[ad_1]

adventtr/E+ via Getty Images

Investment Thesis

Blade (NASDAQ:BLDE) is an urban mobility company that went public last year through a SPAC merger with Experience Investment Corp. Blade is a US-based company founded back in 2014. The company has a huge ambition to build out the infrastructure and platform for urban air mobility. It is currently providing the platform for helicopters and jets but its long-term goal is to prepare for the future adoption of EVA.

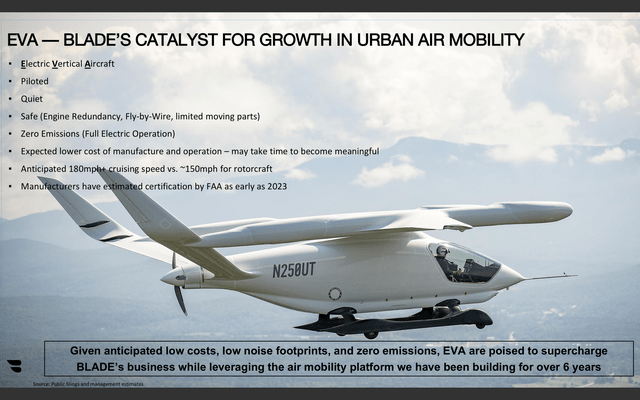

EVA (electric vertical aircraft) uses electric power to hover, take off, and land vertically. By leveraging more advanced batteries and electric motors, the new technology allows an aircraft to land like a helicopter and fly like a plane quietly. EVA is able to drastically reduce noise, emissions, and cost compared to traditional aircraft. Companies like Blade are trying to build an urban air mobility network in order to solve the congestion in current traffic networks.

I like Blade’s idea and prospect, however, in order for the thesis to work out, EVA need to be developed first. A platform without the aircraft is essentially meaningless. It is already making revenue through its bookings with helicopters and jets but its success relies on whether EVA can be commercialized. Companies like Joby Aviation (JOBY), Lilium (LILM), Archer Aviation (ACHR), and others are already developing EVA but there are still a lot of uncertainties. Therefore I rate the company as a hold until the production of EVA becomes clearer.

Blade

What is Blade? and why Blade?

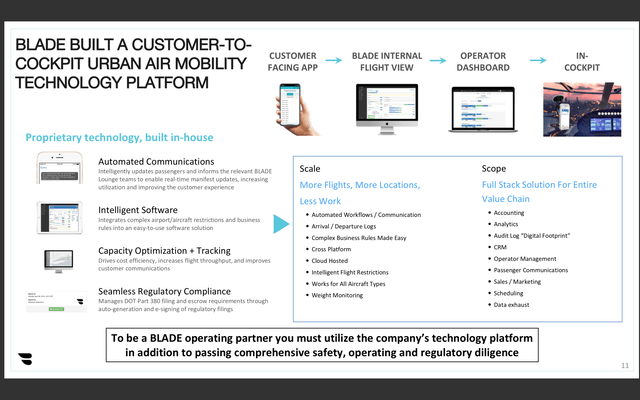

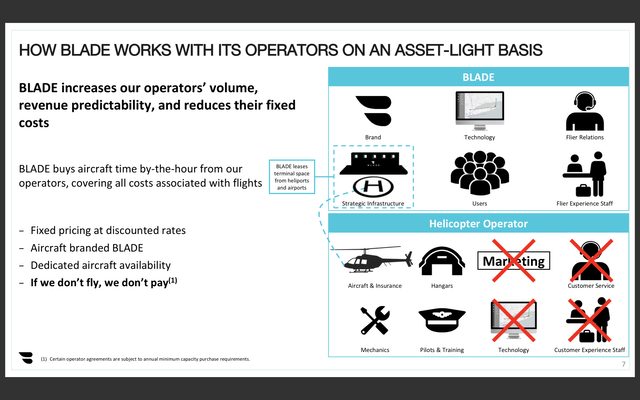

Blade is an urban mobility platform that allows customers to book a flight easily through its mobile app. It also provide the terminal and helipad for customers and operators. Unlike the old urban mobility platform which is costly, inefficient, and has no service, Blade is able to provide a flight from Manhattan to JFK for $195 with integrated service. For context the price is actually cheaper than calling an Uber black. Unlike before, you can now book the flight 20 minutes before takeoff which significantly increases efficiency and flexibility for customers.

Blade’s platform also tries to make the whole flying experience a lot more enjoyable for customers. It offers easy to use mobile app for booking, scheduling, communication, and tracking. It also provides private terminals and lounges for passenger management, baggage handling, and better security.

The company aims to provide congestion-free traffic networks as road traffic in the US increases 50% in rush hour and in India, it increases by 95%. Blade’s JFK to Manhattan flight only costs 32 minutes in total yet driving costs 90 to 150 minutes with potential traffic delays. Blade is currently operating already with smaller and more efficient helicopters and will soon transit to EVA once it is available. The company currently offers short-distance flights, airport-to-city flights, and organ movement flights.

I think EVA and urban air mobility are compelling because it is more environmentally friendly and is able to ease the current road traffic congestion if it is able to become popular. Traffic congestion has been a problem for a long time and everyone is finding a solution to it. For example Elon Musk’s Boring Company has been trying to solve this problem by introducing underground loop tunnels.

Blade

Acquisitions

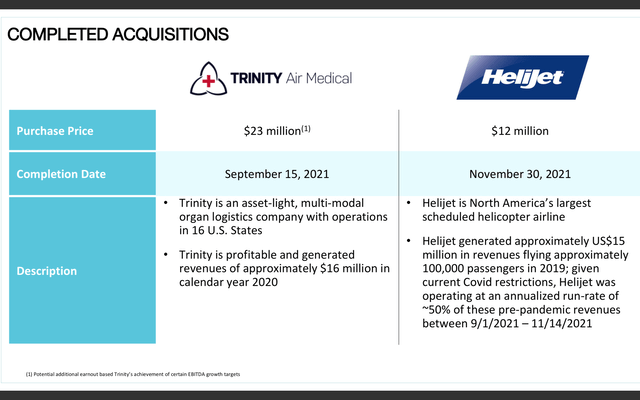

M&A is a big part to Blade’s expansion. I really like that Blade is investing actively while waiting for EVA to be mass produced. These low costs strategic acquisition generates a high ROI once the company starts to scale. It also allows them to significantly increase their footprint and market presence. The company went on a shopping spree and acquired four companies and one exclusive rights in the last 10 months.

They first acquired Trinity Air Medical last September, multi-modal organ logistics and transportation company. This is an effort to expand its Blade’s MediMobility business, which has been growing over 60%.

Rob Wiesenthal, CEO, on Trinity acquisition

“Trinity’s end-to-end services integrate air missions with ground transport. Given the existence of landing pads at most hospitals today, we have the ability to immediately replace Trinity’s ambulances with helicopters on certain hospital-to-hospital missions, while preparing for a transition to both existing ‘last-mile’ cargo drones as well as Electric Vertical Aircraft, as soon as they become available.”

In December, the company then acquired the exclusive rights to Helijet’s scheduled passenger business in Canada. This allows Blade to on-board more customers and have access to passenger terminals at conveniently located heliports in Canada, which allows them to increase their infrastructure footprint.

Blade

In May, it acquired three Europe-based air mobility operators to expand its footprint. The three companies are Monacair SAM, Héli Sécurité and another undisclosed leading helicopter operator in the South of France. The acquisition enables Blade to create branded passenger terminals at over 10 airports, heliports and vertiports that already exist or are under development throughout Europe.

Rob Wiesenthal, CEO, on latest acquisitions

“These three acquisitions are core to our strategy of leveraging our asset-light model to aggregate the premier use cases for urban air mobility. As a result, Blade has now amassed what we believe to be the most valuable routes in the world. Adding this formidable presence in Europe to our existing operations across the greater New York area, Vancouver and India, is a critical step in our expansion,”

It is also worthy to note that all of these acquired companies are also asset-light, in-line with Blade’s business model. Some are also already generating revenue or even free cash flow, which will help increase the top-line and improve profitability before any synergies are even made.

Blade

Problems

With current technology advancing rapidly, I believe some EVA companies will be able to deliver their EVA on time and start operating in 2024 as promised. However, I think that urban air mobility has a lot of restrictions that limit its scalability. It is undoubtedly very useful for certain routes but in general, it may not be that practical. In most urban areas there are not enough spaces to build enough helipad for taking off and landing, this limits the number of flights that the platform is able to offer each day. It is also harder to expand this service to other less developed countries as they do not have the infrastructure for take-off and landing.

Besides, even with the lowered price compared to traditional helicopters, the fare is still expensive and unaffordable for most people. In remote areas, EVA is unable to operate as it currently does not have to capability to fly back and forth from the city to rural areas. I think EVA and commercial urban mobility will remain a niche market for a period of time until we see a further breakthrough in technology. It works well in specific areas but in most places, it is hard to operate efficiently.

Financials and Valuation

Blade announced its first-quarter results last month. It reported revenue of $26.6 million, up 187% YoY (year over year) from $9.3 million. MediMobility organ transport and Jet revenues increased 186% YoY from $7.7 million to $22.1 million. Short distance revenues increased 300% YoY from $1.1 million to $4.4 million. Net loss was $(11) million compared to $(4.2) million in the prior year, largely due to the increase in G&A expenses regarding staff costs. Adjusted EBITDA loss widened from $(2.2) million to $(7.7) million while operating cash flow went from negative $(0.6) million to negative $(10) million. The increase in loss is expected as the company is still in its early stages and is investing heavily back into the business. Its current annualized weekly passenger run rate is 25,000. The company ended the quarter with a strong balance sheet of $269 million in cash and only $960 thousand in debt.

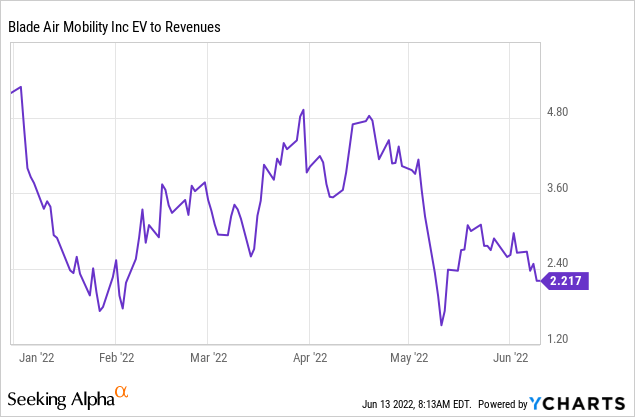

It is hard to quantify the valuation of such an early-stage company as a lot of growth is not materialized and a lot of risks aren’t priced in too. If we use an EV/sales ratio (since the company has no income and no positive cash flow), the company is currently trading at 2.2x EV/sales. This is cheap in my opinion as the company has enough cash for cash burn while growing quickly as it keeps investing in its business.

Conclusion

In conclusion, I believe Blade is a hold at the current moment. The company has a very ambitious goal to become the go-to urban air mobility platform for EVAs, the next-generation aircraft. EVA allows greener and more efficient air mobility while Blade allows customers to easily book a flight and have an enjoyable flying experience with its end-to-end services. It has been very active on the M&A end and acquired 4 companies in the last 10 months. These strategic acquisitions helped Blade grow quickly and expand its footprint outside of the US. The company is also showing strong revenue growth and is now trading at an EV/sales ratio of only 2.2x. However, my concern lies in the availability of EVA, which is the most important aspect of Blade’s thesis. There are too many uncertainties regarding the development of EVA that could sabotage the thesis. The practicality of urban air mobility also remains a question. Therefore I rate the company as a hold and will revisit it when the technology of EVA becomes more mature.

Source link