[ad_1]

Author’s Note: This is the shorter version of an article published on iREIT on Alpha on the 3rd of June 2022.

Peach_iStock/iStock via Getty Images

Dear subscribers,

In this article, we’re going to be moving to Austria and taking a look at the company ams-OSRAM AG (OTCPK:AMSSY). The company is in small-form-factor electronics, with products including sensors, sensor ICs, interfaces, and related software for mobile, consumer, communications, industrial, medical, and automotive markets.

It’s a growing and high-demand market, where ams-OSRAM is one of the market leaders.

Let’s see what we have here.

ams-OSRAM – What does the company do?

The company arose out of the Austrian steel company Voestalpine AG when it decided to expand its products into the semi-industry. The first partner for the company was American Microsystems Inc., with whom the company cooperated. The resulting fab was chosen to be the top fab in 1992, and it was the first semi company to go public back in 1993, with an IPO on the Vienna stock exchange.

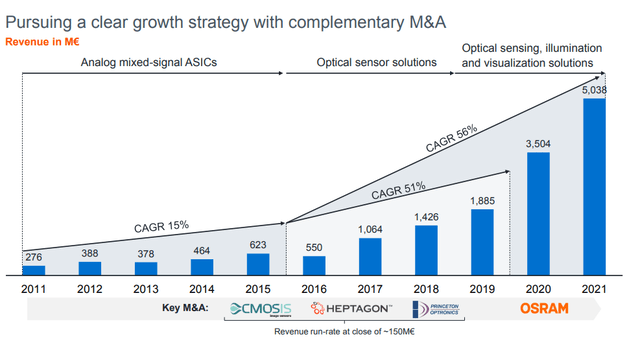

Multiple M&As, structural shifts, and deals later, the company successfully closed its M&A of German lighting, LED, and opto-semi manufacturer OSRAM, which brings us to the company’s current makeup.

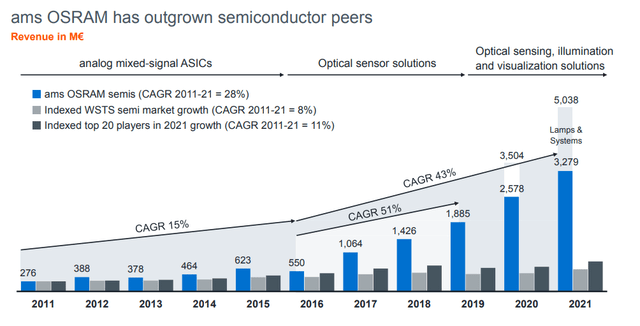

This company has an excellent track record, with M&As that the company made always resulting in some sort of sector-based outperformance to other semi companies. The company has seen significant sales growth thanks to its active strategy of complementary M&A.

AMS Osram M&A’s (ams OSRAM IR)

As I mentioned, ams-OSRAM has been provably able to outgrow its Semi peers over time.

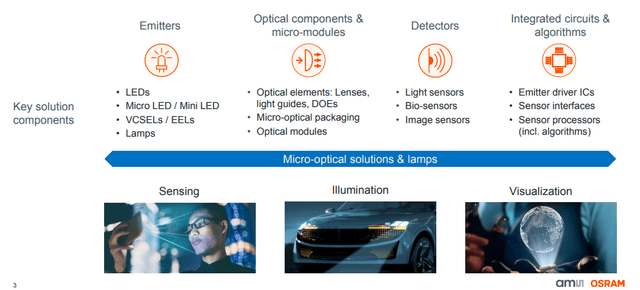

This company works with a very attractive product portfolio in the areas of Sensing, Illumination, and Visualization.

Its focus is sensors and interfaces based on analog and mixed-signal semi-design, a business that gained substantial traction with the acquisition of Texas Advanced Optoelectronic Solutions in 2011. The former CEO of this company headed up ams until 2016. The market for sensors alone was worth $14.5B in 2020 while analog semiconductors represented a ~$55B market and growing. So in terms of the available market, there is a lot to like here.

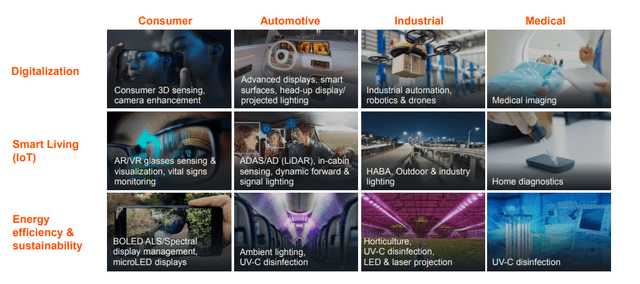

The main end markets are split between Consumer/Communications (around 70%+ of total revenues), composed of sensors (light, pressure, gesture, MEMS microphones), power management solutions and wireless solutions (NFC, NFC boosters, RFID), and specialty end-market solutions with targets towards to the smartphone, tablet, and IoT market.

The other part of the market is Industrial/Medical/automotive, which is now around a quarter of company revenue for the year. This market is focused mainly on sensors and products the type of ASICs, standard solutions, power management, and a broad range of sensor solutions and interfaces (sensitivity, position, magnetic, health monitoring, gas sensing, etc.)

ams OSRAM Sectors (ams OSRAM IR)

The company also is in the relatively unique position of having a foundry business able to fulfill specific customer demands. It manufactures analog and mixed-signal components based on analog processes, with a manufacturing capacity of 190,000 wafer capacity on an annual basis. This portion of the business is fully integrated with in-house testing, packaging and finishing capacities.

The company’s current mix relies on smartphones and mobile devices as consumer/communication now represents a significantly increased part of the business mix.

ams OSRAM presentation (ams OSRAM IR)

The company is a long-time supplier to Apple (AAPL), which represents a large, 50% of its revenues. Now, Apple doesn’t have its own sensor production capacity, and no sign that they’re planning to do so. But it still represents a customer concentration risk and is worth mentioning for sure. Beyond Apple, ams managed to increase significantly its exposure to the Android ecosystem since 2019, from below 10% exposure in 2018 to 30% in 2019 and beyond due to BOLED ambient light sensing systems and the iToF solution for 3D sensing. So the company is working on diversifying, but it’s a slow process.

Fundamentally speaking, ams-OSRAM is likely to enjoy advantages from the increased number of chips on a per-device basis, as it allows for greater functionality with things like IoT. IoT will require a large amount of energy-efficient sensors, and this is exactly what the company does.

Osram, in this perspective, has been a way for the company to diversify its operations and accelerate that diversification. The company generated €3B in revenues from 3 adjacent segments of Semiconductors, Automotive and Digital, with the logic behind the M&A being the ability to master the entire range of optical solutions, including emitters, optical components, to detectors and algorithms. The integration of these techs into the portfolio is expected to lead to new company product opportunities, from optical sensors in micro-LED screens to MLED itself (a suggested successor technology to OLED).

ams paid a high price for the OSRAM M&A, almost 17X the company’s annual adjusted EBITDA, but this is a high-quality portfolio and business. It’s also a way for ams to move into LIDAR and cabin sensing.

On a high level, products represent 95% of the operating profit, thanks to its very strong presence in the consumer market and customer advantages of being an Apple supplier. Smartphones and tablets remain high-growth business opportunities, and the high margins seen by the company are at high technological content. ams-OSRAM products typically have a lower electrical footprint due to company experience in design, low energy consumption, and efficiency, which are key factors in appeal to this market.

ams-OSRAM has a sector advantage due to experienced and strong R&D, including a good team of analog engineers who are driving innovation, as analog devices can’t be designed automatically by a computer and require hard-to-learn engineering competencies, which are becoming rarer and rarer in today’s market.

The preservation of these competencies is the key to the quality of the future products: e.g. the new NFC booster has allowed a reduction in the size of NFC antennas, enabling one to be fitted in the Apple Watch, where a traditional antenna wouldn’t fit.

Fundamentally speaking, this company isn’t all that well-rated. We have a BB-credit rating, in no small part due to the debt taken on by the OSRAM M&A. The company also lacks a dividend, which makes this a “growth” investment as opposed to a DGR one.

This is a good time to point out that I’m not opposed to growth investing at all – as long as the company invested in is one of quality, and the upside is solid enough.

In this case, I believe that it is, and I will show you why I believe that.

Let’s look at some risks for the business.

ams-OSRAM Risks

So, as mentioned, this company is a business in emitters, optical components, sensors, and IC/algos.

There are some significant risks to consider for the company prior to your investment in the company. Debt is one – OSRAM has left the company with almost €1.9B in net debt, with a 2.0X net debt/adj. EBITDA leverage at the end of 1Q22. The leverage is one of the risks to the company, together with the sub-par credit rating associated with the business.

The second risk without a doubt is the excessive customer concentration seen from Apple, accounting for 50% of company revenues, with growing competition in the Android space (where the company hasn’t been all that active compared to iOS). It’s never positive when a company has this sort of concentration, and what’s happened with Intel (INTC) and Apple shows this.

The OSRAM integration is one of the biggest the company has ever had to swallow. While there are significant synergetic potential advantages, realizing these will be a challenge due to cultural gaps and operational differences between the two companies.

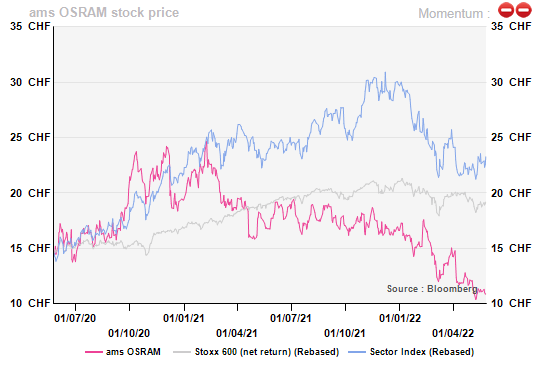

These challenges were confirmed by the relatively depressed shorter-term outlook for the business. Sales growth is expected to be low, and investments are expected to be high. This has resulted in investors losing patience with the business, and the short-term share price has been punished.

AlphaValue ams OSRAM performance (AlphaValue)

In short, the company is still transitioning to its new model, with OSRAM integrated. The expected sales for the next few years lack clear upward catalysts in the near term. Sales CAGR until 2024 is no more than 5%.

Russia and Ukraine have nearly no impact at all – less than 1% of sales went to these regions, but the overall macro impacts to automotive which is the most important growth driver are significant.

The current shortage of commodities coming from Russia has forced the car industry to review its production objectives downwards, which will negatively impact the main sales contributor of ams-OSRAM in the short term.

In short, the main risk is that it will take time for the company to fully form into an integrated company with OSRAM. Cost synergies are around 60% completed, but the remainder will take more time. A majority of that risk is also the fact that the company’s current fabs do not meet the necessary technical requirements for MLED-production. The new plant in Kulim will cost north of €800M. The impact on company cash flows will be immediate, with high CapEx in the next few years, but we can’t expect bottom-line positive impacts until 2024E at the earliest.

It’s correct to characterize this company as a play on “patience” in the sensor sector, with a future potential in MLED.

Let’s look at the company’s valuation.

ams-OSRAM valuation

Without a doubt, the most interesting fact to consider here is the company’s attractive overall valuation. Now, the company doesn’t have a dividend yield, as I mentioned. However, in every single other perspective, the company has a massive upside here.

Let’s dig down into it.

ams-OSRAM is a sensor/semi/optical company. These businesses, such as Infineon, STMicroelectronics (STM), and NXP, trade at P/E multiples of close to 21X, EV/EBITDA of between 5-11X, and book multiples of 2.5X. Premia is not unusual in these markets.

Now, ams-OSRAM trades at less than 10X in P/E, less than 4X EV/EBITDA, and a less than 1X P/B multiple. That is some discount right there.

Is a discount justified?

For sure. The lack of a dividend, the integration issues – all of this means that I assign a 20-25% discount to the company, and consider it completely justified. However, after the company really delivers on these (in the future), the earnings will be considerable, and growth will be there. So for now – discounts.

In the future? Maybe, but not so much. Even with my discount though, AMS is undervalued by more than 100% to peers here.

DCF? The company showed us very impressive growth rates in terms of earnings, combined with impressive margin expansion. This pace has slowed in 2020-2021 due to macro and pricing pressure from some of its main customers putting the boot down.

When it comes to NAV, we use an EV/Sales multiple, and we target a range of 1.3-1.5X of sales, coming to north of 9B CHF for the company’s gross assets, or around 6.7B based on the company’s current debt and commitments. This brings us to a $25.5/share for USD, slightly less for CHF. Again, undervaluation when we look at the current share price.

The literal only downside to AMS is the fact that it does not have a yield – and a sub-par credit rating. But the credit rating doesn’t bother me all that much given the company’s customers, such as Apple.

S&P Global weighs more toward the conservative, while I would say other analysts consider more the realistic long-term upside of the business. I would personally argue that once synergies are achieved, this company is easily worth 20+ CHF or more, calling for an upside of 90-100%.

For me, I consider the company at an upside of more than 95% if you invest in the business for the long term. The argument for a bullish thesis here is a rough one to make, given the visibility for the next 2 years – which is high, in that EPS improvements won’t be high for the foreseeable future.

I don’t yet own AMS – and I’m not sure if I will invest there. But this company deserves highlighting for being a semi company with a 95-100% upside, and one of Apple’s suppliers.

And it’s a “BUY”. I put my PT at 22 CHF/share.

Thesis

AMS is a “BUY” here, but it’s somewhat of a complex buy. The company does have an ADR, but it’s very thinly traded. The best way to invest in the company is the native, Swiss ticker AMS.

The main point here is that the outlook for the company is relatively poor, but the valuation is absolutely amazing. And this isn’t the tech-company sort of amazing, where P/E is still at very high levels despite a 70% decline. This is really attractive. Less than 1X book, less than 2X sales.

I believe the stock price for AMS has bottomed at this level. With the partial loss of Apple, the OSRAM deal, and the impairment linked to macro and the war, it’s my view that there’s little left except upside to the company here. As automotive recovers, so will AMS, and the company’s sensors and emitters will become a significant growth driver.

Prior to the OSRAM acquisition, ams was 74% exposed to the consumer and was too dependent on Apple revenues. It now has a more diversified portfolio and addresses various end markets with high potential.

If you want to buy ams-OSRAM, you’ll want to hold the stock until at least 2024. If you’re unwilling to do this, then other investments might be a better choice.

Source link