibodies is that they have unintended consequences-namely that CD38 is expressed not only on plasma cells, but also on NK cells. This can cause NK cell fratricide, which is the killing of natural killer cells by other natural killer cells directed towards the CD38 antibody that has bound to the natural killer cells expressing CD38. Importantly, CD38 is reportedly involved in forming the immunological synapse between the NK cell and their targets, with the blocking of CD38 severely inhibiting their killing of tumor cells.

As NK cells are becoming known as key tumor-killing cells and companies like Fate Therapeutics (FATE) and Nkarta (NKTX) are sporting billion-dollar valuations based on their engineered NK cell therapy pipelines, the next frontier of CD38-targeting treatments will likely include cell therapies that work around NK cell fratricide. Coeptis Therapeutics (OTCPK:COEP), which is undergoing a SPAC to uplist, is working on a CD38-modified NK cell therapy to support the combination treatment of CD38-mABs. Their NK cells are designed to avoid ablation by CD38 antibodies and therefore provide the patient with a functioning NK cell population.

Lemzoparlimab

Arguably I-Mab’s most exciting pipeline candidate, though not as relevant near-term for revenues, is its CD47 inhibitor, lemzoparlimab. Many investors learned about the promising CD47 target in immuno-oncology when Gilead (GILD) bought out Forty-Seven Therapeutics in early 2020 for $4.9 billion in cash, which was a few months after the company had reported impressive clinical results in two hematological malignancies (AML and MDS).

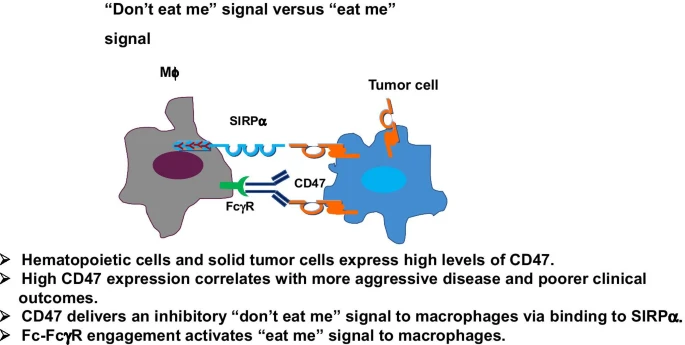

High CD47 (jhoonline biomedcentral website)

CD47 is an inhibitory checkpoint for macrophages that signals through the macrophage’s SIRPɑ receptor to deliver a “don’t eat me” signal to block phagocytosis of the cell. Normally in the body, the CD47 receptor is ubiquitously expressed and functions as an immune regulator to prevent autoimmune response but also help regulate phagocytosis of old erythrocytes (red blood cells). However, some cancers learn to highly express CD47 as a defense mechanism.

Thus, like the PD-1/PD-L1 targets for the adaptive immune system, CD47 is a promising macrophage checkpoint inhibitor. Further, many CD47 mABs both block CD47 and also engage the Fc gamma receptor on macrophages (the receptor that recognizes the tail ends of antibodies) to activate the macrophage and promote phagocytosis. However, CD47 as a target comes with some difficult safety hurdles. Since CD47 is expressed on normal human red blood cells (RBCs), CD47 antibodies can cause hemagglutination (HA) and anemia via the destruction of RBCs. To work around these issues, Forty Seven (developing magrolimab, now part of Gilead) found they could use a low-dose priming dose to stimulate the clearance of old RBCs and the production of new ones before going to a full therapeutically effective dose.

Lemzoparlimab, on the other hand, takes advantage of an epitope difference between CD47 on erythrocytes and cancer cells to selectively avoid the erythrocytes, binding much more weakly to the red blood cells compared to magrolimab and not causing hemagglutination. These potential clinical benefits are being validated in clinical trials as 180 patients have already been treated with lemzoparlimab without needing a priming dose or having serious HA side effects (and maximum tolerated dose not reached). And I-Mab out-licensed the non-greater-China, rest-of-world (ROW) rights to AbbVie in a $1.94 billion deal plus low-to-mid teen royalties.

I-Mab is aiming to achieve registration of lemzoparlimab as first-in-class in China and facilitate global development working with AbbVie for commercialization. The company is currently running multiple lemzoparlimab clinical studies in the U.S. and China, with three clinical programs in China, including NHL, AML, MDS and solid tumors, while AbbVie is running two clinical trials globally. The antibody will further be studied in solid tumors, and MDS and NHL pivotal studies are expected to be initiated this year.

Lemzoparlimab’s potentially better safety profile was thrust into the spotlight when Gilead announced clinical holds on its magrolimab trials due to an imbalance in suspected unexpected severe adverse reactions (SUSARs). Previously noted had been significant drops in hemoglobin levels but later the FDA has since reversed most of the clinical holds. Regardless of the clinical hold status, lemzoparlimab has the potential to demonstrate a better tolerability profile compared to magrolimab, with current efficacy signals across cancers looking roughly on-par with magrolimab. The company plans to present the full phase 2 dataset of lemzo +AZA in MDS at a scientific conference in 2H2022.

Eftansomatropin Alfa

I-Mab is also bringing eftansomatropin alfa, a pure protein (no linkers or PEGs), long-acting growth hormone for pediatric growth hormone deficiency (PGHD), to market through its commercial partner Jumpcan, as its in-house commercial team is focused on hematological oncology. The companies inked a deal in late 2021 for the commercialization of I-Mab’s differentiated product, which has the advantage of weekly versus daily dosing. Jumpcan is a leader in the pediatric space in China, and as such, I-Mab estimates they can achieve $800 million in peak sales.

Uliledlimab

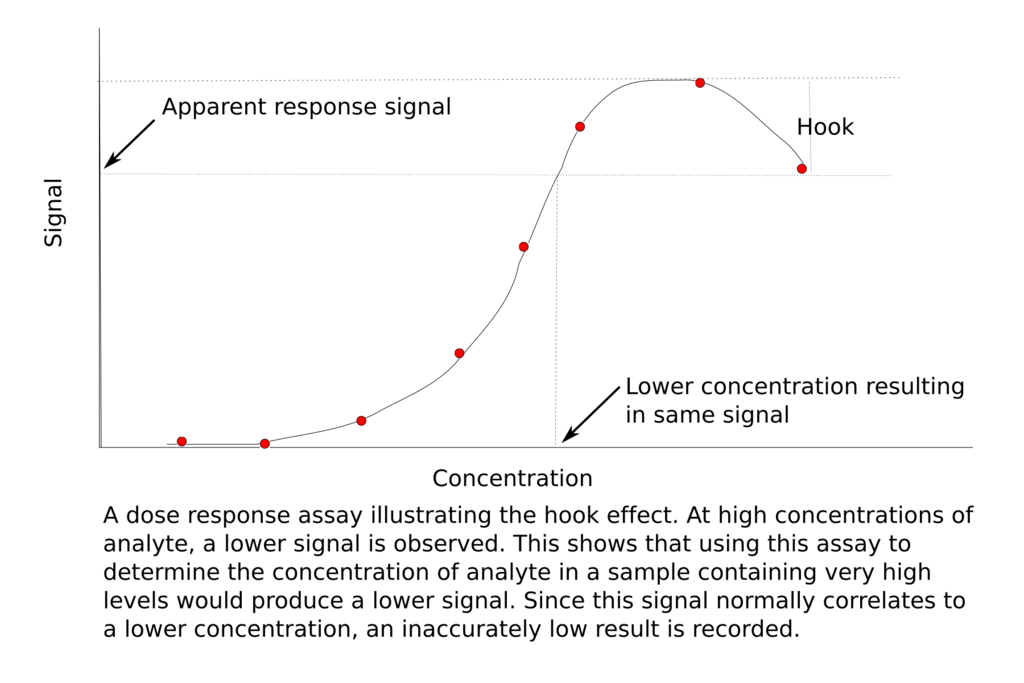

One other highly promising product I-Mab is developing is uliledlimab, a leading and differentiated CD73 inhibiting antibody for immuno-oncology (I-O). CD73 is a novel target in the I-O space and may function as an additional valuable target like PD-1 to improve host immunity. Arcus Biosciences (RCUS), a competitor with a small molecule CD73 inhibitor, has a good video on the mechanism of CD73-mediated immune suppression and why its inhibition is relevant for immunotherapy. The thing that sets I-Mab’s candidate apart from others in the CD73 space is that it has not demonstrated the hook effect, as opposed to other CD73 antibodies in development.

Hook effect (Wikipedia)

The hook effect is an antibody phenomenon where the ability of antibodies to form proper antibody-ligand immune complexes is impaired, particularly when antibody concentrations are too high. This is thought to be due to clumping together of the antibodies which interferes with their proper binding to antigens or target epitopes. This means that during dose escalation, there may be decreased efficacy at a higher dose.

I-Mab recently reported its latest phase 2 data for uliledlimab in solid tumor patients. The data looked decent with advanced cancer patients in three cohorts demonstrating varying responses, the highest of which was patients that were not as heavily pretreated and had previously been ineligible for standard of care. In combination with a PD-1 inhibitor (toripalimab), among 19 efficacy evaluable patients from the higher-performing cohort, there was an overall response rate (ORR) of 26%, and disease control rate (DCR) of 73.7%. About 80% of the patients had low PD-L1 expression at baseline (predicting poor response to PD-1 inhibitors) and CD73 levels correlated with responses in these patients:

“Noticeably, the clinical response observed in this patient cohort displayed a correlation with CD73 expression in tumors. High CD73 expression (≥35% expression level in tumor cells or immune cells) was found in 4/5 PRs with a mean value of 53.4%, 4/9 SDs with a mean value of 30.5% and none in the 5 remaining patients with a mean value of 19.2% who progressed on the treatment. The clinical data continue to mature.”

The data was straightforward with respect to biomarkers (consistent with data released last year at ASCO), along the pending phase 3 trial expected to be initiated next year to have a higher chance of success by using those biomarkers. The market seemed to be disappointed with these results as the raw ORR underperformed compared to uliledlimab’s readout in 2021, but investors should be careful drawing such conclusions from different cancer types, disease stages, prior treatment regimens, and small sample sizes. Perhaps it was thought that I-Mab was looking to partner out this program similar to its deal with AbbVie last year, and investors don’t see the data as convincing enough to sign a good deal yet.

With decent data and investor pessimism seemingly at a maximum, I-Mab’s shares aren’t really pricing in any success for uliledlimab, it seems, so this one is now icing on the cake if the company can show response rates for those with high CD73 expression, perhaps in the first-line NSCLC setting which was the patient population their recently shared phase 2 data was focused on. After all, Merck’s (MRK) Keytruda (pembrolizumab) was approved for first-line non-small cell lung cancer (NSCLC) for tumor expression PD-L1. Biomarkers are well-known to improve the odds of clinical trials and they further give confidence for treatments in the clinic.

Earlier, AstraZeneca (AZN) showed in a phase 2 study in stage III NSCLC an ORR of 30% vs 18% when used in combination with its own PD-1 inhibitor. These results even lifted CD73 competitor Surface Oncology (SURF) shares at the time, which had inked a deal with Novartis (NVS) including its CD73 antibody before it reached the clinic, and according to some reports, was entitled to over $500 million in milestone payments plus tiered royalties. An asset further in development may be worth more in a partnership deal, and when compared to AstraZeneca’s results in easier-to-treat patients, uliledlimab’s results don’t look so bad. Additionally, I-Mab’s uliledlimab is focused on frontline stage 4 NSCLC while Astra Zeneca’s Oleclumab is focused on Stage 3 NSCLC, making it that I-Mab is focused on a cohort of patients with a more advanced disease state.

Risks

China-Specific

There have been a few factors likely dragging China-based stocks in the past year, including Chinese crackdown against its own companies in internet and tech space and this targeting spreading to additional sectors including education and real estate, and finally risk of a lack of foreign capital coming from the U.S. or other western countries due to heightened US/China tensions.

These issues could serve as significant headwinds for I-Mab’s stock price; however, these issues are secondary to the company’s execution of its plans in the long run. Also, areas of innovation in producing complicated goods like semiconductors and biotechnology align with China’s aims of self-reliance.

Recently, Chinese ADR companies have also come under pressure due to various regulatory actions taken by Chinese authorities, spanning tech stocks and their IPO plans (discouraging NYC listings) to for-profit tutoring companies. This has resulted in pressure on ADR shares and some discussion about the potential “end of Chinese ADR” (though ADR shares can be converted to underlying securities). Without going through all the intricacies-read this article for a summary of the situation-it appears Chinese ADR shares could be phasing out but this doesn’t mean that one’s shares will disappear, nor does it mean that Chinese regulatory authorities don’t want to cooperate with overseas authorities. According to CSRC releases, it appears Chinese authorities are taking steps to develop reasonable cooperation agreements with U.S. authorities.

In I-Mab’s case, the company is taking steps of its own to reduce ADR risks, including moving to switching auditing firms to one that is subject to PCAOB inspection of FY2022 auditing reports, which is expected to take effect in their 2022 annual report. The company is also looking to list in Hong Kong, which would reduce China listing risks.

Other Risks

As with all biotech companies in I-Mab’s stage of growth, clinical trial failures, failures to launch key drugs and reach cash-flow positivity, and running out of cash resulting in the need for additional capital can result in a depressed share price as execution, due to the company’s operations or clinical trial readouts, come in below expectations. Further, delays are common in biotech and start-up businesses in general.

Financials

I-Mab had $671 million in cash and cash equivalents at the end of ’21. The company is also expecting to receive over $250 million in cash at the end of 2022 and over $250 million between 2022 and 2025, from its multiple out-licensing deals. These tranches of cash are significant and could potentially propel the company well into its commercial phase without significant dilution, given the company’s 2021 operating cash burn was $165 million, which is expected to land between $180 million to $220 million in 2022-2023. So, it is not difficult to see why the company believes it has cash for 3+ years.

Valuation

First of all, I-Mab is expected to bring in significant cash flow by 2025 (~$1 billion cumulatively), significantly more than its current market capitalization, where it trades near its cash value.

Second, big pharma M&A and partnership deals, including I-Mab’s own with AbbVie, serve as a decent proxy for some of I-Mab’s pipeline candidates. Notably lemzoparlimab seems to be a best-in-class late stage CD47 antibody, potentially better than Gilead’s $4.9 billion magrolimab. As I-Mab already partnered this asset off to AbbVie in a ~$2 billion deal and retained Greater China rights, the company could be undervalued on this asset alone.

|

Asset |

Target |

Valuation Proxy |

Value |

Estimated Present Value |

|

Felzartamab |

CD38 |

$10B global market, over $260 million peak sales per I-Mab (I-Mab sales in Greater China only, minus royalties to MorphoSys) |

$780 million (3x peak sales) |

|

|

Lemzoparlimab |

CD47 |

$4.9 billion buyout (Gilead), $2.3 billion buyout (Pfizer) |

$3.6 billion (average of two, I-Mab to bring in sales and royalties globally) |

$3.6 billion |

|

Eftansomatropin Alfa |

Growth Hormone |

$315 million partnership with Jumpcan (China) With low double digit royalties, 50/50 profit split |

~$660 million (1x peak sales, milestones, 0.6x risk discount) |

|

|

Ulilidlimab |

CD73 |

Surface Oncology and Novartis deal, 2016 |

$170 million up-front/near term milestones, $525 biobucks deal, plus tiered royalties |

~$200 million |

These estimations lead us to a price target of $27.6/share using 190 million shares outstanding.

The average price target (13 ratings) on the WSJ page shows a consensus price target just shy of $80/share. While there is skepticism on China ADR companies as well as a tough biotech market, it is not just my opinion that the company’s shares are a steal. The price targets range from $45 to $103 as of writing this piece, and as such these estimations are likely not idealistic or over-optimistic (they ignore I-Mab’s mid and early-stage pipeline, which may also hold future value).

Conclusion

I-Mab is transitioning into a globally relevant, commercial biotech entity with multiple medicines potentially hitting the market and many in development. The company has demonstrated its dealmaking capacity as well as its ability to identify and develop differentiated assets that are potentially worth hundreds of millions or billions of dollars. I-Mab is well positioned with 3+ years worth of cash and will transition into a commercial entity, so the macroeconomic conditions many biotechs are facing now with potentially suboptimal fundraising opportunities is not much of a concern.

The Chinese ADR issues may be a hassle for shareholders, but they can always convert their ADRs to actual shares and so there is no consequence. Finally, with shares trading at about 1/10th of the average analyst price target, which are higher than our conservative valuation, the shares appear to be a steal.

Source link